Will Homeowners Insurance Cover Mold Remediation

Homeowners make claims under the water damage policy and get coverage for mold damage as well.

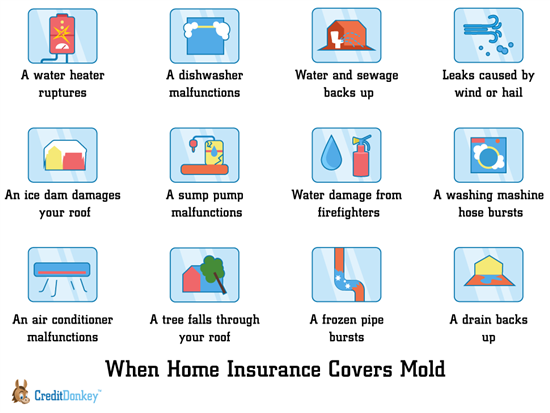

Will homeowners insurance cover mold remediation. Does homeowners insurance cover mold removal. Homeowners insurance covers mold damage if a covered peril caused it. Otherwise an insurance company will likely not cover mold damage. Standard homeowners insurance policies protect you from water damage caused by sudden and accidental incidents such as a burst pipe or an overflow resulting from a malfunctioning ac unit.

The amount of coverage provided for mold damage had a maximum limit which usually fell between 1000 to 10 000. Mold removal can be extremely costly so you don t want to find out too late that you re not covered. Nonetheless even if you have sewage backup coverage if a sewage problem leads to a mold outbreak your policy may not cover mold remediation. Mold remediation pros of baltimore will get this question all the time when we go out to do a free mold inspection.

For most standard homeowners policies mold removal is only covered when the source of the mold is an already covered peril in your policy such as water damage. We will get into later in this article. Find out in advance if your insurance will cover a problem if one arises. There are exceptions though.

This extent of mold coverage is typically limited for example a company may cap mold removal and remediation at 10 000 for a single occurrence says pat howard homeowner s insurance. Homeowners insurance will sometimes cover your mold remediation project depending on how the mold got there. Homeowners insurance cover mold remediation. Home insurance policies usually don t cover mold that resulted from a preventable water leak flooding or high humidity.

When mold is usually covered in most cases if mold results from a sudden and accidental covered peril such as a pipe bursting or the dishwasher overflowing the cost of the mold remediation should be covered. Mold is covered by your homeowners insurance if it is the result of water damage related to what the insurance industry terms a common peril such perils include burst pipes and an. Some insurance policies have mold exclusions they. Mold removal is only covered when the source of the mold is a peril already covered in your homeowners policy such as water damage.

Don t wait until you have a household mold problem to ask does homeowners insurance cover mold removal.

/moldy-basement-56a343d63df78cf7727c9826.jpg)