Sell Annuities

With life insurance and annuity products the commission paid to the selling agent is typically built into the policy.

Sell annuities. These companies represent the annuities that we believe are the best in class. The process of selling annuity payments typically includes. Secondly you ll need to research companies that buy annuities for cash. Selling annuity payments in exchange for a lump sum of cash is simple convenient and can be completed in just a few steps with some assistance from an established company with several years of experience in the field.

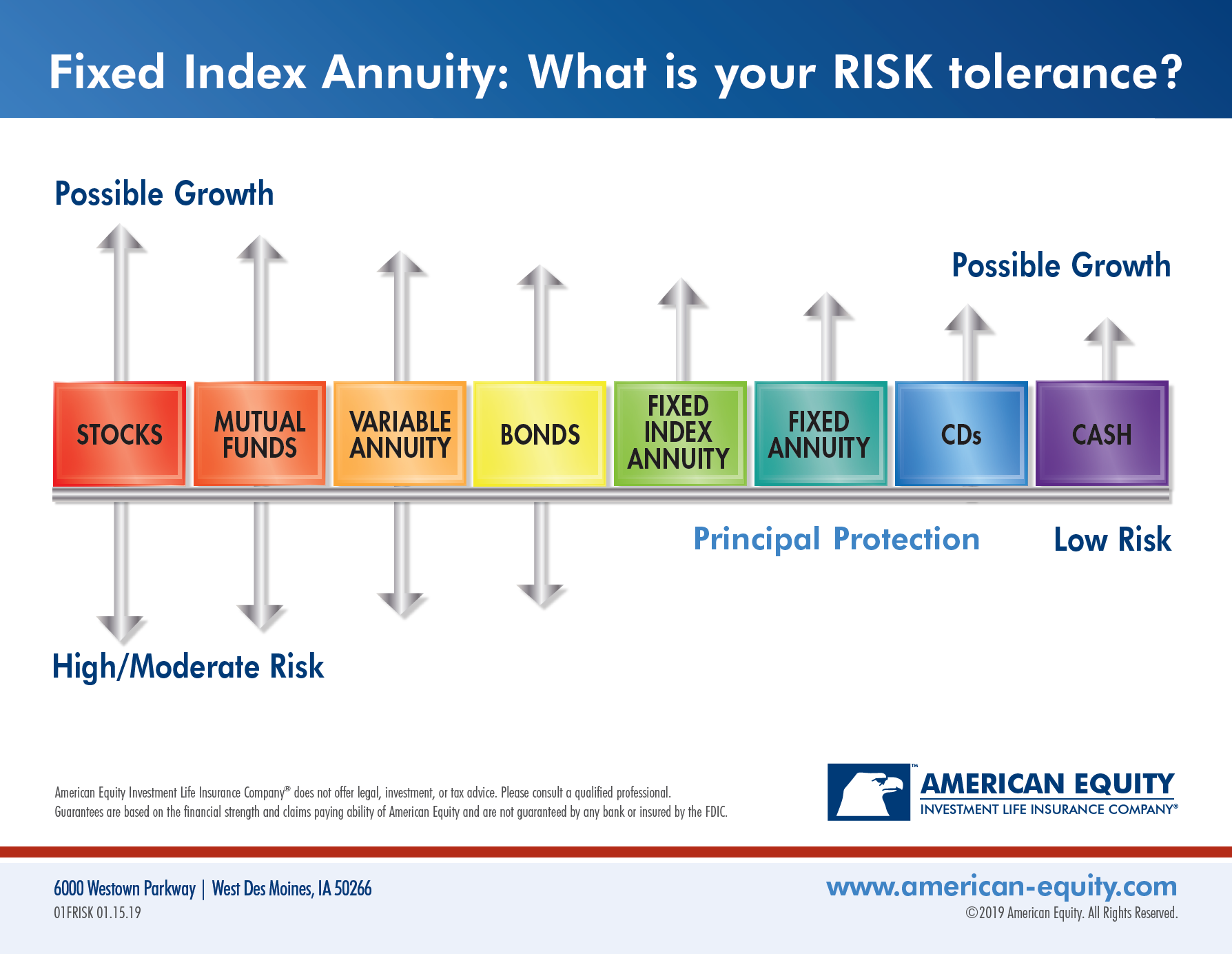

You need to complete the product training provided by each company you contract with. You will need e o insurance. How to sell your annuity. For an agent to sell fixed annuities they only need a life insurance license issued by their state of residence fixed annuities are primarily represented by five different products.

The following list represents our current picks for the top 10 best annuity companies of 2020. Therefore there are certain steps you need to take to do it correctly. Below is a basic run down of some of the common annuity commission levels based on some of the most common annuity products. In order to sell annuity you do need to check a couple items off your to do list.

Annuity agent commissions are built into the policy. 2020 best annuity companies please click on a company name to find out more about each individual carrier and the products offered. Single premium immediate annuities spias longevity annuities also called deferred income annuities or dias fixed rate annuities also called multi year guarantee annuities or mygas qualified longevity. Training and e o insurance for annuity sales.

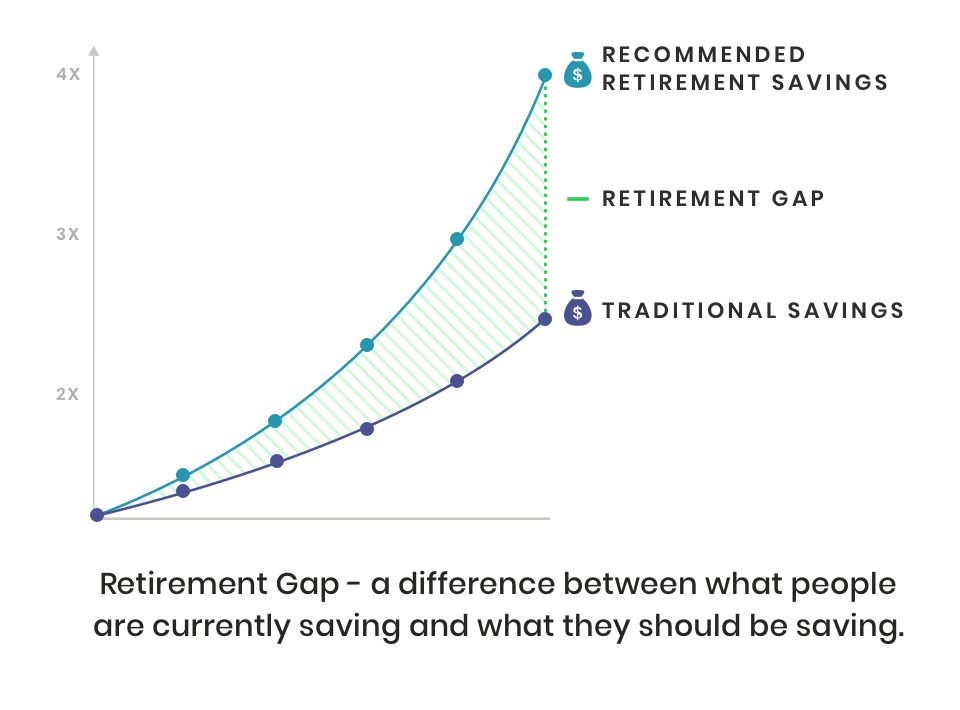

In exchange for quick turnaround on cash annuity buyers will charge a fee and sell your annuity at a discounted rate for profit. While many types of financial companies can sell annuities only an insurance company can issue an annuity because annuities are insurance products the same large corporations that sell life home automobile and other types of insurance in the united states also sell the majority of annuity contracts. Firstly you may want talk to your financial advisor about whether selling an annuity is the right move and which sale option is best. First and foremost selling your annuity does not guarantee a full payout equal to the initial value of the contract.

Your most important source of information about investment options within a variable annuity is the mutual fund prospectus. Insurance companies sell annuities as do some banks brokerage firms and mutual fund companies. Annuity commissions are going to vary based on the product type so it s hard to actually pinpoint exactly how much you can make selling annuities unless we know exactly what you re selling. Make sure you read and understand your annuity contract.

All fees should be clearly stated in the contract. Selling your annuity payment does have tax implications. Insurance companies issue annuities and if you put 100 000 into an annuity you will see 100 000 on your statement and 100 000 will go to work for you.