Roll Over 401k To Ira Then Cash Out

If you had a traditional 401 k you can transfer the money into a traditional ira without having to pay any taxes on it you ll pay taxes later when you take the money out in retirement though.

Roll over 401k to ira then cash out. An individual retirement account provider may be able to pay to move that asset over for a fee. You can roll over a part of a 401 k distribution into a qualified retirement account but the rollover is subject to certain restrictions. Normally you can t cash out your 401 k unless you separate from your job reach age 59 1 2 or qualify for an early distribution. Keep your 401 k with your former employer.

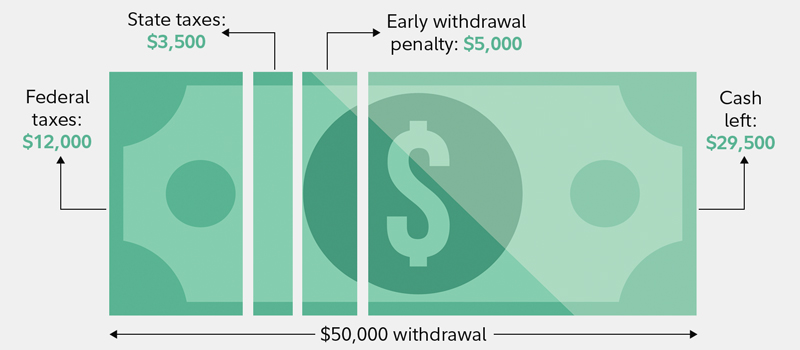

If you have a traditional 401 k plan that means you didn t pay taxes on the money when you contributed it to your account. Consolidate your 401 k into your new employer s plan. Straight of the bat pretax contributions made to your 401 k are now subject to tax because they do not enjoy the safety and tax exemption offered by this account structure. If you move 100 000 from your 401 k into a roth ira you instantly lose 25 if you re in that tax bracket.

You can cash it out leave it where it is transfer it into your new employer s 401 k plan if one exists or roll it over into an individual retirement account ira. You must sell the stock and roll over cash. Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan. You can rollover from a traditional 401 k into a traditional ira tax free.

Likewise if you had a roth 401 k you could roll the money into a roth ira completely tax free. Cash out your 401 k. Same goes for a roth 401 k to roth ira rollover. While 401 k and rollover ira accounts have some similarities they.

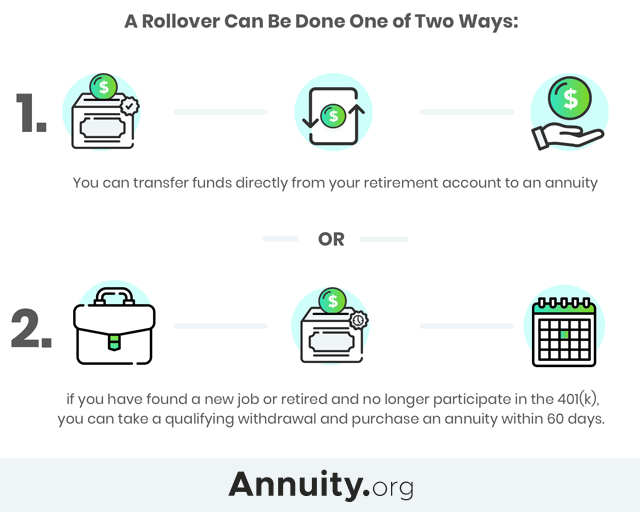

If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place. If you want to move that money into a roth ira you ll have to pay taxes on it. Roll the assets into an individual retirement account ira or roth ira. If the distribution was instead paid to you and then rolled to the ira within 60 days you would have to replace the amount withheld for taxes with money from another source to complete the rollover of the entire amount.

Your funds are considered. A rollover ira lets you move money out of a 401 k without sacrificing the benefit of delaying your tax bill until retirement.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)