What Are Settled Funds

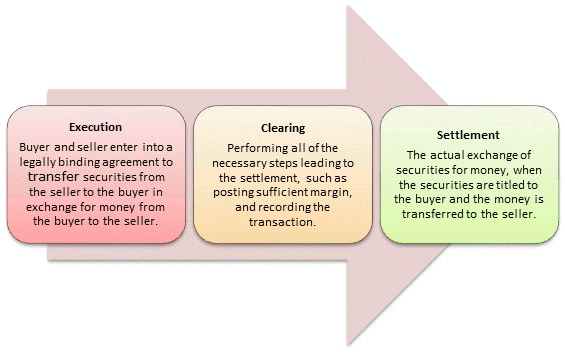

Funds settlement is an important back office function and the faster it occurs the more it reduces market risk by ensuring that trades are executed properly.

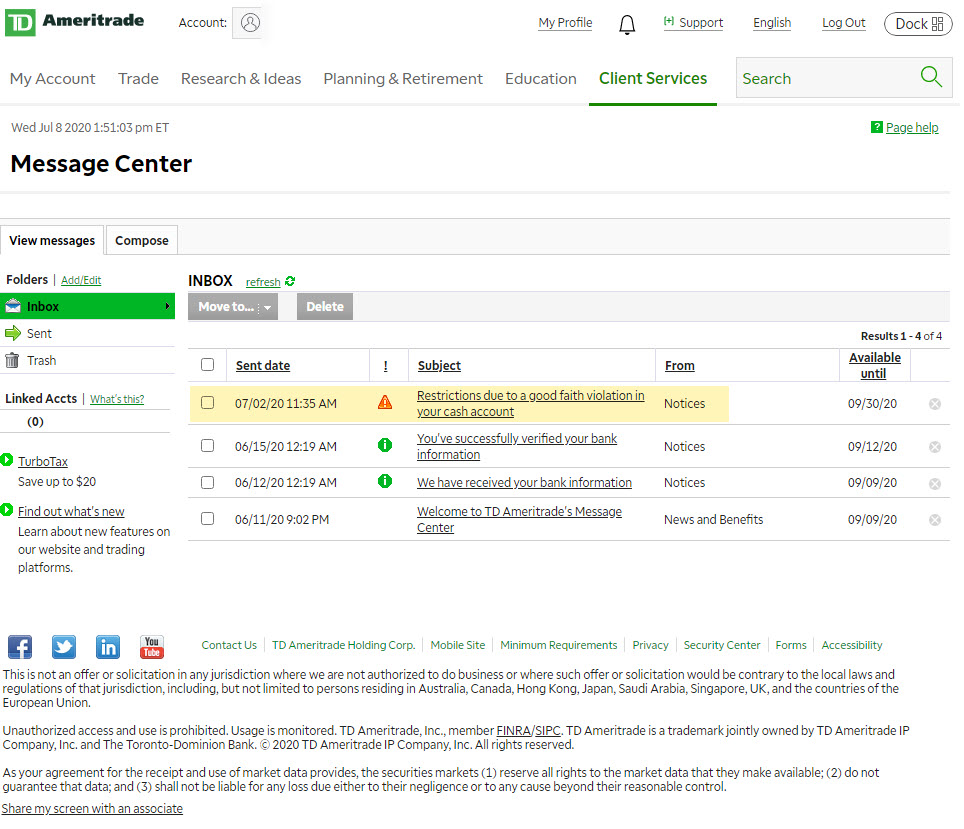

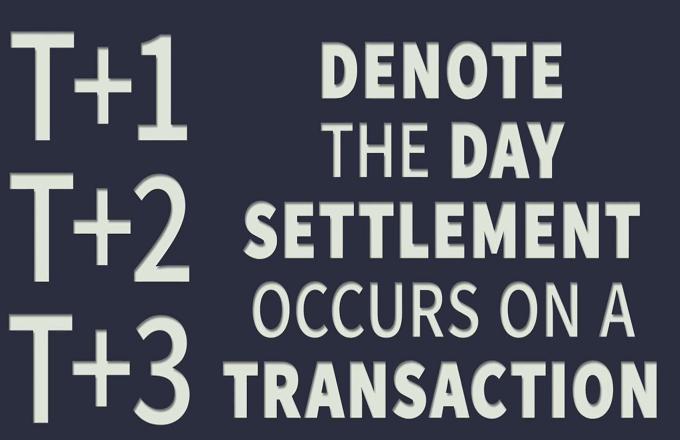

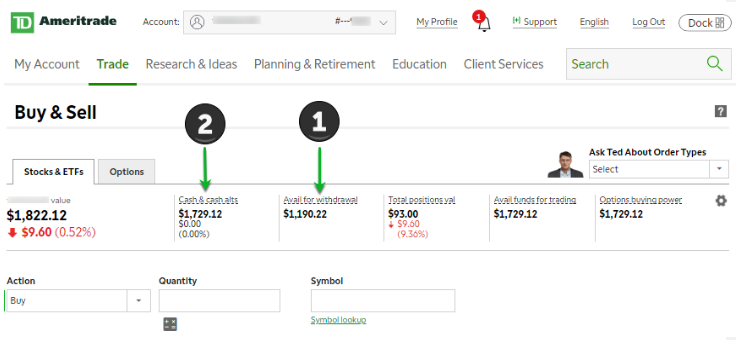

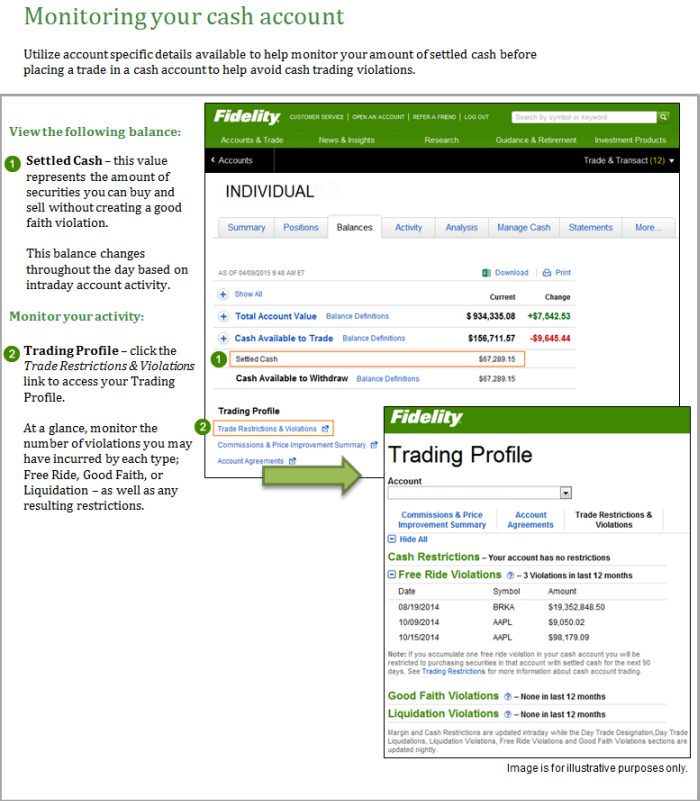

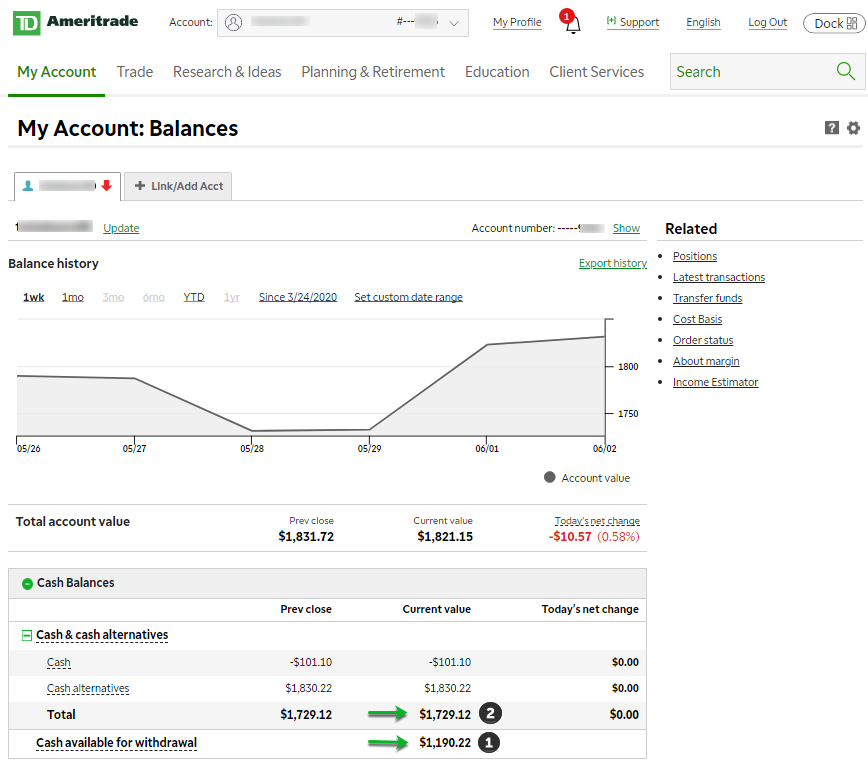

What are settled funds. In the united states the settlement date for marketable. Lee places an order to sell his xyz stock. Only cash or the sales proceeds of fully paid for securities qualify as settled funds liquidating a position before it was ever paid for with settled funds is considered a good faith violation because no good faith effort was made to deposit additional cash into the account prior to settlement date. The remaining 900 in settled funds needed to fully pay for the uvw purchase is due by the settlement date which is day two t 2.

Settled funds are those funds that are available to the account holder for either withdrawing from the account or use the funds for further investing. Settled funds are incoming cash such as a deposit or wire available margin loan value and settled sale proceeds of fully paid for securities. Doing so is a good faith violation. While unsettled funds may be used to purchase a security in good faith you cannot sell any part of the newly purchased security before the funds have settled.

If the account has sufficient settled funds there are no restrictions as to what may be purchased. Rather than deposit cash into his account mr. Settlement of securities is a business process whereby securities or interests in securities are delivered usually against in simultaneous exchange for payment of money to fulfill contractual obligations such as those arising under securities trades.

:max_bytes(150000):strip_icc()/mutual-fund-of-funds-56a090ea5f9b58eba4b19e62.jpeg)

:max_bytes(150000):strip_icc()/mutual-fund-fb4cea5f2aad4f2e9f31737e0ec8609e.jpg)