Wells Fargo Business Lines Of Credit

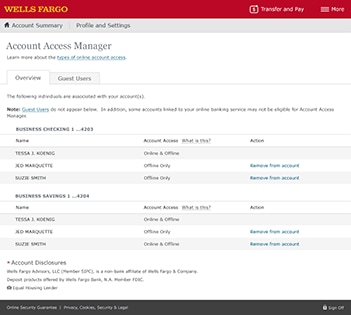

Establishing or re building business credit with wells fargo.

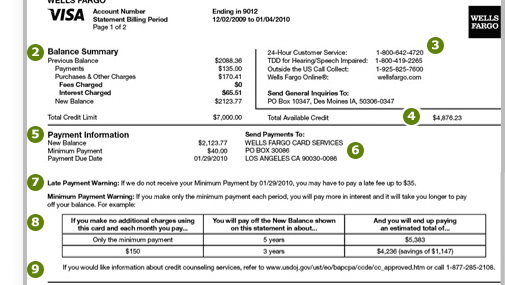

Wells fargo business lines of credit. Small business administration ideal for businesses in operation for less than 2 years. Credit lines from 5 000 to 50 000. Wells fargo personal line of credit will typically approve or deny a line of credit application within 24 hour s and fund personal lines of credit within 3 business day s of approval. The wells fargo business lines of credit are marketed to both established businesses and new businesses.

Rates for these lines of credit are based on prime rates such as wells fargo prime rate but include a small percentage added on top of that. For businesses that are more than two years old the credit amounts extend from 5 000 to 100 000 and do not require collateral. Wells fargo small business advantage line of credit backed by u s. 5 year revolving line of credit no scheduled annual review.

The options are both secured and unsecured options with different interest rates and fees. Wells fargo s credit line products are the businessline line of credit which comes in secured or unsecured flavors and the small business advantage line of credit which is an unsecured line of credit for businesses that have been in operation for fewer than two years. Wells fargo business lines of credit give you the flexibility to access up to 100 000 and track expenses. What is the estimated funding time for a personal line of credit via wells fargo personal line of credit.