Reducing Tax Debt

/will-the-u-s-debt-ever-be-paid-off-3970473-finalv2-acb523b4dacf43529f4915254c600777.png)

For example some critics have argued that the cost of equity should also be deductible.

Reducing tax debt. This standard practice statement sets out the commissioner s practice when considering the options for removing or deferring the obligation to pay tax interest and or penalties under the tax administration act 1994. There are moves you can make to reduce the impact of unpaid taxes on your life credit and financial well being. It is your right as a citizen to have federal tax professionals file a true tax return on your behalf to replace the substitute for return that the irs filed for you. Struggling with tax debt.

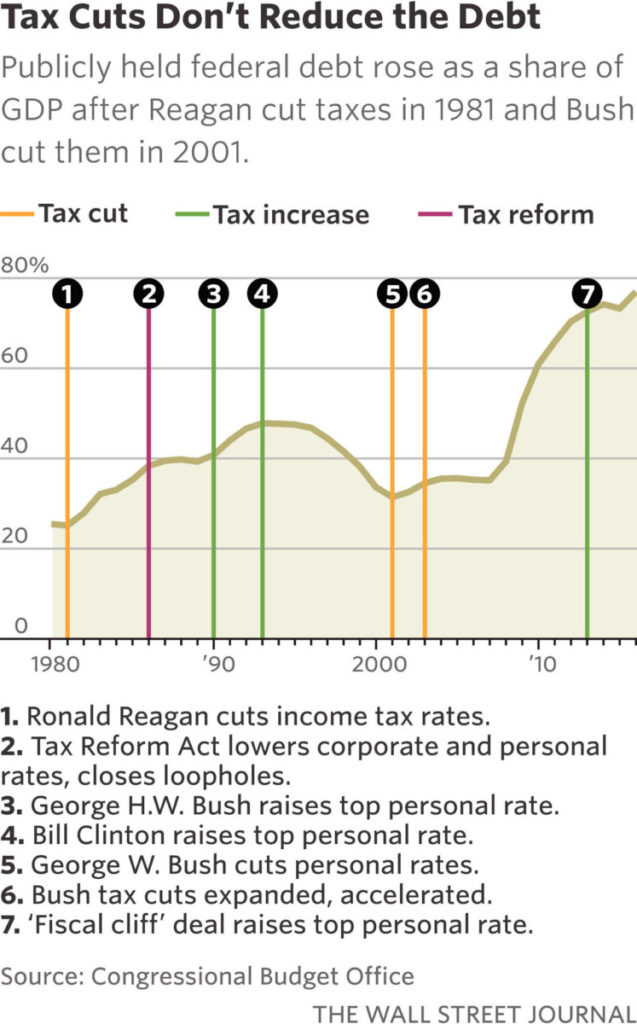

Maintaining interest rates at low levels is another way that governments seek to stimulate the economy generate tax revenue and ultimately reduce the national debt. Options for relief from tax debt. Which could reduce the internal revenue code s influence on capital structure decisions potentially reducing the economic instability attributable to excessive debt financing. Tax debt can snowball quickly keep in mind that tax debt can get out of hand quickly if you procrastinate about dealing with it.

Here are five tips to lessen that burden. Eventually it will run out of patience and take more serious measures imposing levies and liens.

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)