Who Can Sell Annuities

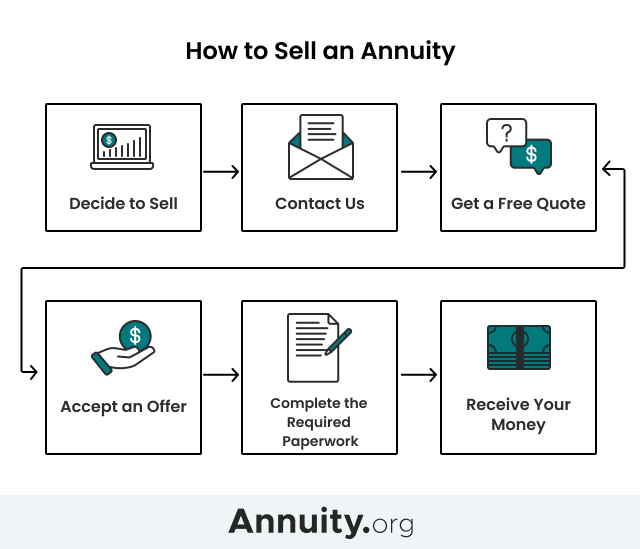

Thanks to our experience the process of selling your annuity payments is straightforward and relatively fast.

Who can sell annuities. At this point you ll have to complete paperwork related to the sale and schedule a court date for a hearing. Make sure you read and understand your annuity contract. If you sell all or part of your annuity the factoring company that purchases it will try to make the biggest profit it can. The difference between the value of your annuity and what you actually receive when you sell it is called the discount rate.

You can use the attorney provided by the settlement company or choose your own to represent you. Only a judge can approve the sale of an annuity. Research annuity buyers for best service. 1 you can sell your annuity as a straight purchase where you will get a one time lump sum for your annuity typically somewhere in the neighborhood of 75 of its value depending on the buyer.

That is right there are companies that specialize in buying structured settlements and annuities for one lump sum and you can use them to sell your annuity. You can also sell your annuity in parts. For an in depth view of the annuity selling process visit our page on how to cash in on your annuity. Consult with your financial planner.

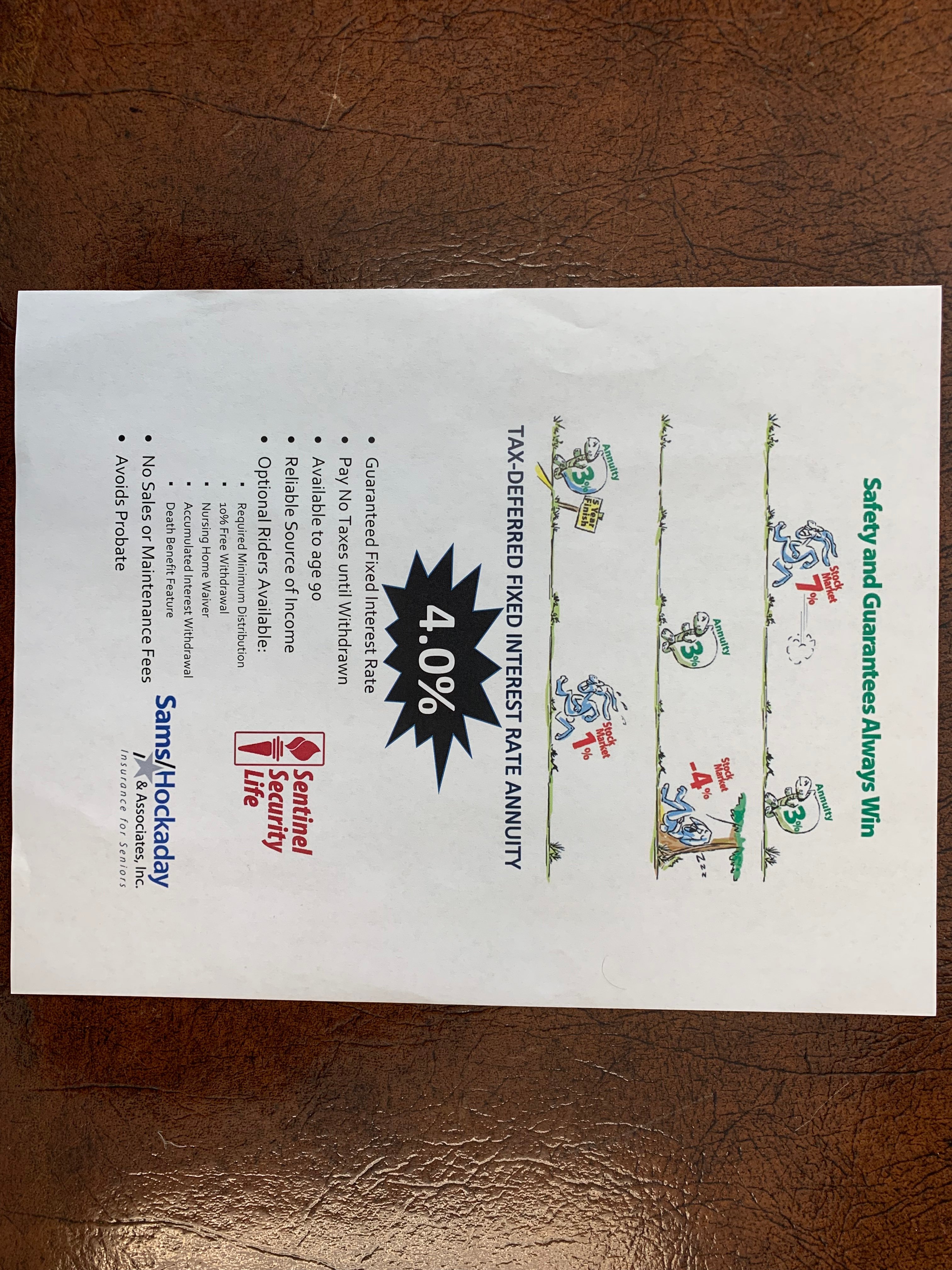

All fees should be clearly stated in the contract. The lower the discount rate the better for you. An annuity can be sold as a whole or in part based on your needs. Here are three different ways you can sell all or some of an annuity.

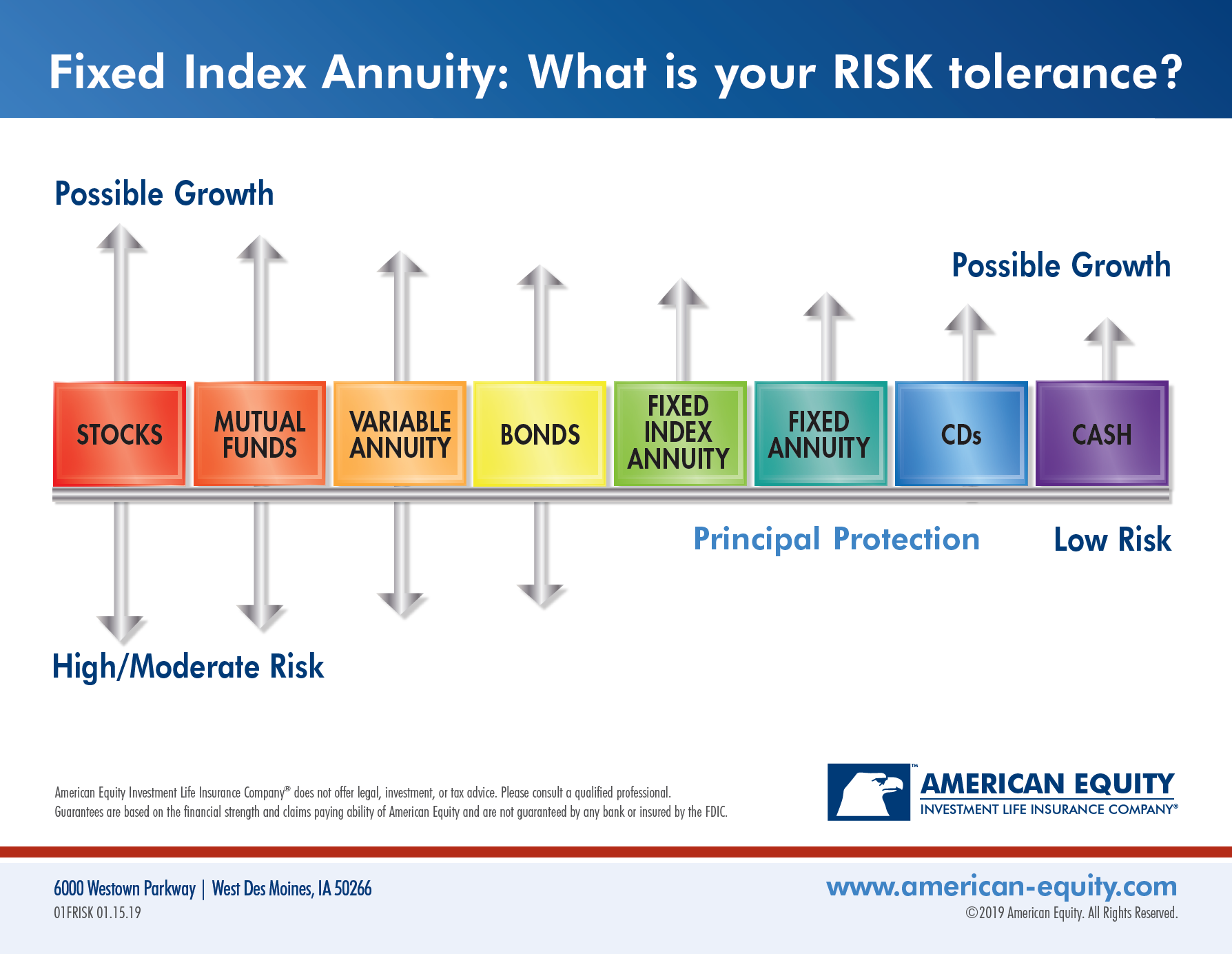

Many people will sell their annuity because their financial circumstances change and they need cash immediately rather than waiting for their scheduled payments. Selling fixed annuities is definitely a shiny object for many but the life insurance brokers who embrace it are not only rewarded but build better relationships with their customers. Insurance companies sell annuities as do some banks brokerage firms and mutual fund companies. Your most important source of information about investment options within a variable annuity is the mutual fund prospectus.

You can also get cash against future earnings by signing over your annuity to a third party such as a company that specializes in purchasing annuities. Wentworth for a lump sum you can rest assured that you ll receive the cash you re looking for. If i was to sell my annuity in a straight purchase i would no longer receive the annuity payments. Complete and submit required paperwork.

For an agent to sell fixed annuities they only need a life insurance license issued by their state of residence. Selling fixed annuities is not as easy as falling off a log but it s not as bad as you think if you take the time to learn how to market annuities properly. Receive a quote. Why would i sell my annuity.

Selling your annuity involves a number of steps. Once you get quotes you can sell your annuity to a settlement company. You can make the decision to receive cash for all or part of your annuity.