Va Loan 0 Down

You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan.

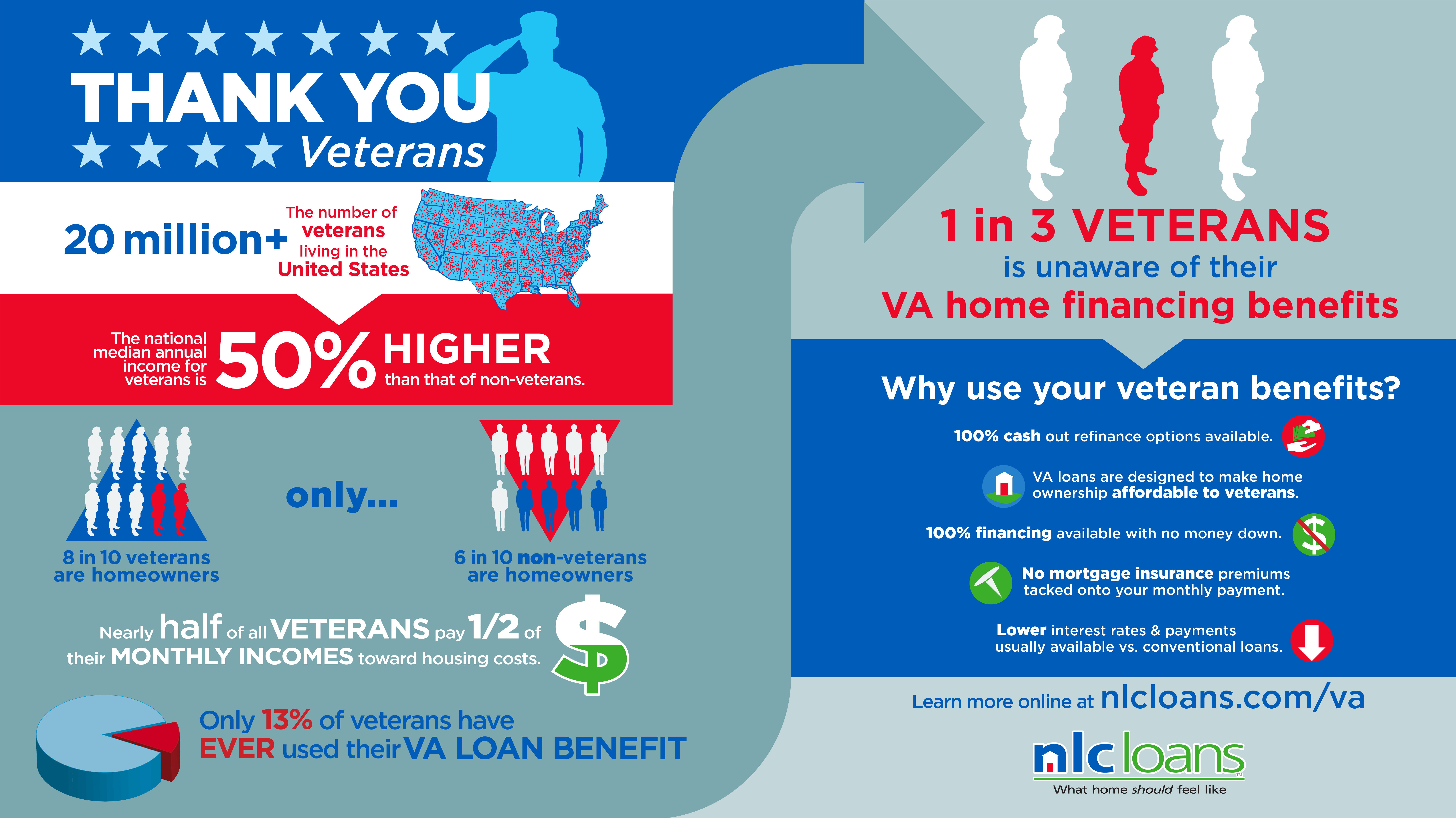

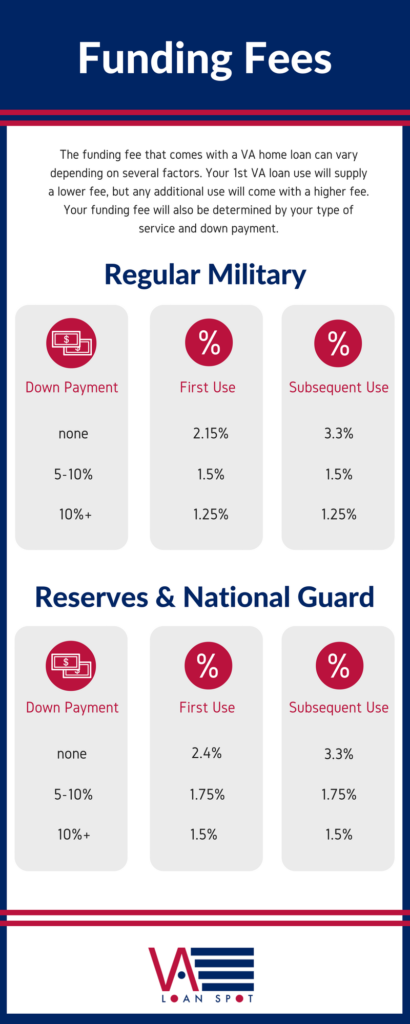

Va loan 0 down. The va funding fee varies from 0 to 3 6 depending on down payment amount the veteran s military experience type of home and loan purpose. The va loan requires no down payment making it the most popular choice for loan programs among our nation s past and present military. Discussion about common disbeliefs further demonstrates that zero down va backed mortgages are hard to beat. Verify your eligibility for a zero down va loan sep 13th 2020 2.

All about the va loan guaranty. There is no limit to the amount you can borrow on a va loan but there is a limit to the amount of liability the va takes on. The most popular term for a va home loan is 30 years because it lowers the payments substantially. Va home loans are available in 15 and 30 year terms.

Dismiss va home loan myths about the federally backed zero down loan program. Banks mortgage companies and other lenders are the ones who put up funds for service members to. Va borrowers generally pay an up front funding fee. The va is a loan guarantee program.

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries. Va loans are made by private lenders. No down payment necessary. Department of veterans affairs va.

For applicants with 10 or more service related disability or their surviving spouses the fee is waived. Va loans are one of the last zero down home loans available today. Find out the current loan limits and how they may affect the amount of money you can borrow using a va backed home loan without a down payment. Let s put those suspicions to rest with a thorough discussion of the va loan program and an explanation of some why some va borrowers can get a va loan with a 0 down payment.

The va loan is a 0 down mortgage option available to veterans service members and select military spouses va loans are issued by private lenders such as a mortgage company or bank and guaranteed by the u s. The home must be for your own personal occupancy.