Robot Advisor

:max_bytes(150000):strip_icc()/wealthfront-vs-etrade-core-portfolios-3cf44d7f34e846d6993d425e0d9f3888.jpg)

The best robo advisor for your needs typically comes down to the cost and features.

Robot advisor. Unfortunately thanks to stiff competition in the robo advisory space smartly has decided to cease operations in singapore announced 24 mar 2020. The term robo advisors is commonly used to describe digital platforms that utilise automated solutions and algorithms to help us invest and manage our money. Robo advisor versus human advisor in some ways the term robo advisor is misleading. Smartly has shut down apr 2020 established in 2016 smartly is one of the most well established og robo advisors.

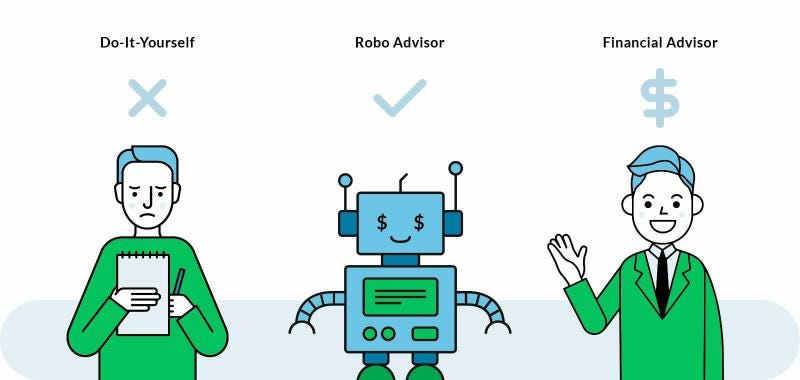

Robo advisors or robo advisers are a class of financial adviser that provide financial advice or investment management online with moderate to minimal human intervention. They provide digital financial advice based on mathematical rules or algorithms. Most robo advisors use similar signup systems and relatively similar portfolio models. If you know investing is important but don t want to put in a lot of work or cash a robo advisor might work.

Robo advisors in singapore represents a personalised trust where investors can invest their money in. Robo advisors use advanced software to handle many of the tasks that used to require expensive experts to manage. The first robo advisor betterment launched in 2008 and started taking investor money in 2010 during the height of the great recession their initial purpose was to. The best robo advisors offer easy account setup robust goal planning account services portfolio management and security features attentive customer service comprehensive education and low fees.

Services range from automatic rebalancing to tax optimization and require little. These algorithms are calculated and programmed by humans based on financial models and risk appetites set by the company and requires lesser human supervision. They provide a investment solutions based on mathematical rules or algorithms. By doing this robo advisors are able to reduce the number of human advisors they employ offer more consistent advice and scale up operations very efficiently.

Cost is a huge driver of your long term returns so that should be the first place you look when choosing any investment advising service robo advisor or otherwise.

/iStock-578561568-59b6e40b519de20011769cab.png)