What Affects Auto Insurance Rates

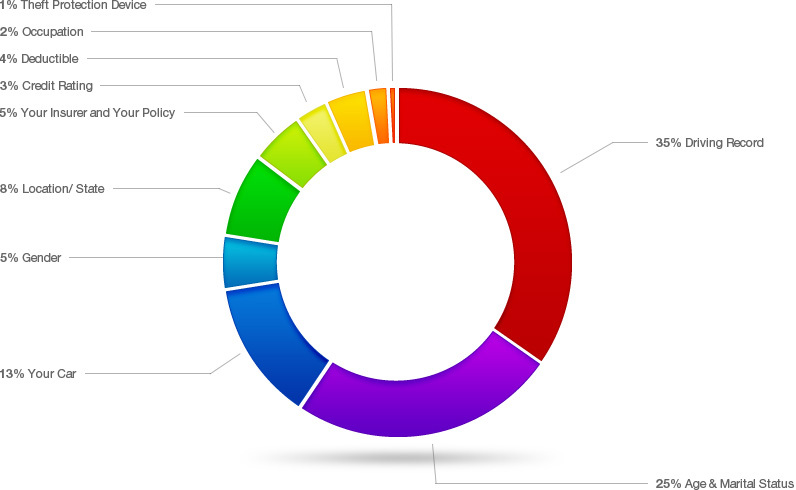

You may not realize it but your overall rate is also affected by many more different factors some of which you can control and many of which you cannot.

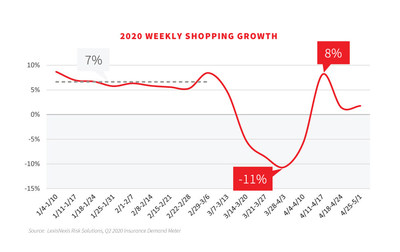

What affects auto insurance rates. For instance your age location and driving record play a part in determining your insurance rates but while these things aren t easy to change the type of car you buy is. How covid 19 may affect future auto insurance premiums. Insurance costs more for teen drivers. Teens pay more because statistically speaking they have more accidents.

Information on risk factors that affect car insurance rates are collected by the insurance company as you fill in a quote form. Your location affects your car insurance rates. Most states have some auto insurance requirements typically involving liability coverage coverages that are also typically included in a car insurance policy are comprehensive coverage collision coverage uninsured underinsured motorist coverage and medical payments or personal injury. Your insurance history affects your car insurance rates in two separate ways.

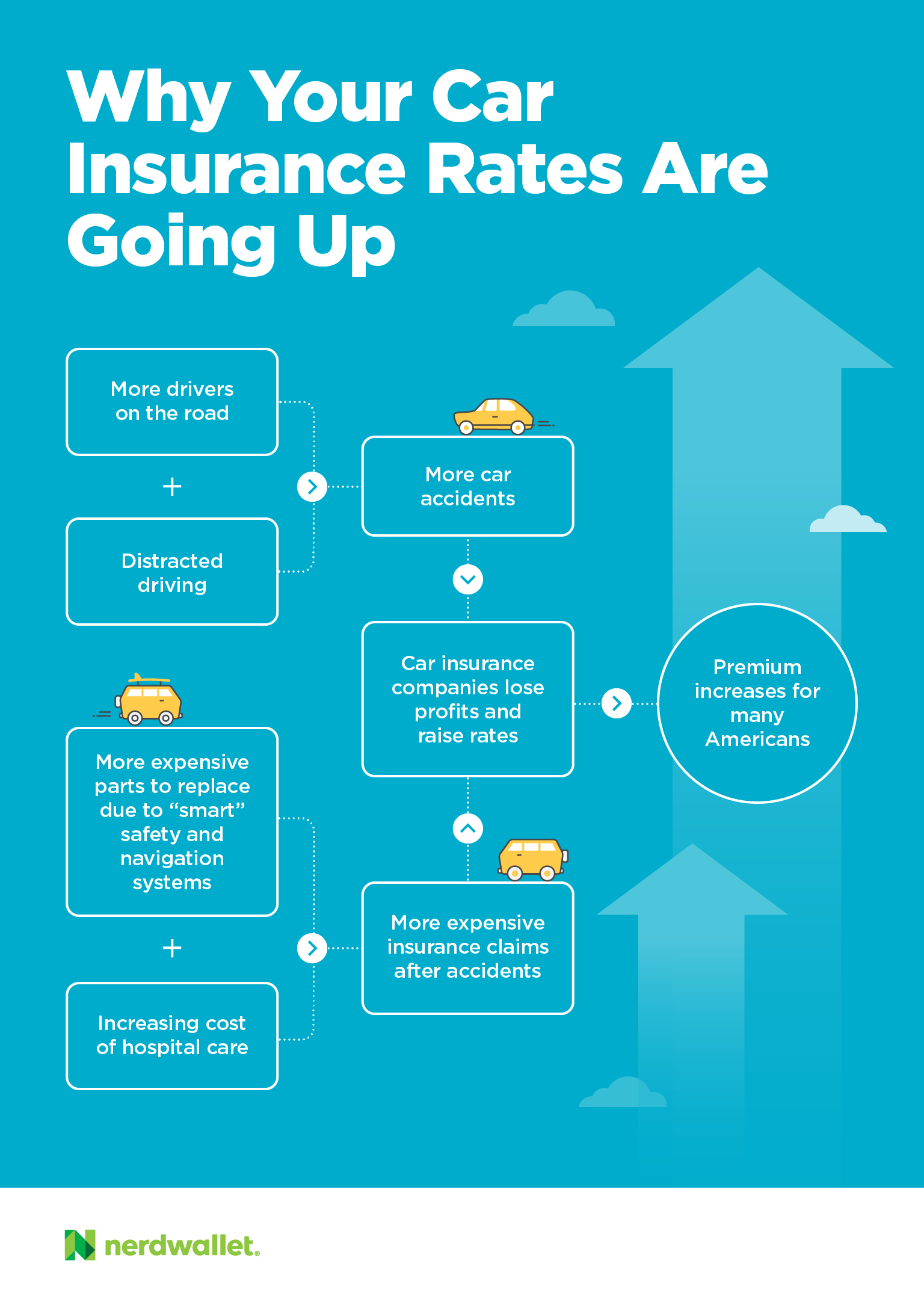

Even though they may consider the same. Teens cause more accidents than any other age group in the u s. The coverages you choose may affect the cost of your car insurance premium. But once shelter in place policies subside road traffic auto insurance claim rates and auto premiums should eventually return to normal.

Different insurance companies give you wildly different quotes. The safer you seem the less you ll pay. Prior insurance shows that you ve continually maintained insurance which is required by every state but new. If you live in an area with high claims or high theft your insurance rates will be higher.

When shopping for car insurance it can be tempting to reduce your rates by choosing lower amounts of coverage or by raising your deductibles these are of course the two most obvious factors that affect the cost of your auto insurance. Teens are new drivers inexperienced at dealing with complex traffic patterns and bad weather and are. Your rates will never again be as high as they are when you are a teen it s a simple fact. Here are five all about you factors that can affect your car insurance premium.

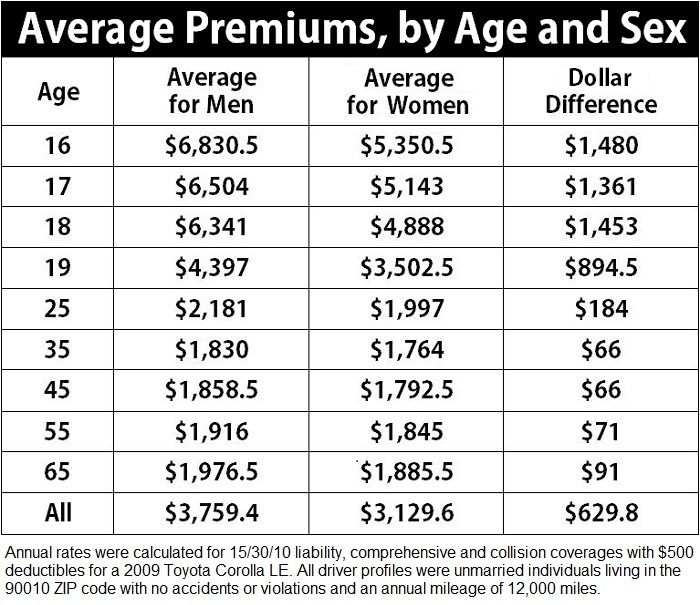

The type of coverage. Although a car s value and its performance potential are the primary vehicle related factors that determine car insurance rates other factors can help decrease or increase your rates too. Average car insurance rates by age. Next behind the scenes the company s algorithms go to work to make an educated guess on your risk level and calculate your rate quote.

If you live in a rural area you may pay more because of a high deer accident volume.