Rolling Over Ira To Roth

Undoubtedly the roth ira has some substantial advantages over a traditional ira for example the roth ira offers tax free withdrawals of.

Rolling over ira to roth. As an ira owner i withdrew the majority 80 of my rmd required minimum distribution in january 2020 so i m now past the 60 day rollover limit. You ll use the information from that form to report your roth conversion income on form 8606 with the taxable portion of the conversion income reported on your form 1040. As with traditional ira conversions to roth iras if you are required to take an rmd in the year you roll over into an ira you must take it before rolling over your assets. Converting a non deductable ira to a roth ira.

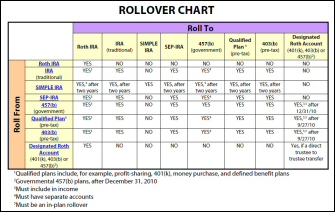

Rolling over a traditional ira to a roth ira makes good financial sense for many people. Note also if you have assets in a designated roth account i e roth 401 k and would like to roll these to an ira the assets must be rolled into a roth ira. Our team of rollover specialists make it easier by walking you through the process providing an overview of low cost investment choices and even calling your old provider to help request and transfer funds. Roth iras can only be rolled over to another roth ira.

There are lots of good reasons to make the switch but watch out for the taxes. You may want to note the differences between roth iras and designated roth accounts before you decide which type of account to choose. Forms 1099 r are generally sent out by the end of january of the following year. A roth ira rollover transfers money from a traditional ira into a roth.

Can i roll over my ira into my retirement plan at work. You could save a lot of money on taxes in the long run. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover. It will be coded as a rollover to a roth ira.

While rolling over funds can translate into tax free income. Check one more item off the to do list by rolling over your old 401k into a td ameritrade ira.

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)