Tax Relief

Medical expenses for parents.

Tax relief. Tax relief applies to pension contributions charity donations maintenance payments and time spent working on a ship outside the uk. Tax relief is any program or incentive that reduces the amount of tax owed by an individual or business entity. We do not assume tax debt make monthly payments to creditors or provide tax bankruptcy accounting or legal advice. It also applies to work or business expenses you may be.

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. You ll get tax relief based on what you ve spent and the rate at which you pay tax. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too. Read and understand all program materials prior to enrollment.

However please evaluate whether you would benefit from the tax relief and make an informed decision. This relief is applicable for year assessment 2013 and 2015 only. Optima tax relief is a tax resolution firm independent from the irs. 5 000 limited 3.

Example if you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12. First time handicapped parent relief claims. In the above example you can claim a total cpf cash top relief of 12 000 for this year. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

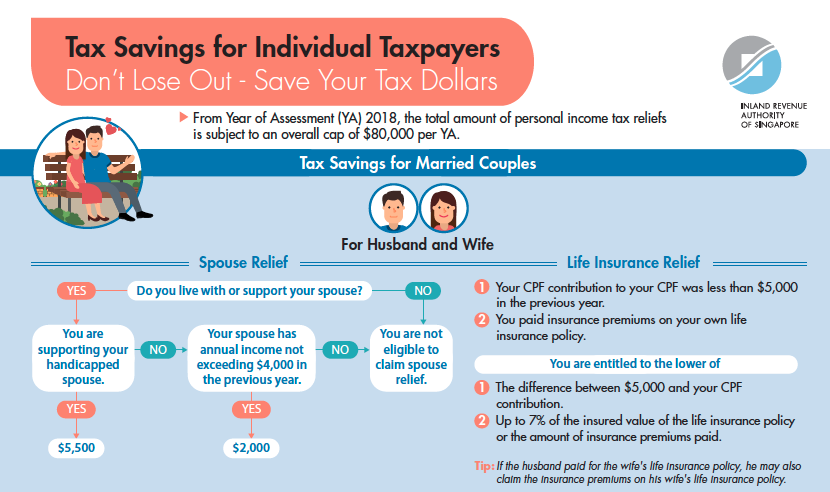

Amount rm 1. Examples of tax relief include the allowable deduction for pension contributions. A personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each year of assessment. If you are claiming handicapped parent relief and this is your first time claiming this relief on the dependant please complete and submit the handicapped related tax relief form doc 243kb by email.

.jpg)