Roth Ira Beneficiaries

Spouse as roth ira beneficiary as with a traditional ira if your spouse is your roth ira beneficiary and you happen to go to the great beyond your spouse can treat your roth ira as her own.

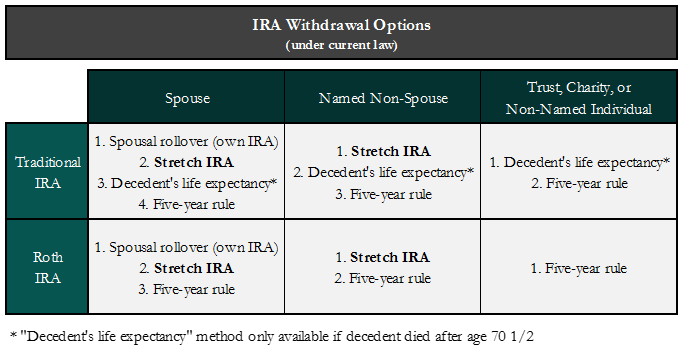

Roth ira beneficiaries. Beneficiaries of qualified plans. Only non spouse beneficiaries must take required minimum distributions after the death of the original roth ira owner. The stretch ira is the tax equivalent of the treasure at the end of the rainbow. If the sole beneficiary is the spouse he or she can either delay distributions until the decedent would have reached age 70 or treat the roth ira as his or her own.

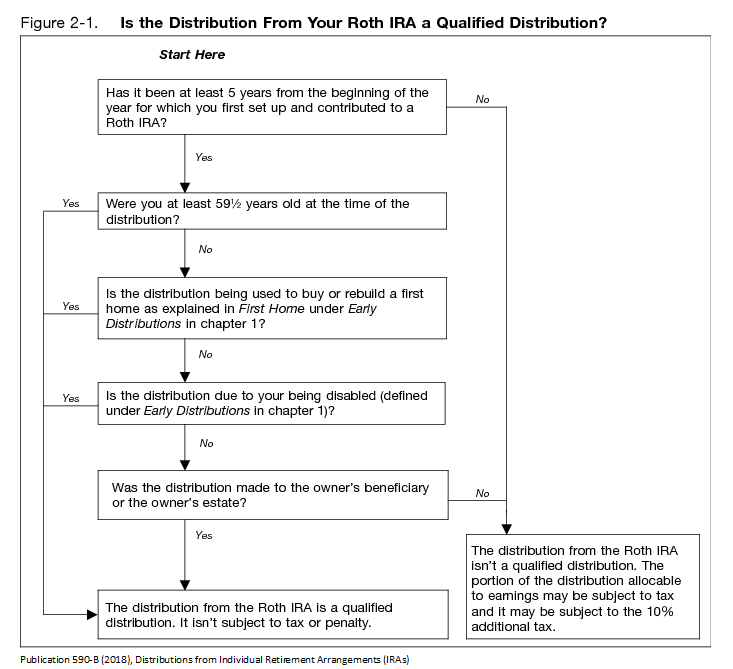

Scott sparks a wealth management advisor with northwestern mutual in denver colorado told the wall street journal from a. The irs sets the minimum distribution rules for a roth ira as though the owner died before the required beginning date. Generally a beneficiary reports pension or annuity income in the same way the plan participant would have reported it. A roth ira can be a fundamental part of your estate plan.

With a roth ira you can leave the money in the account as there are no required distributions until after the death of the owner. Ira accounts and other types of retirement accounts like 401 k s 403 b s and 457s have a beneficiary designation attached to them. Many people think that a will can designate how their individual retirement account ira is paid out but this is not true. Roth iras can provide beneficiaries with a lasting tax free gift.

After you die the money in the roth is not just handed over to your designated beneficiaries. You must have earned income from work to contribute to an ira and your income can t exceed the roth ira income limits if you qualify you can put as much as 6 000 per year 7 000 if 50 or. As long as the original roth ira owner remains alive there are no required minimum distributions. Any roth ira assets that you haven t withdrawn.

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg)