Rollover Ira Time Limit

To do a rollover from a traditional 401 k to a roth ira however is a two step process.

Rollover ira time limit. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. Once the funds are in an ira you can make your one time tax. Ira rollover time limit. The important thing to know with either one for the rollover to be tax free the funds must be deposited in the new account no later than 60 days from the time they were withdrawn from the old one unless it s a trustee to trustee transfer as discussed in more detail below.

Is there a time limit on a direct rollover from 401 k to ira. In the first type of direct rollover funds are transferred directly between custodians. You have up to 60 days to make the ira contribution once the 401 k distributes the funds. That s on top of paying taxes on.

Of the funds in your ira 95 are tax deferred so when you make a 5 000 distribution to roll over to a roth ira you ll owe tax on 95 of that 5 000 or 4 750. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. A rollover occurs when you receive a cash distribution from your 401 k and contribute it to an ira. To roll over funds from other types of retirement accounts such as a 401 k or 457 plan you must first roll those funds into an ira.

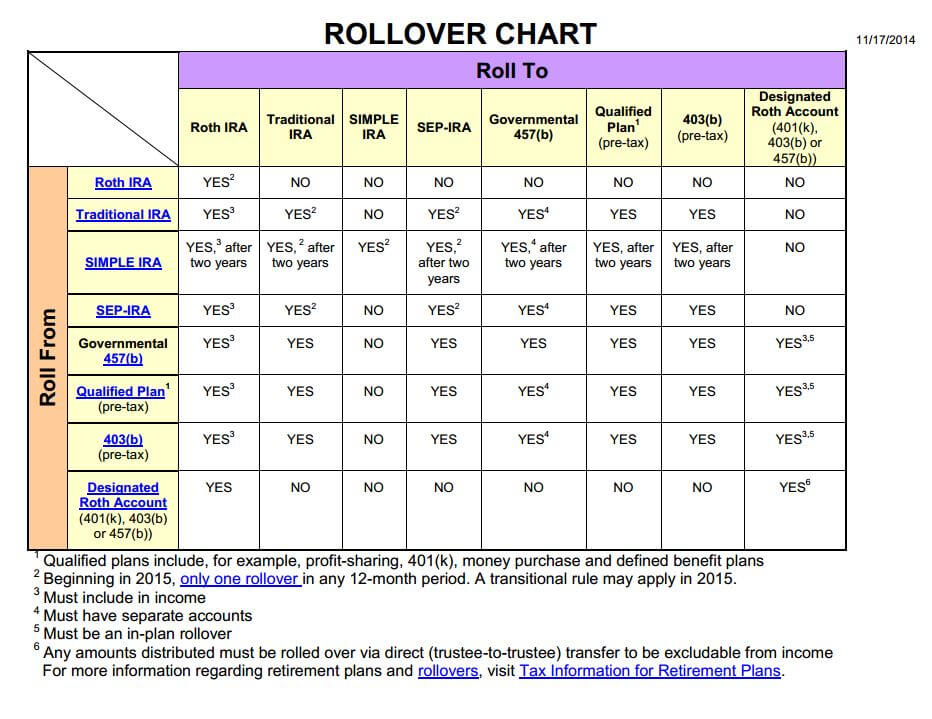

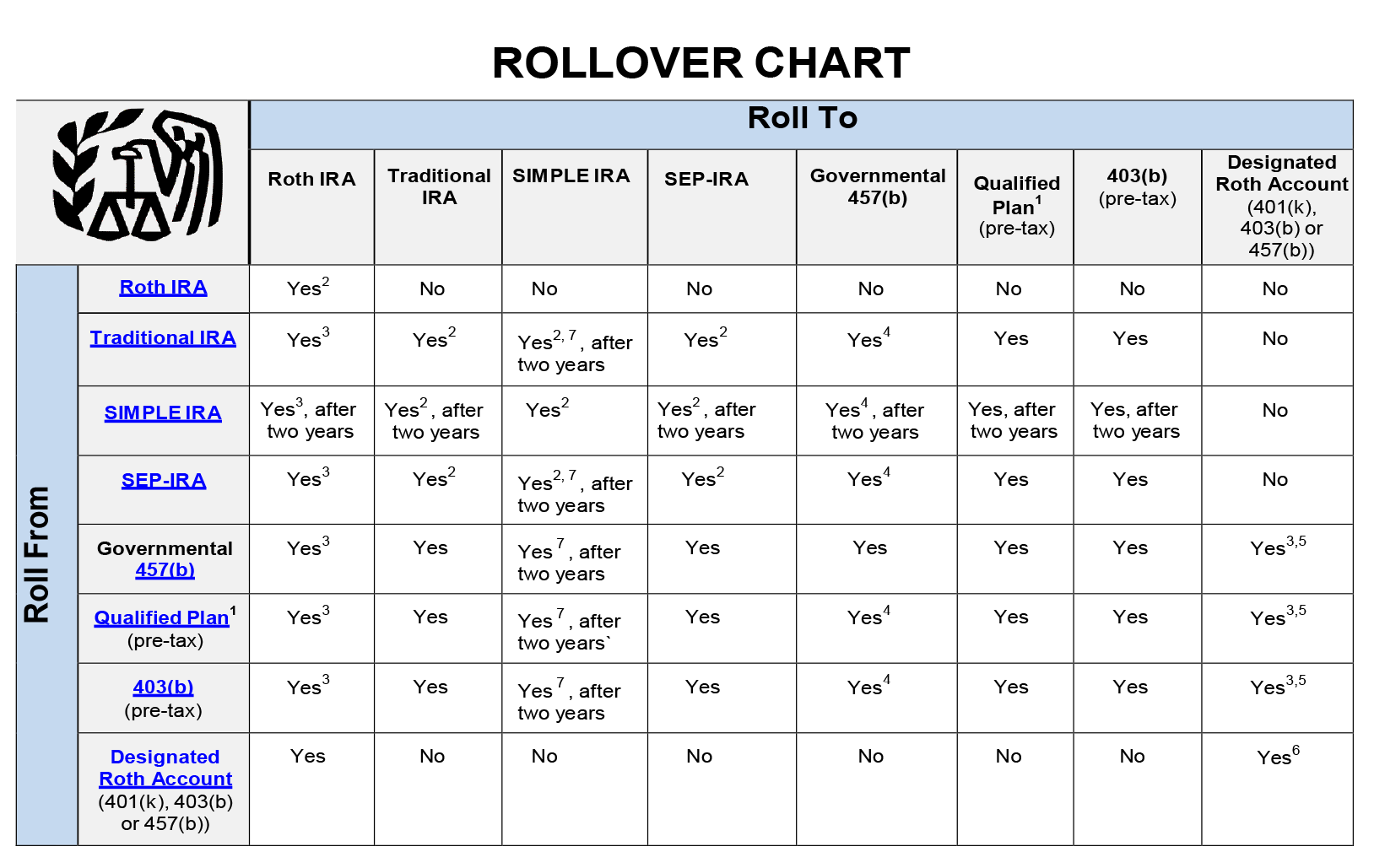

Beginning in 2015 you can make only one rollover from an ira to another or the same ira in any 12 month period regardless of the number of iras you own announcement 2014 15 and announcement 2014 32 the limit will apply by aggregating all of an individual s iras including sep and simple iras as well as traditional and roth iras effectively treating them as one ira for purposes of the. There are subtle differences between what is considered an ira rollover and what is considered an ira transfer. As part of a larger relief package the internal revenue service extended late thursday the 60 day rollover rule for individual retirement accounts until july 15 but only. First you roll over.

Retirement account owners transfer or roll over more than 300 billion in assets between different accounts each year. If you miss the deadline by even one day the irs will consider it a taxable distribution. There are two types of ira rollovers. A direct rollover is the simplest and easiest type of rollover.

:max_bytes(150000):strip_icc()/iStock-512752254.kroach.IRA-675837a730c744938bf57072739e65c8.jpg)

/ira-5bfc47b5c9e77c00587d681d.jpg)