Water Leak Insurance Coverage

In most cases water damage will only be covered if the event is sudden or.

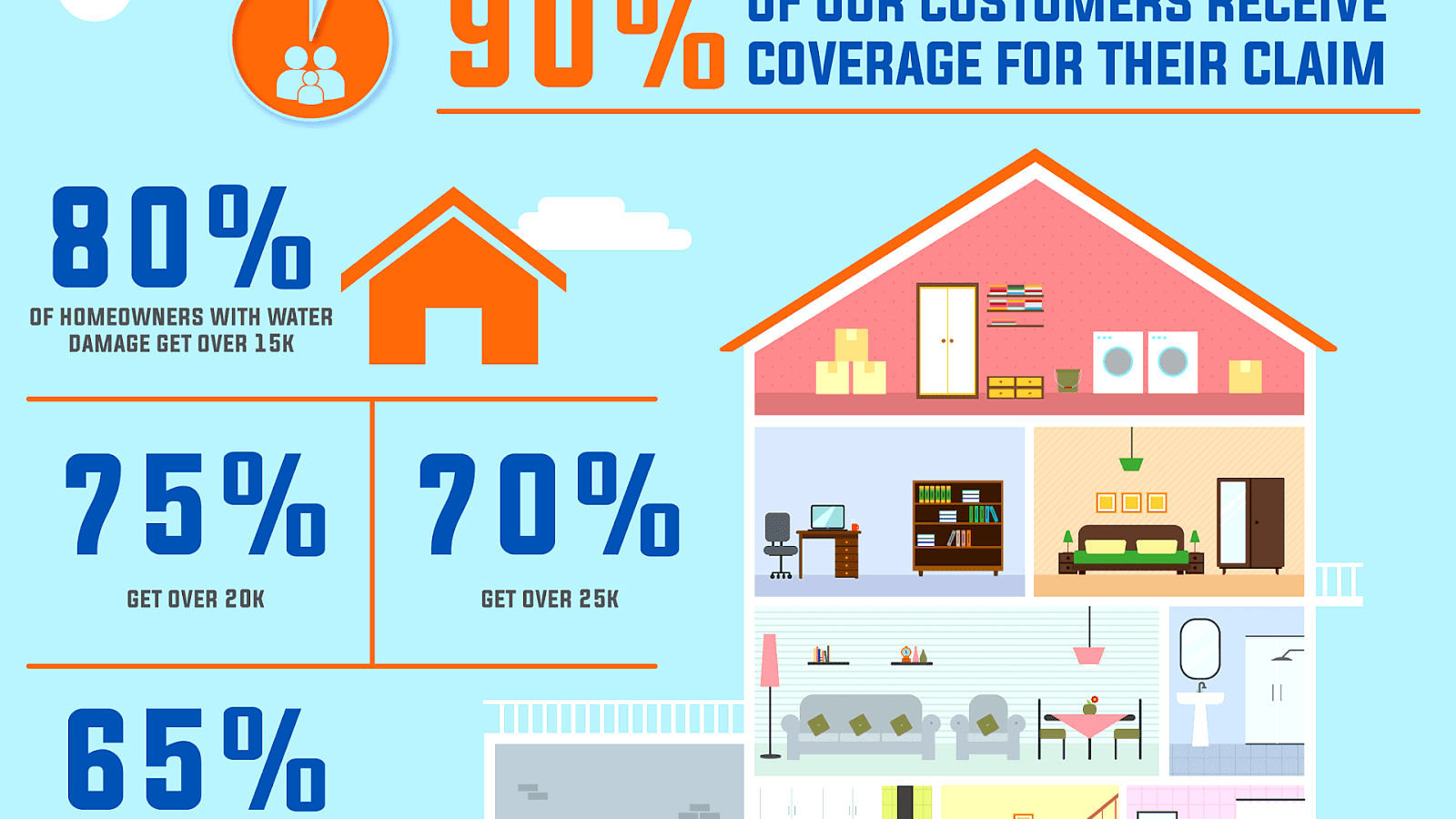

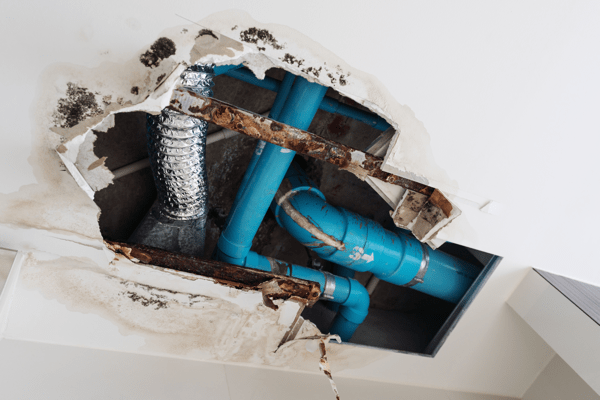

Water leak insurance coverage. According to the insurance information institute homeowners insurance may help pay for repairs if for instance your drywall is drenched after your water heater ruptures or an upstairs pipe bursts and water saturates the ceiling below. Water damage can be caused by a number of scenarios including frozen pipes storm damage and faulty plumbing systems. Claims due to water damage impacts 1 in 50 homeowners each year. And even policies that include cover may exclude some elements of a claim related to a leak.

Some home insurance policies will cover water leaks and some won t. Comprehensive auto insurance coverage is necessary to file have a claim for water leaks. Auto insurance may not pay for a water leak that goes unreported for a long time. Most home insurance policies cover water leak damage but there are many exceptions.

Your homeowners insurance policy should cover any sudden and unexpected water damage due to a plumbing malfunction or broken pipe. February 24 2020 may 14 2019 by homeowners insurance cover. Your auto insurance may cover water entering your car due to a storm or other accident. Over time materials that seal sunroofs can deteriorate causing water leaks.

Another common scenario is leaking pipes due to sudden events any damage that it may cause to your home will be covered by your insurance policy. Trace and access insurance can be extremely useful. Plumbing and drainage insurance gives you protection and reassurance so that if ever you experience a blocked drain or water leak you can rely on us to get you back on track. This will cover the cost of finding the source of a leak.

Consider american family insurance s hidden water coverage which covers water damage hidden from view that s caused by continuous or repeated seepage or leakage of water or steam from within a plumbing heating or air conditioning system or from within a household appliance. Plumbing and drainage insurance with homeserve covers a wide range of problems including burst pipes blocked drains and water supply pipe leaks. This isn t the same as escape of water insurance which may only cover you for any damage the leak causes. Most homeowners insurance policies help cover water damage if the cause is sudden and accidental.

Roughly one in 50 homes will have a water damage claim every year according to the insurance information institute. What is plumbing and drainage cover. For example companies may pay for the cost of removing parts of your building to find an escape of water but they won t pay for your property to be repaired once the leak is sorted.

:max_bytes(150000):strip_icc()/how-to-handle-water-damage-claims-3860314-FINAL-5ba50164c9e77c0082224c9c.png)