Strike Price Stock Option

Employee stock option basics.

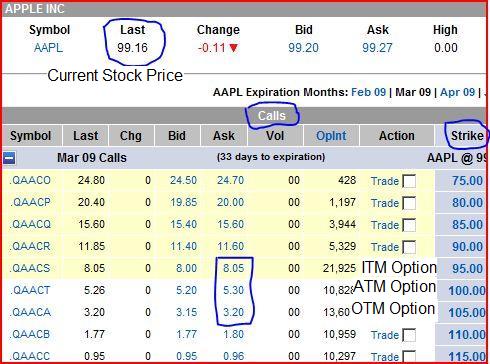

Strike price stock option. Option strike price. With an employee stock option plan you are offered the right to buy a specific number of shares of company stock at a specified price called the grant price also called the exercise price or strike price within a specified number of years. When you buy a call option the strike price is the price at which you can buy the underlying stock if you want to use the option for example if you buy a call option with a strike price of 10 you have a right but no obligation to buy that stock at 10. The following table lists option premiums typical for near term put options at various strike prices when the underlying stock is trading at 50.

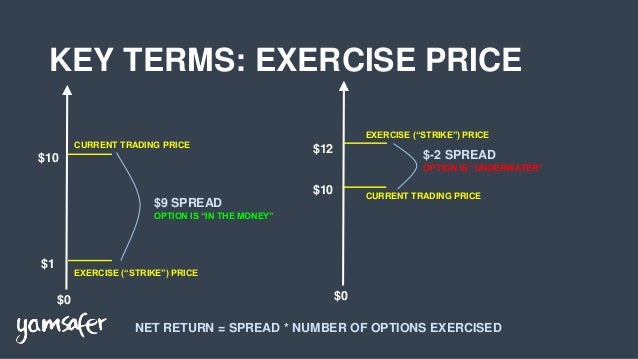

The fixed price at which the owner of an option can purchase in the case of a call or sell in the case of a put the underlying security when the option is exercised. Over the life of the option contract the holder has the right to exercise the option and purchase 100 shares of abc for 500. A strike price is set for each option by the seller of the option who is also called the writer. For put options the strike price is the price at which the underlying stock can be sold.

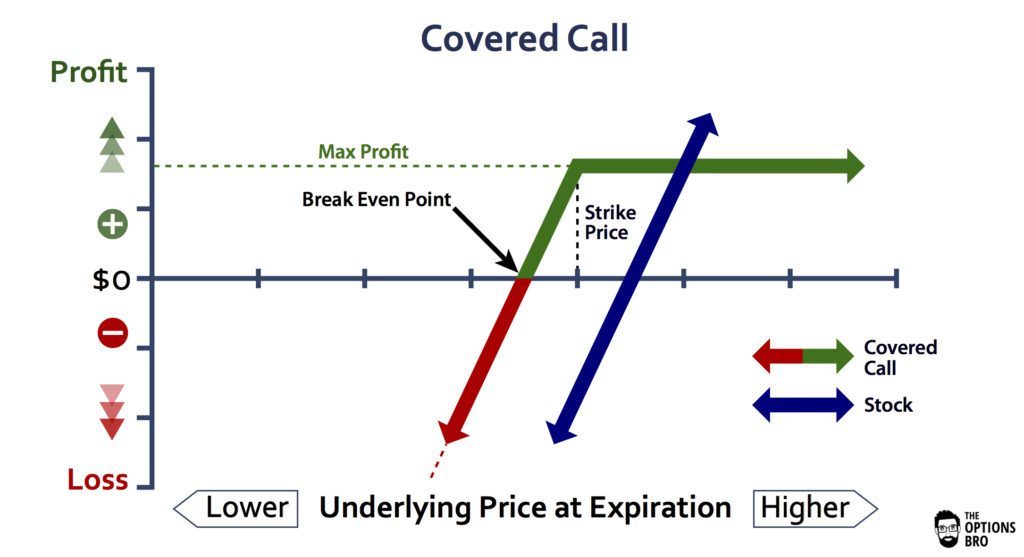

The strike price also known as the exercise price is the stock price that an option contract is exercised at allowing shares can be purchased or sold this is one of the most important elements of options pricing because it reflects the risk associated with underlying asset hitting that value or falling short. The strike price may be set by reference to the spot price which is the market price of the underlying security or commodity on the day an option is taken out. Relationship between strike price put option price. The specified price for the stock is called the strike exercise price.

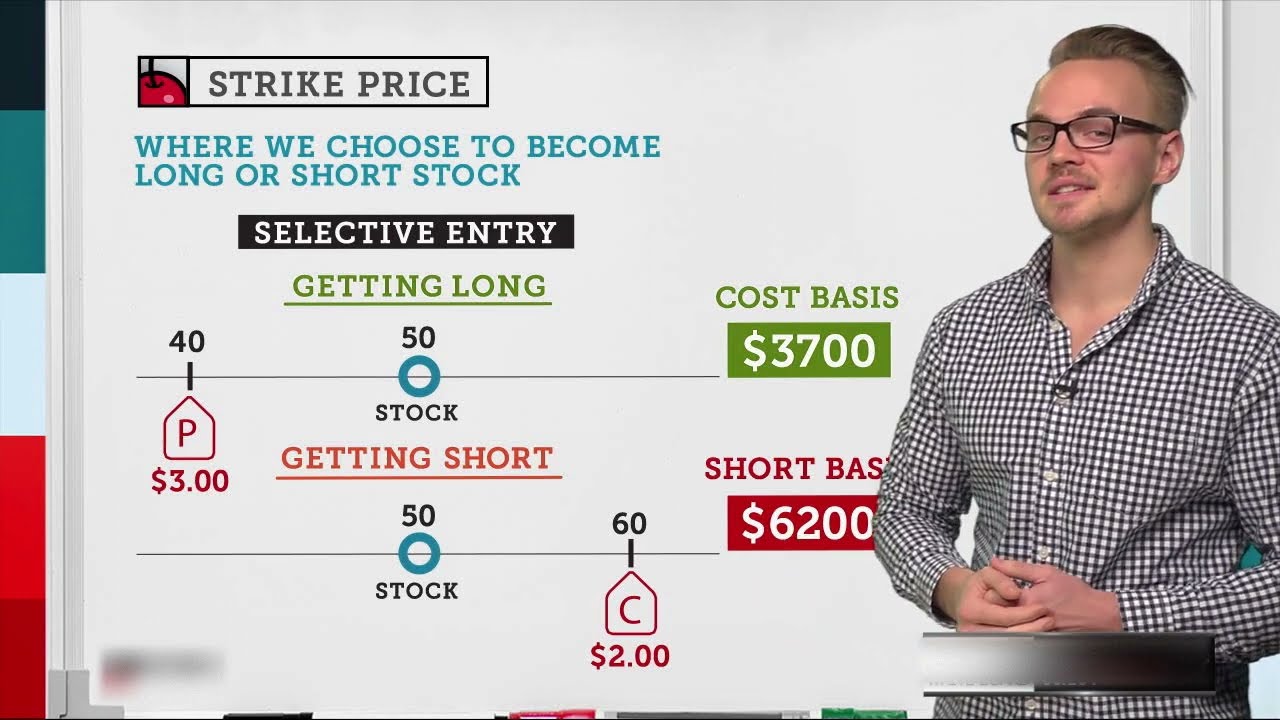

In finance the strike price or exercise price of an option is a fixed price at which the owner of the option can buy in the case of a call or sell in the case of a put the underlying security or commodity. A strike price is the price in which we choose to become long or short stock using an option. A relatively conservative investor might opt for a call option strike price at or below the stock price. The strike price of an option is the price at which a put or call option can be exercised.

Conversely for put options the higher the strike price the more expensive the option. For example an investor purchases a call option contract on shares of abc company at a 5 strike price. The price difference between the underlying stock price and the strike price determines an option s value.

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)