Small Business Medical Insurance Quotes

Workers compensation insurance helps provide medical disability survivor burial and rehabilitation benefits to employees who are injured or killed due to a work related injury or illness.

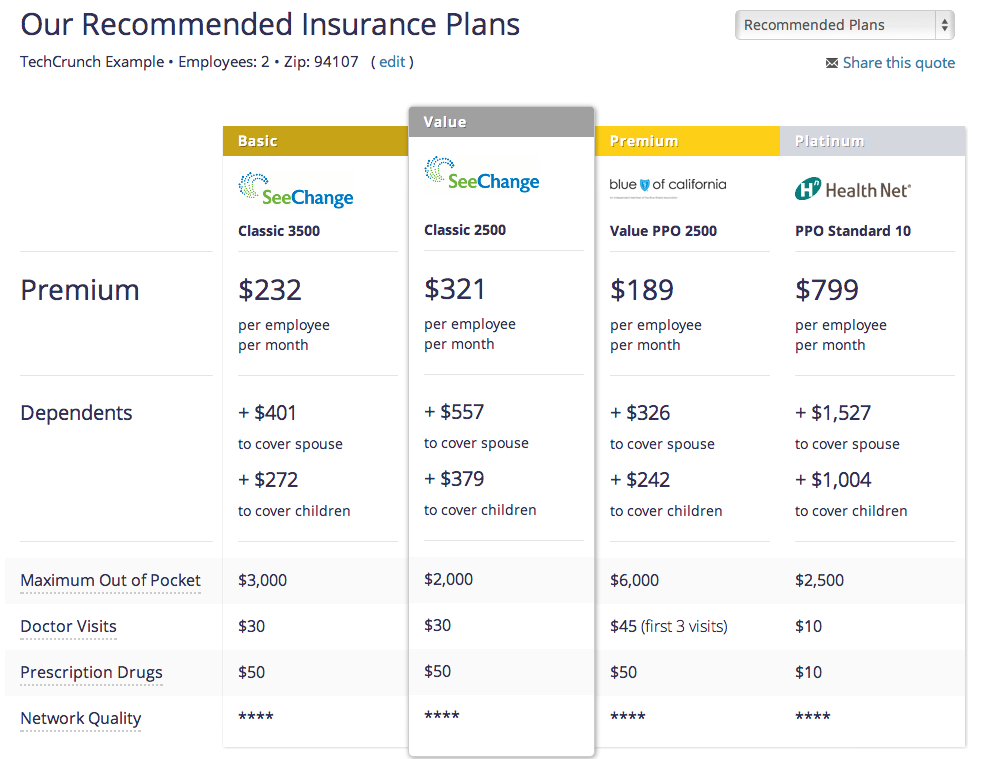

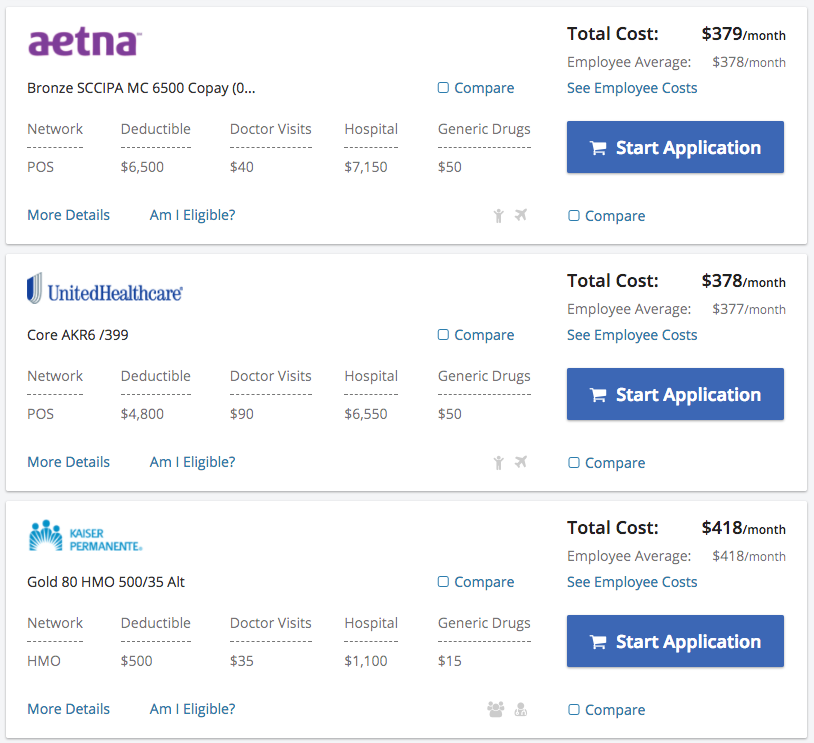

Small business medical insurance quotes. If you ve considered offering small business health insurance to your team it s likely that you have a lot of questions around how it works. At ehealth we recommend using the following 5 criteria to find plans that best match your needs. In this article we will explore health insurance for those who are self employed on their own and for those who are seeking small business health insurance plans. Our health insurance plans help you save money on health care costs and keep your employees informed and healthier.

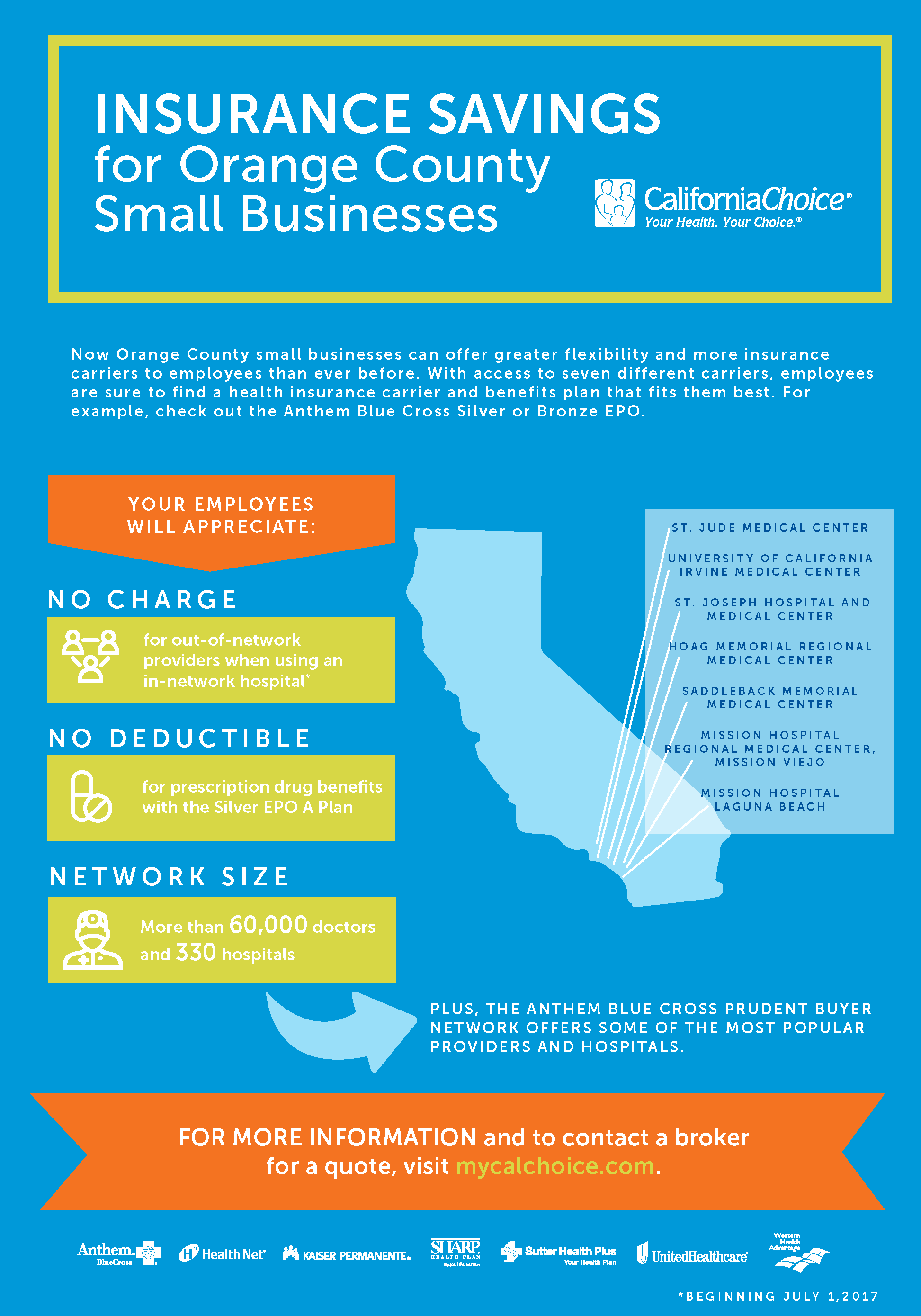

While health insurance helps cover small business employees in the pursuit of health and wellness there are other types of coverage a small business owner also needs to consider. If you run a small business you may be concerned about finding health insurance options either for yourself if you do not have any employees or for your small workforce. That s why we ve created our small business guide to health insurance which covers off a number of frequently asked questions. Collecting small business health insurance quotes.

Know what you and your employees will be able to pay on a monthly basis. Explore aetna s small group health insurance options to find the right plan and benefits for the needs of small businesses and its employees. Compare small business health insurance options. This will continue as obamacare is phased in.

There are a lot of factors to consider when weighing your small business health insurance options. Small business health insurance is regulated by the states and each state has different policies. Availability affordability and eligibility will vary from state to state but the new federal law will mandate certain requirements down to the states. The small business guide to health insurance.

:strip_icc()/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)