When To Buy Whole Life Insurance

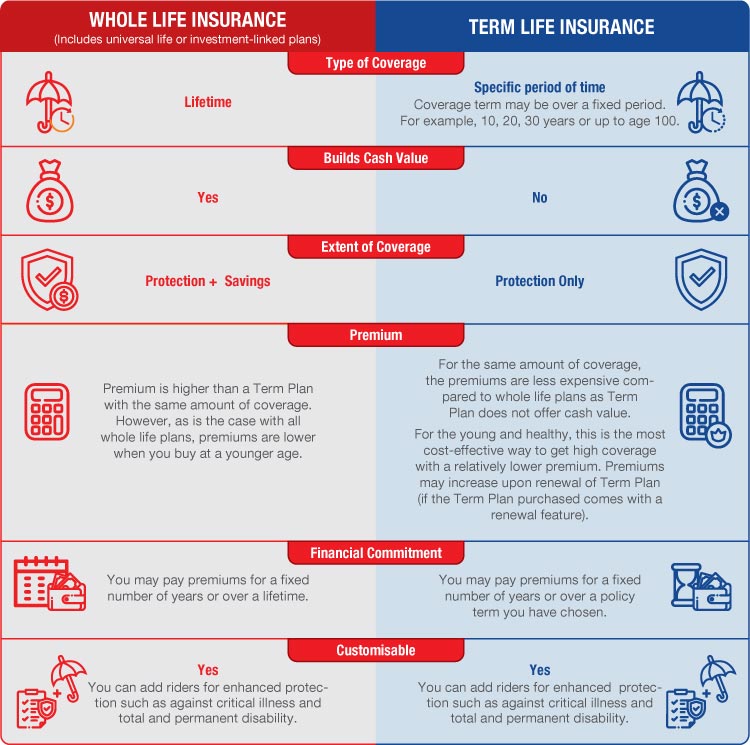

A category of long term coverage that includes whole life and universal life policy types.

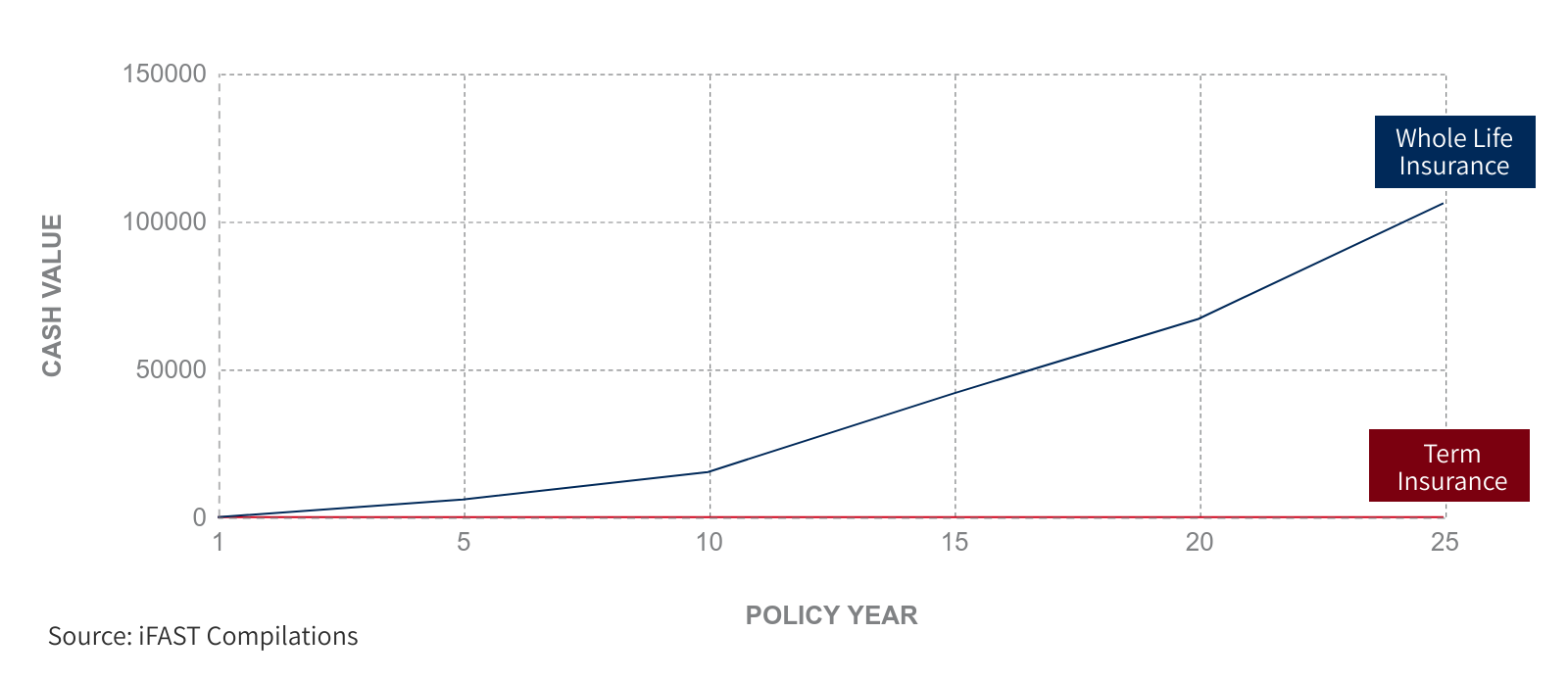

When to buy whole life insurance. Whole life cover the policy covers you for 99 years. Know where to buy whole life insurance and how to find the best policy. Many life insurance sales people focus on the investment portion of the whole life insurance policies. In a whole life insurance policy you ll pay more than the costs of insurance and administration and that excess will accumulate in a cash value account.

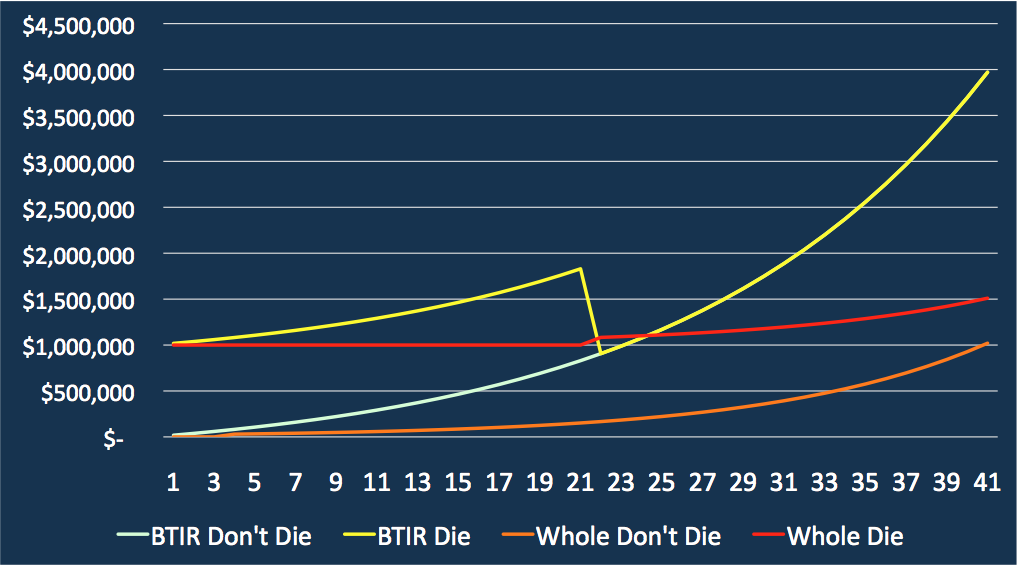

When you buy term life insurance you typically lose the premiums you paid over the policy s length if you outlive your policy. These are more expensive than term but offer more benefits. Its life insurance products are term life whole life and universal life. Premium contributions to whole life policies purchased at an early age can.

When to buy permanent life insurance. Whole life insurance policies commonly referred to as whole life build cash value at a fixed interest rate that you can access as a loan while you re still living. When you die the whole life insurance policy pays a pre specified amount called a death benefit to the person or people you ve chosen as your beneficiary typically your spouse children or other family members. There are three basic types of whole life insurance.

Whole life insurance is often referred to as a hybrid product a blend between insurance and a savings or investment vehicle. Whole life insurance covers you for a lifetime with steady premiums and a guaranteed return on the policy s cash value. Benefits of buying whole life insurance. Many people have financial dependents even in their old age and such a policy can take care of their financial dependents.

Term life insurance is compared to renting and a whole life policy is compared to owning. This protects your family for an extended period of time. With a permanent life insurance plan the cash value grows tax deferred. The cost of whole life insurance is much higher because of this and the rates of return on whole life insurance are usually much lower than normal investments.