Roth Brokerage Account

:strip_icc()/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)

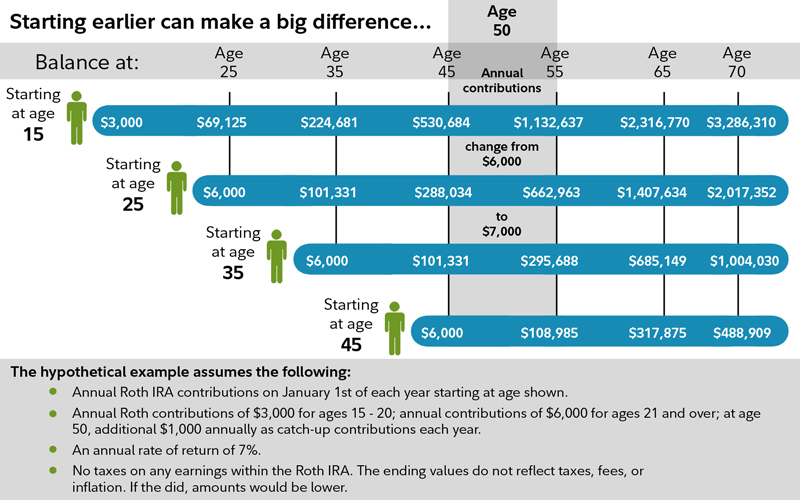

That s because for a long term goal like retirement you want to harness the power of the stock market.

Roth brokerage account. First there s a limit to how much you can invest. Generally a broker or robo advisor is a better option than a bank for a roth ira account. While you can enjoy tax deferred growth in an ira or tax free growth in a roth ira a brokerage account lets you contribute unlimited amounts of money and to declare capital losses when you sell securities. Would you believe that a non qualified brokerage account a k a.

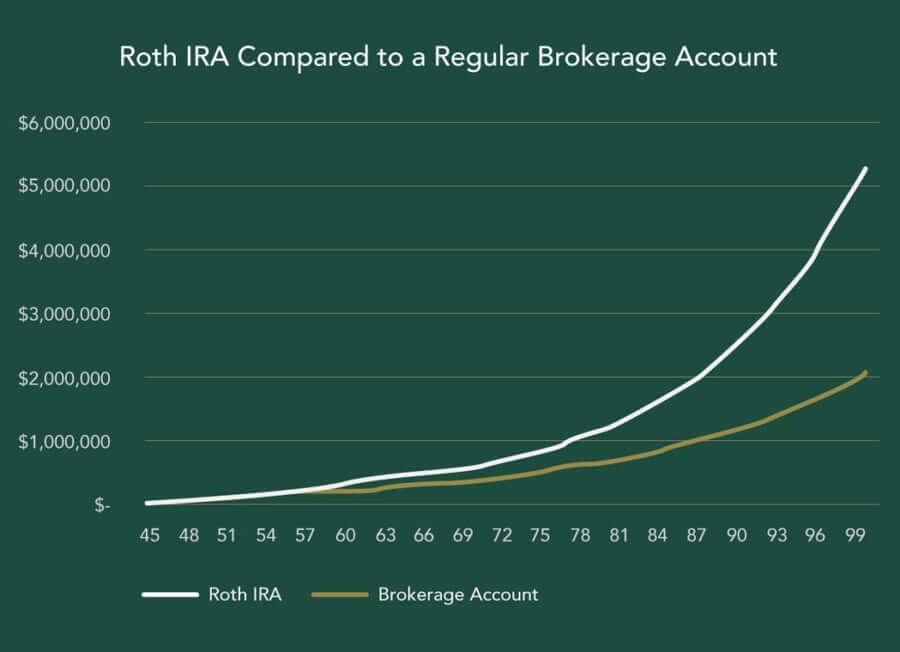

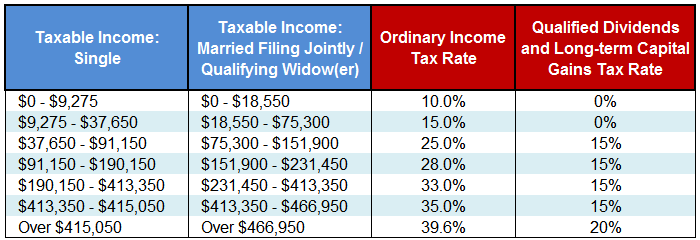

One key difference between a standard brokerage account and a roth ira involves how the irs treats earnings generated by the investments you hold. Traditional individual retirement accounts and brokerage accounts are taxed under two different systems. That tax free treatment is extremely unusual and sets apart roth iras both from regular taxable brokerage accounts and from several other types of tax favored retirement accounts. Roth ira rules dictate that as long as you ve owned your account for 5 years and you re age 59 or older you can withdraw your money when you want to and you won t owe any federal taxes.

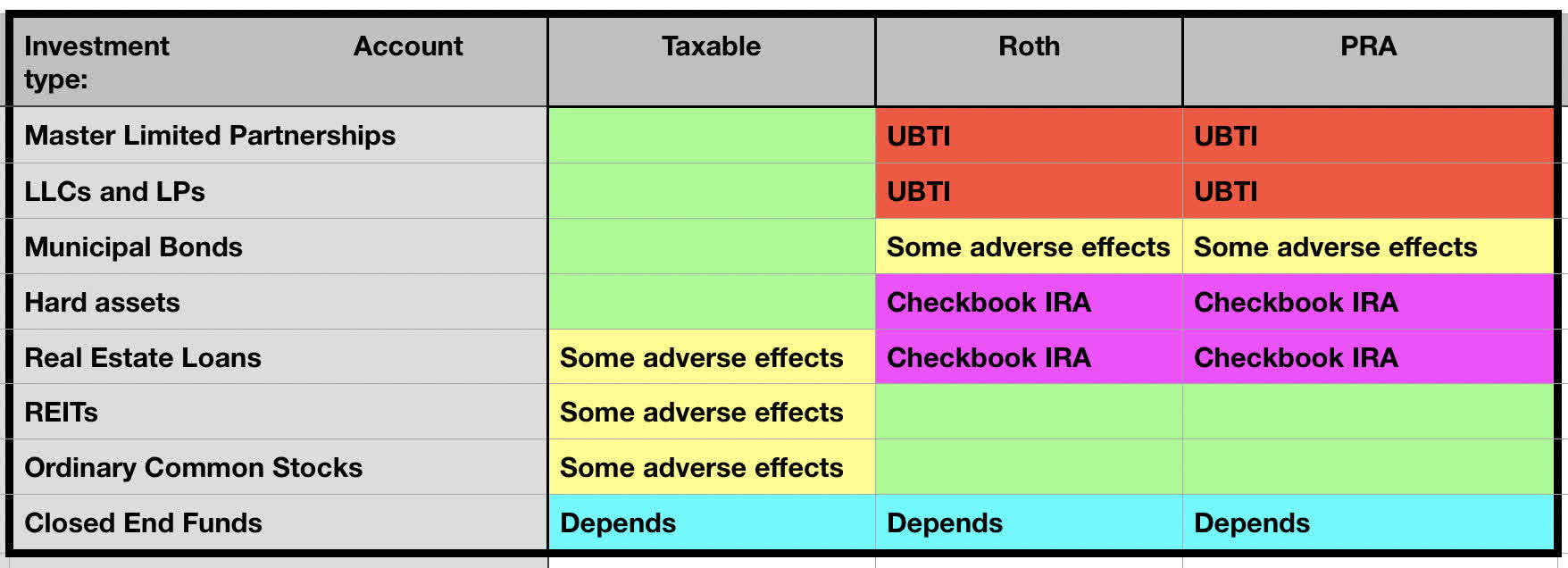

Roth iras can be great but there are some restrictions to be aware of when investing in these accounts. In 2020 you can put away 6 000 in a. Taxable account could mimic the benefits of a roth ira. With a traditional ira contributions will be taxed upon the withdrawal of funds from the account.

Or be as good or better than a roth 401 k. Tax benefits of a brokerage account vs. While capital gains dividends and interest grow on a tax deferred basis in a roth the flexibility of a taxable brokerage account could suit you better if you need to access your money prior to retirement without paying a penalty. An ira is important for long term retirement goals while a brokerage account is good for short term growth and long term wealth building.

A roth ira is an individual retirement account that offers tax free growth and tax free withdrawals in retirement. Ira accounts fall under income tax rules.