Whole Life Insurance Versus Term Life Insurance

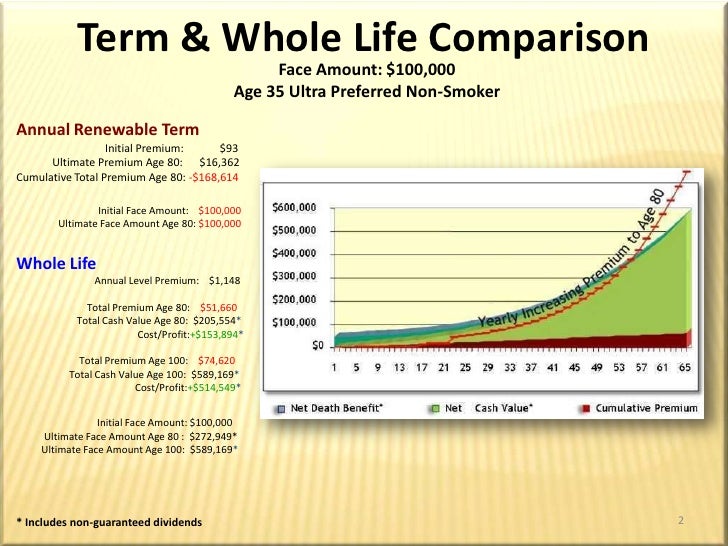

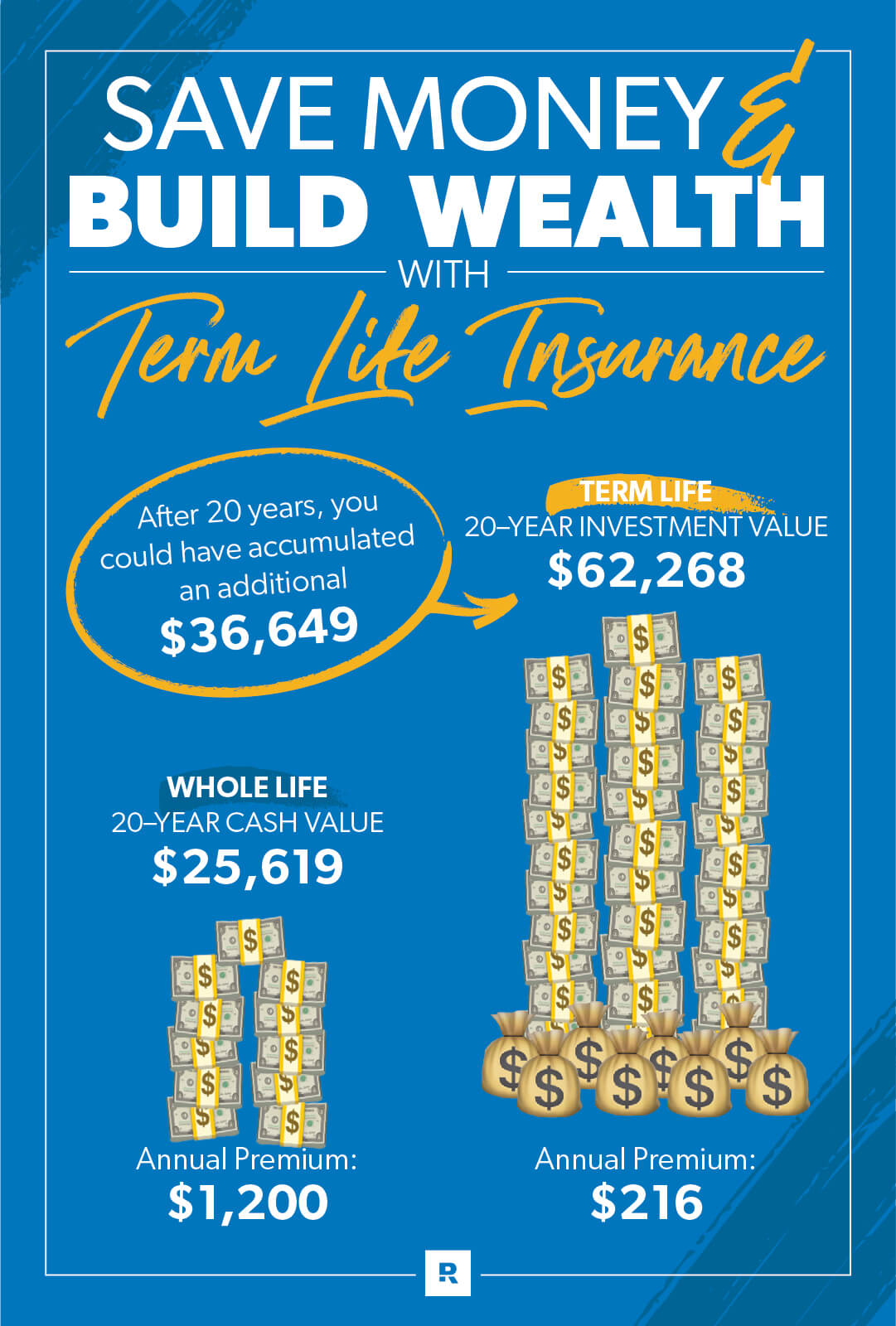

Term life insurance plans are much more affordable than whole life insurance.

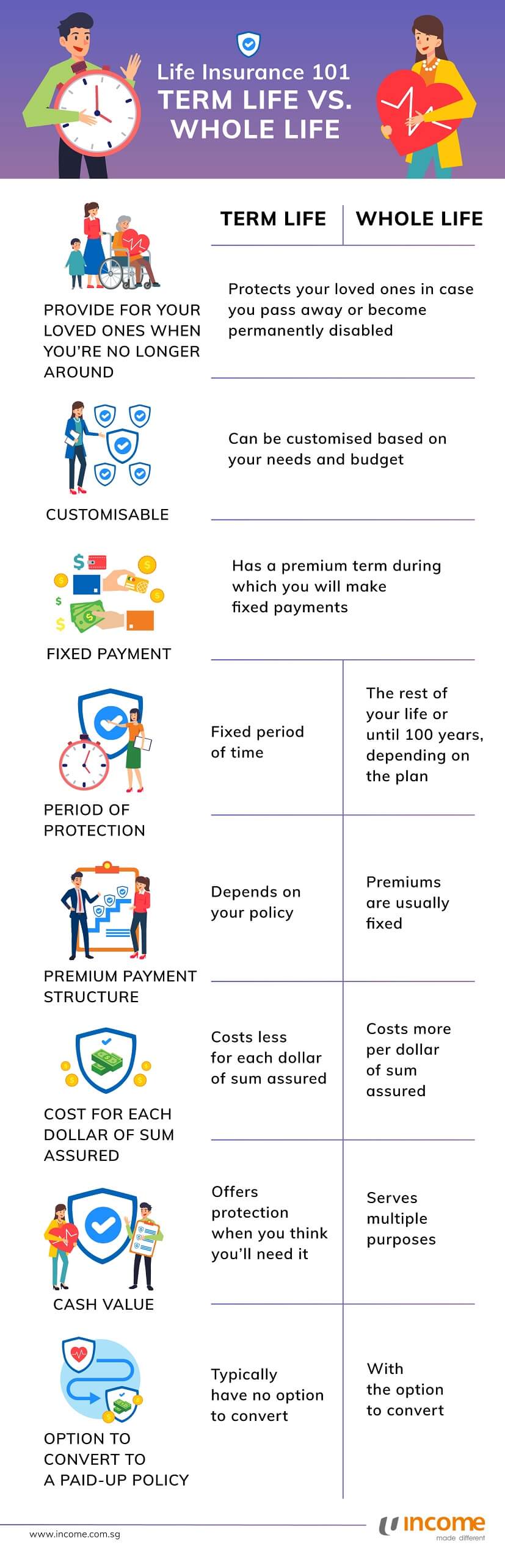

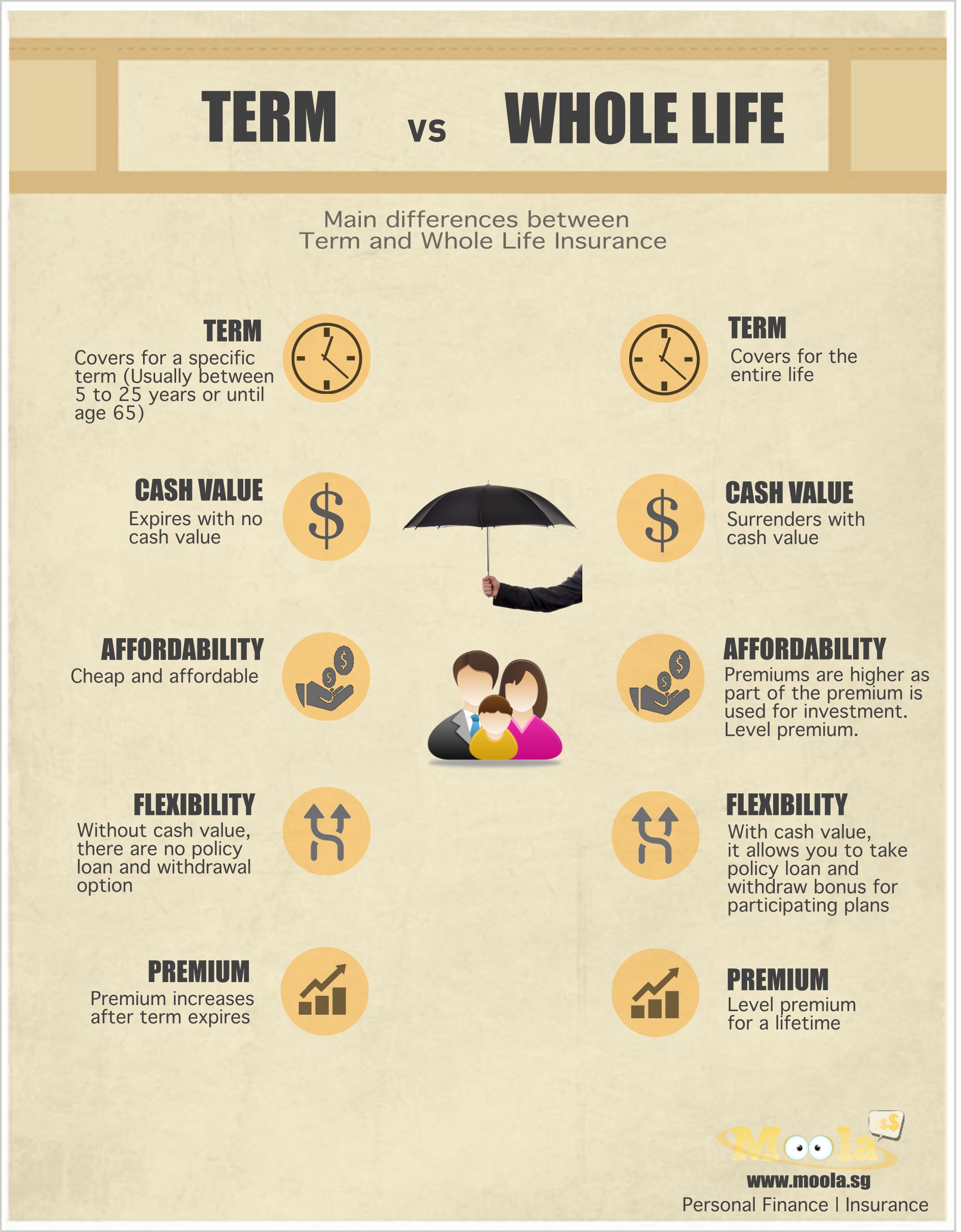

Whole life insurance versus term life insurance. If you are over 65 or 50 it may be a lot more difficult to get a term life insurance policy in the us. Tl dr before choosing between term life or whole life insurance. Whole life is a form of permanent life insurance which differs from term insurance in two key ways. Never lose focus on your objective why are you buying insurance.

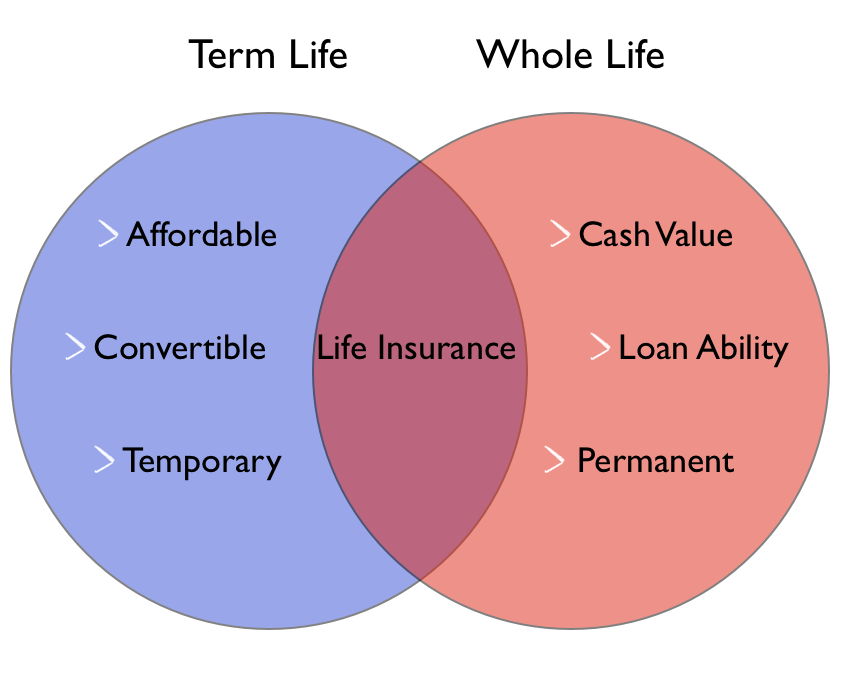

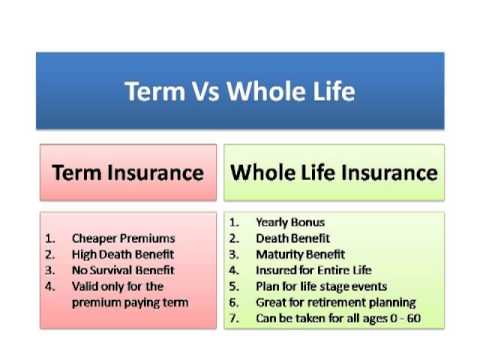

Term life insurance is the easiest to understand and has the lowest prices. Insurance is a form of backup. This is because the term life policy has no cash value until you or your spouse passes away. For most people the negatives of whole life insurance outweigh the negatives and term life insurance is the better option but there are some circumstances where a whole life policy is a better fit.

Term life insurance is usually significantly cheaper than whole life insurance. It covers you for a fixed period of time like 10 20 or 30 years. For one it never expires as long as you keep making your premium payments. Converting term life to whole life insurance can be an excellent way to continue your life insurance policy and also build cash value that you can borrow from.

The money saved can be invested in other investment options. In the simplest of terms it s not worth anything unless one of you were to die during the course of the term then that s when you receive money. If you buy whole life instead you ll be paying significantly more over many years for coverage that. You can get life insurance quotes online.

Buy term life insurance whole life insurance plans from singapore s leading insurance provider to protect you your loved ones. Term and whole life insurance policies both come with their own sets of positives and negatives. Life insurance association singapore suggests that coverage of 11 times your annual earnings is the most optimal but it really is relative to your lifestyle. Whole life insurance pros and cons.

There are many different ways to structure this type of policy depending on your needs and goals so be sure to work with a life insurance professional who can answer all of your questions and help you make the best choices. That s because whole life insurance is guaranteed to pay out no matter when you die and it builds cash value.