What Is Dwelling Coverage In Home Insurance

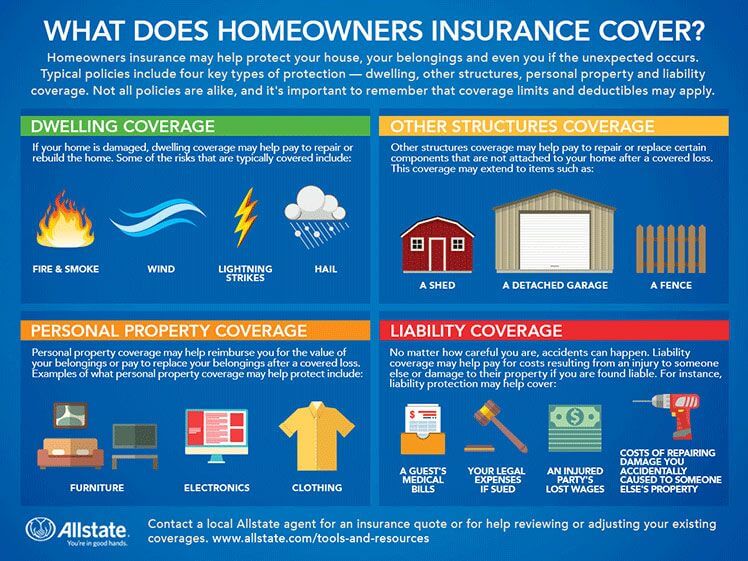

The portion of your policy that covers the structure of the home against covered hazards commonly referred to as coverage a or dwelling coverage may be the most crucial coverage as your home is arguably your most important asset.

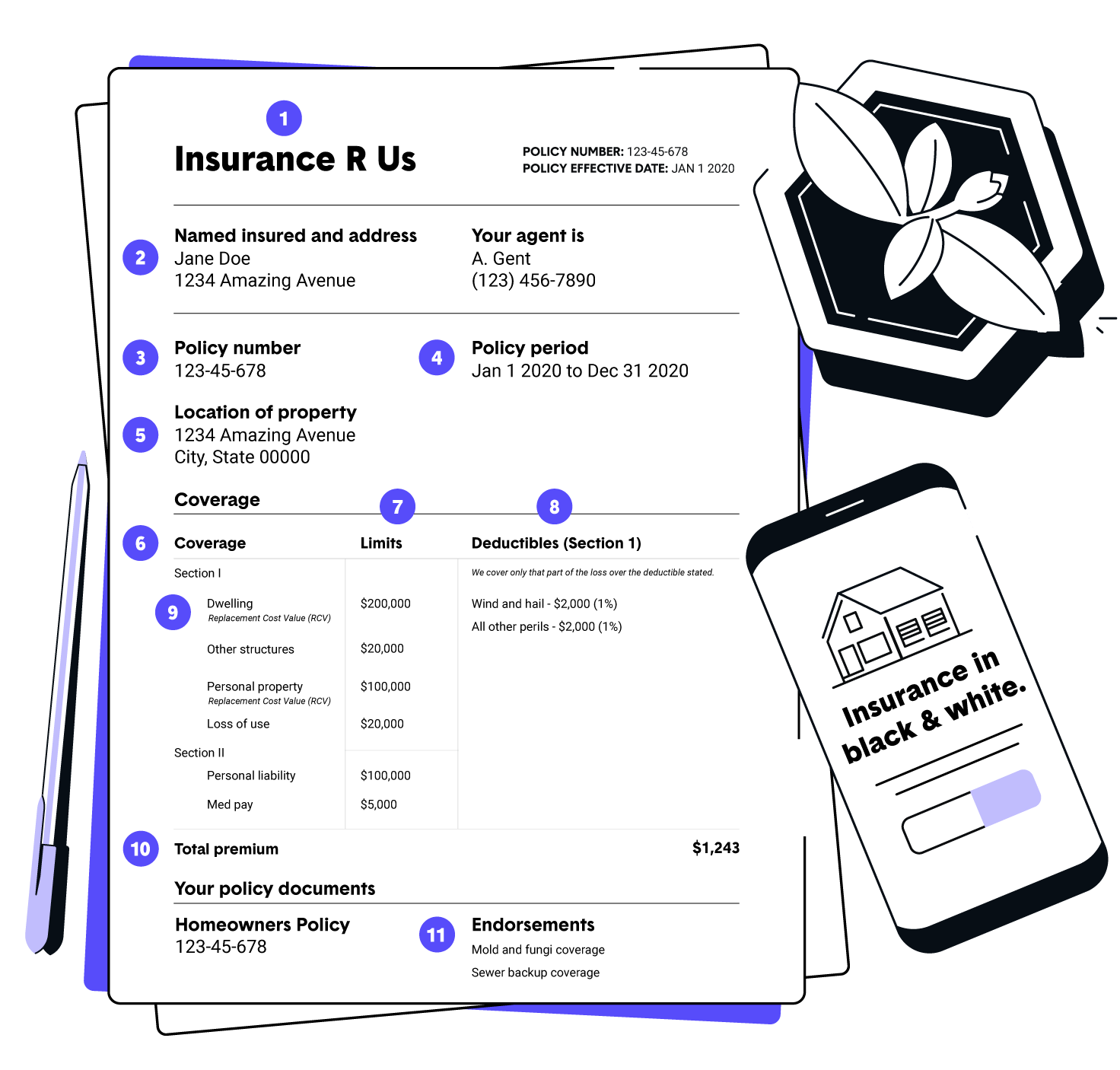

What is dwelling coverage in home insurance. Your limit is the maximum amount that your homeowners insurance policy will pay toward a covered loss. It covers your home s structure not its contents or land. That limit should be based on the cost of rebuilding your home not. Dwelling coverage is one part of your overall home insurance policy.

When you buy homeowners insurance you choose your dwelling coverage limit. What it covers. You can select enough dwelling coverage to rebuild your home at today s prices. Features like installed fixtures and permanently attached appliances are also covered.

For the full protection you need after a disaster make sure you have a sufficient amount of dwelling coverage in place and are covered against the right perils. Dwelling coverage is the part of your homeowners insurance policy that helps pay to rebuild or repair your home and any attached. Dwelling coverage protects the structural components of your home from damage and covers in the event of damage to the home that impacts walls floors ceilings home systems and more. Standard homeowners insurance however does not cover damage from floods or earthquakes.

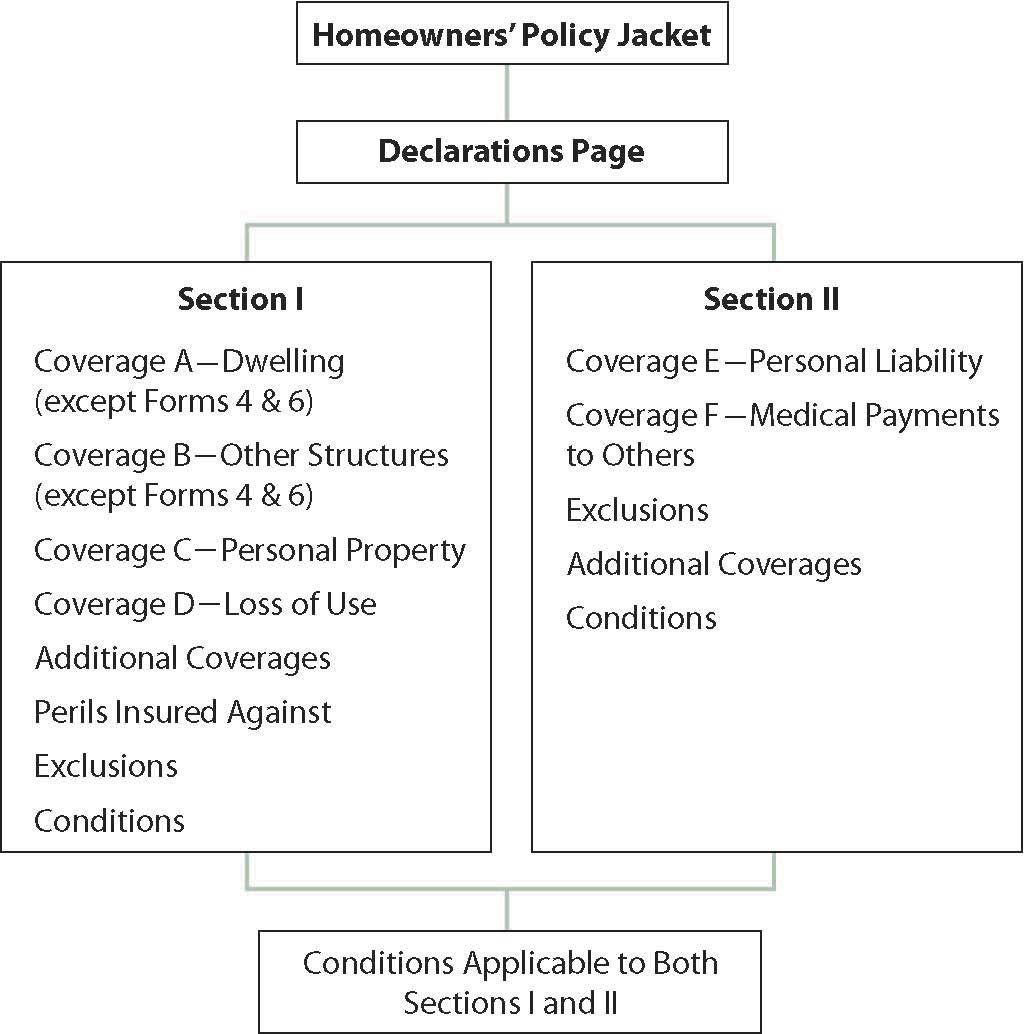

It covers cabinets appliances like your furnace and water heater and may also cover other. Dwelling insurance also known as dwelling coverage or coverage a is the portion of your homeowners policy that covers the costs to repair or rebuild your home after it s damaged by a covered peril such as fire. Homeowners insurance is made up of coverages that offer varying levels of protection for your home and assets. The covered perils or causes of loss can be found in your policy.

Dwelling coverage sometimes called coverage a is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind hail lightning or fire. Your dwelling insurance coverage is one of the most if not the most important pieces of your homeowners insurance policy. Coverage a or dwelling coverage is the central coverage included in a homeowners policy and will generally have the highest limit of types of coverage on your policy. Equal to your home s replacement cost.

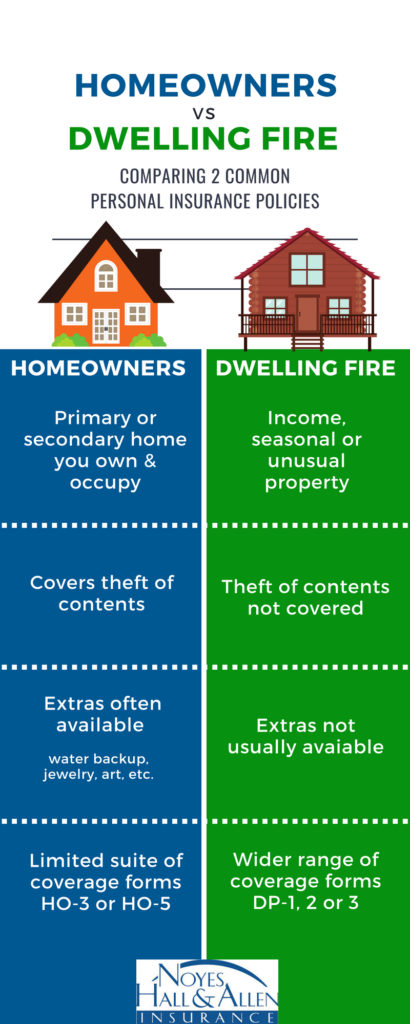

Dwelling insurance covers damage to your home including the foundation frame walls and roof. Dwelling coverage or coverage a is the primary coverage on the homeowners condo owners or dwelling fire policy.