Va Home Loan No Money Down

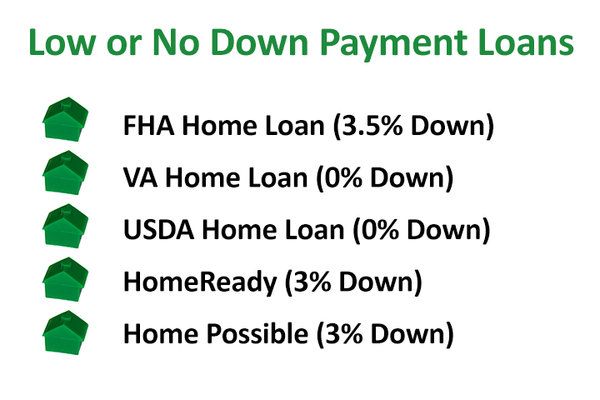

However they do allow for loans with a down payment as low as 3 5 of the home s purchase price.

Va home loan no money down. It is a true commodity to have access to a 100 mortgage with no down payment required. The va is not a home management and wants to turn around and sell the va owned home as quickly as possible. The va pays insurance to the mortgage lender that originally lent money to the borrower. No down payment loans with the va program for home purchase.

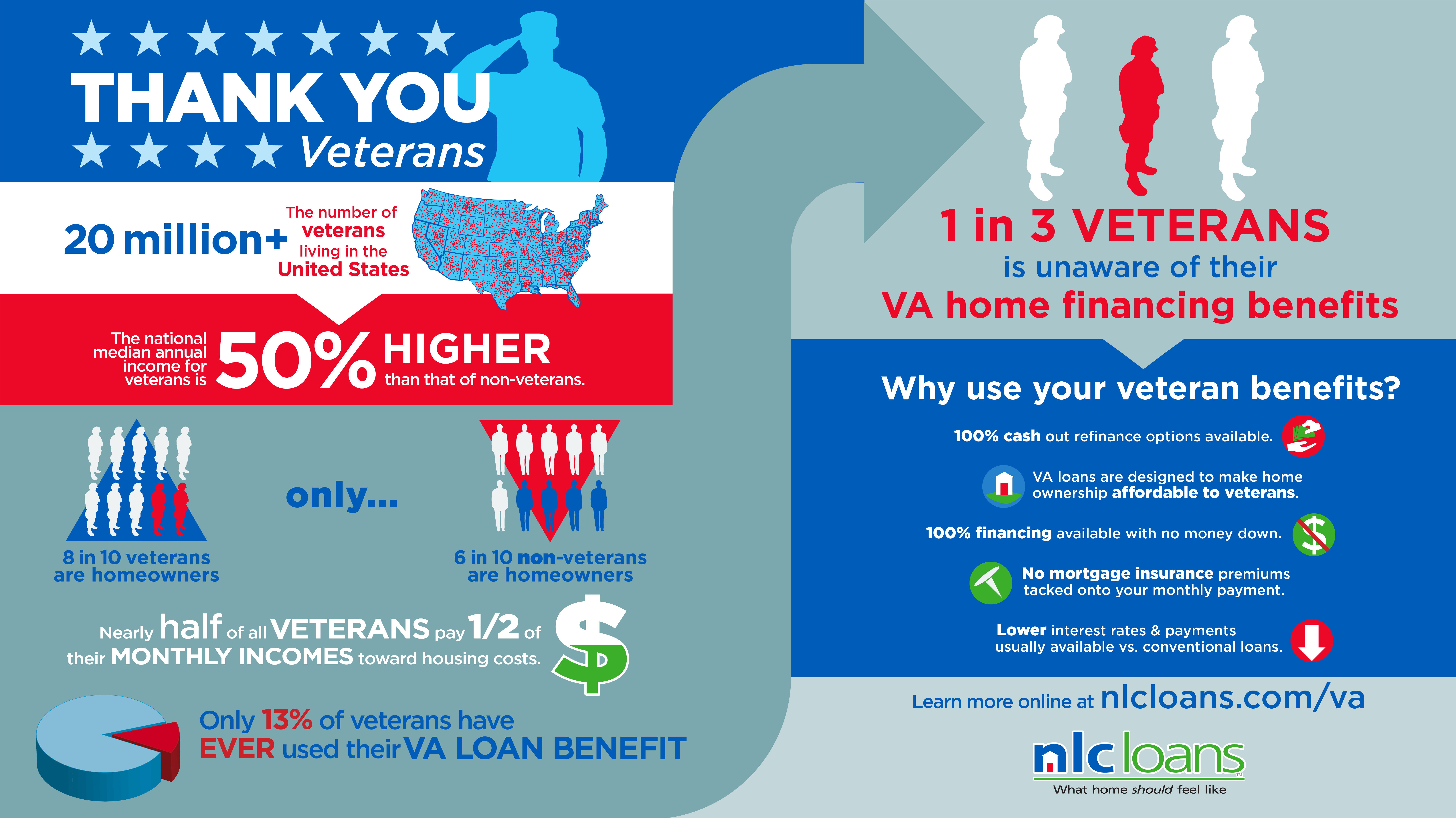

Get started with your va loan request. One way the va does this so is to sell the home with no money down. Once a va loan borrower puts down at least that amount the va. Did you know that the veterans affairs offers a no money down home loan to active and retired military borrowers.

The no money down va insured mortgage gives borrowers dealing with tight budgets more flexibility in the all important early years of the home loan. Although about 90 percent of borrowers use va loans with no down payment there s a perk to paying down as little as 5 percent. Not a bad deal and only reserved for va mortgages. The department of veterans affairs offers a government insured 100 financing zero down payment home loan for eligible veterans and active duty service members that requires no monthly paid mortgage insurance.

Va loans also allow you to pay a one time va funding fee that s 2 15 of your loan value in lieu of mortgage insurance. 2 250 2 898 apr with 1 375 discount points on a 45 day lock period for a 15 year fixed va loan and 2 250 2 605 apr with 1 500 discount points on a 45 day lock period for a 30 year fixed va loan. If you have remaining entitlement for your va backed home loan find out the current loan limits and how they may affect the amount of money you can borrow without a down payment. 1 2020 when the new law takes effect the va will not cap the size of a loan a veteran can get with no money down paving the way for veterans to buy higher value homes.

A va no no is the nickname given to a va loan where the veteran doesn t have to pay any closing costs along with no down payment requirement. Va loans are backed by the department of veterans affairs and are another option if you want to buy a home with no down payment. As of 2020 if you have full entitlement you don t have a va loan limit. Imagine buying your first home with no deposit or money out of pocket.

When a veterans uses their va loan benefit more than than once subsequent use a down payment payment may or may not be required so always check with your local va loan specialist. These loan rates assume no down payment and a 250 000 loan amount. In order to qualify for a va loan you must meet any one of the following service requirements.