What To Bring To Mortgage Pre Approval

Paperwork is the lifeblood of the mortgage industry.

What to bring to mortgage pre approval. Going through the preapproval process with several lenders allows a home buyer to shop interest rates and find the best deal. Requirements for pre approval. Thirty days of pay stubs. A pre approval usually specifies a term interest rate and mortgage amount.

Know the maximum amount of a mortgage you could qualify for. These will include but may not be limited to. Mortgage pre approval is a more significant milestone in the process because a lender is actually checking your credit and verifying your financial information. You ve come to the right place.

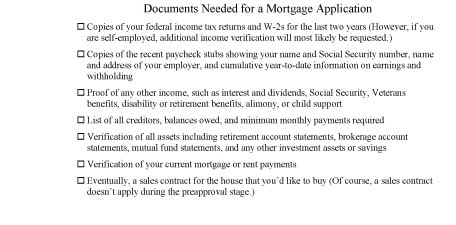

A pre approval is typically valid for a brief period of time and usually has a number of conditions that must be met. Pre approval is an important home buying step get pre approved today and enjoy a 130 day mortgage rate guarantee it s free and there s no commitment. The document requirements for mortgage preapproval vary by lender and your individual circumstances but typically you ll need to provide documents which show your income your assets and any regular commitments against your income. A pre approval checklist to get you started on the mortgage process could take a lot of stress out of the process.

If you re pre approved a lender is making an actual commitment subject to conditions such as a property valuation to loan you money. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you. A seller often wants to see a mortgage preapproval letter and in some. Two years of federal tax returns.

While the industry is gradually adopting paperless procedures such as electronic signatures or e signing there are still plenty of documents required in a typical mortgage pre approval process. A pre approval is an in principal commitment from a mortgage provider to lend you a certain size mortgage at a particular rate. Sixty days or a quarterly statement of all asset. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation.

When you get pre approved for a mortgage you ll find out the maximum amount you can afford to spend on a home the monthly mortgage payment associated with your maximum purchase price and what your mortgage rate will be for your first mortgage term. With a pre approval you can.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)