Va Loan Money Down

1 2020 when the new law takes effect the va will not cap the size of a loan a veteran can get with no money down paving the way for veterans to buy higher value homes.

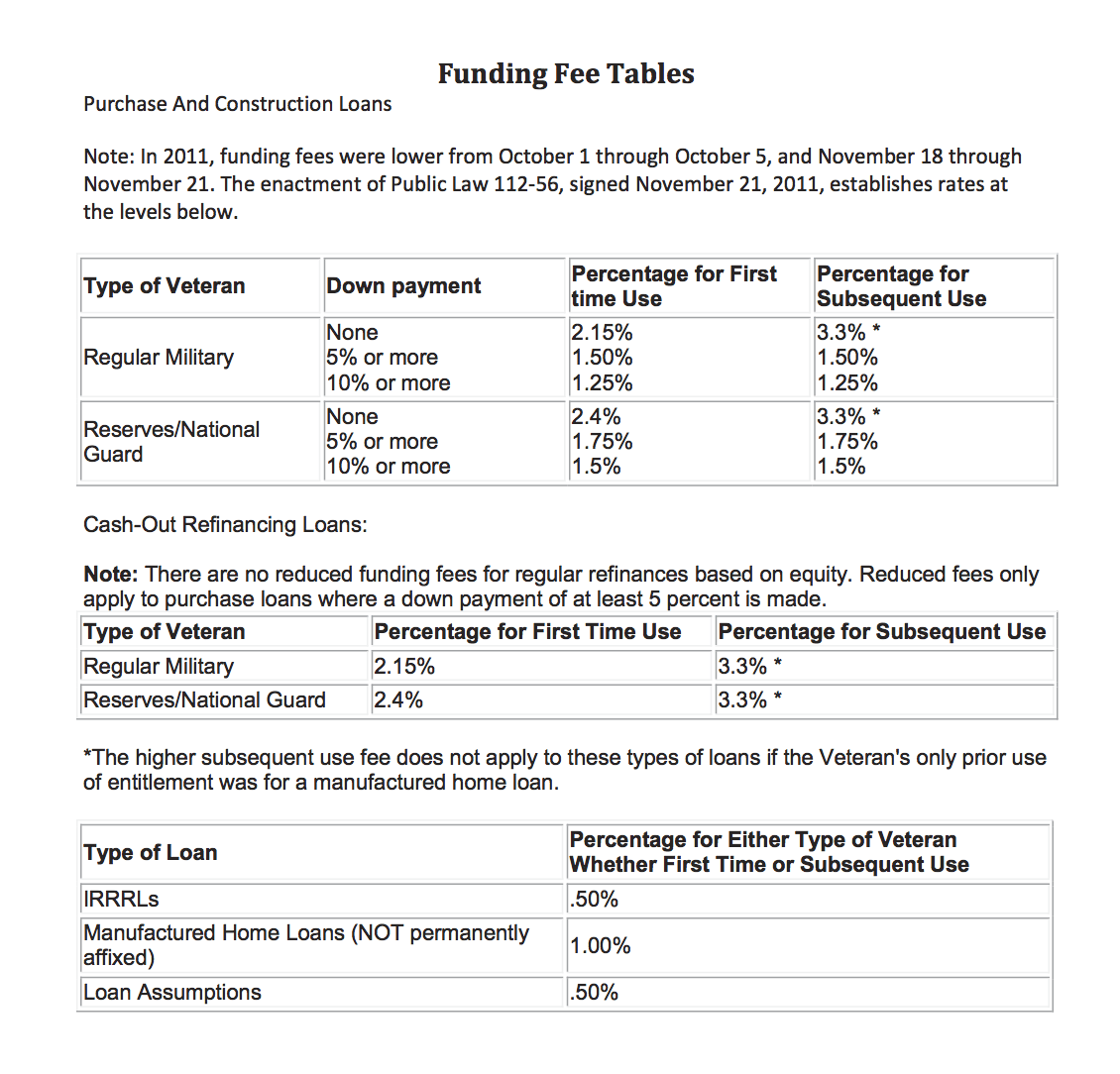

Va loan money down. Put down 10 and the fee goes down to 2 500 saving you 1 800. If however you put down 5 or 10 000 your va funding fee drops to 3 000. Once a va loan borrower puts down at least that amount the va funding fee shrinks. There are important reasons to consider making a down payment on your va loan if you can afford to do so including some that can improve your financial picture over the long haul.

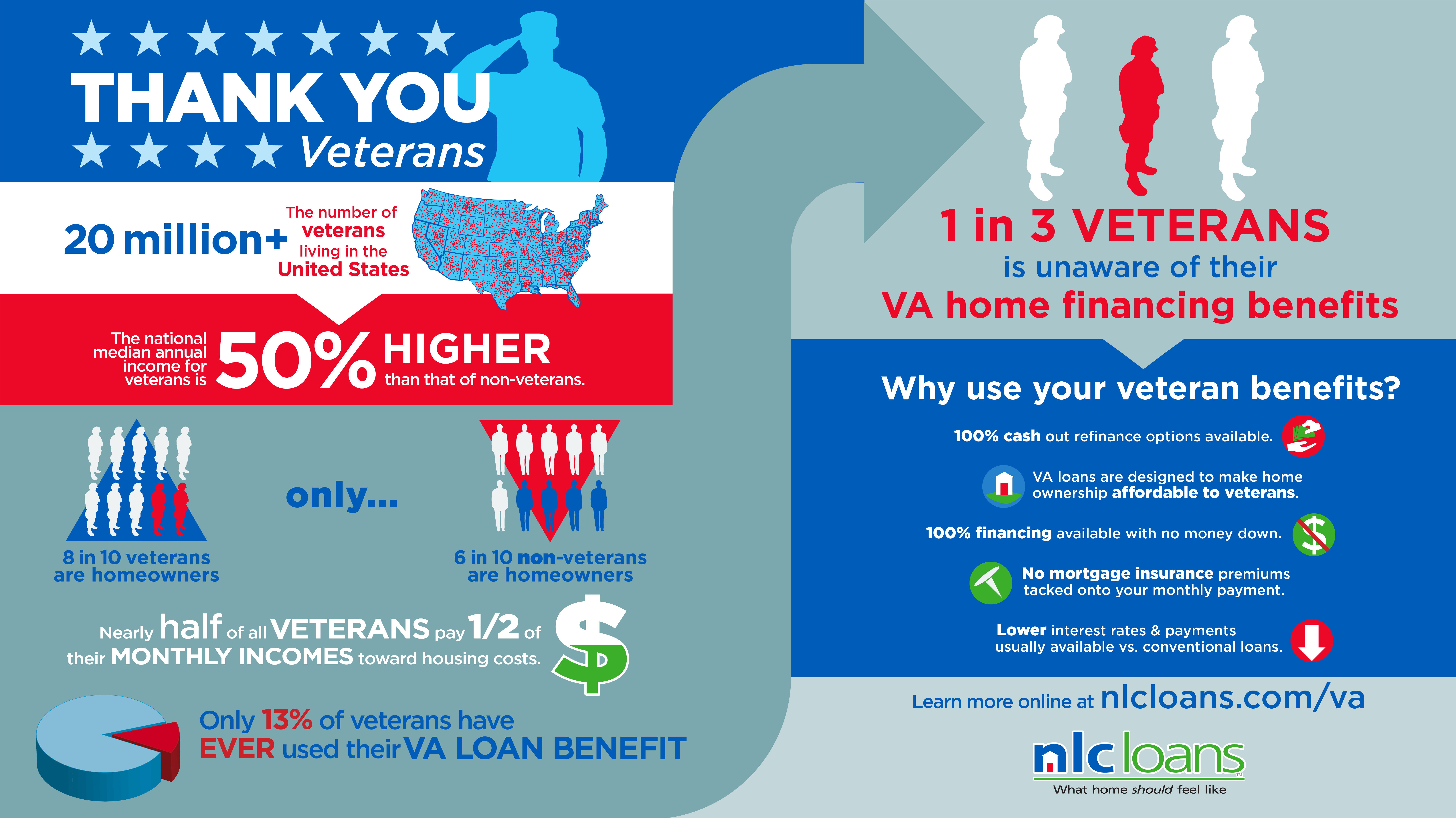

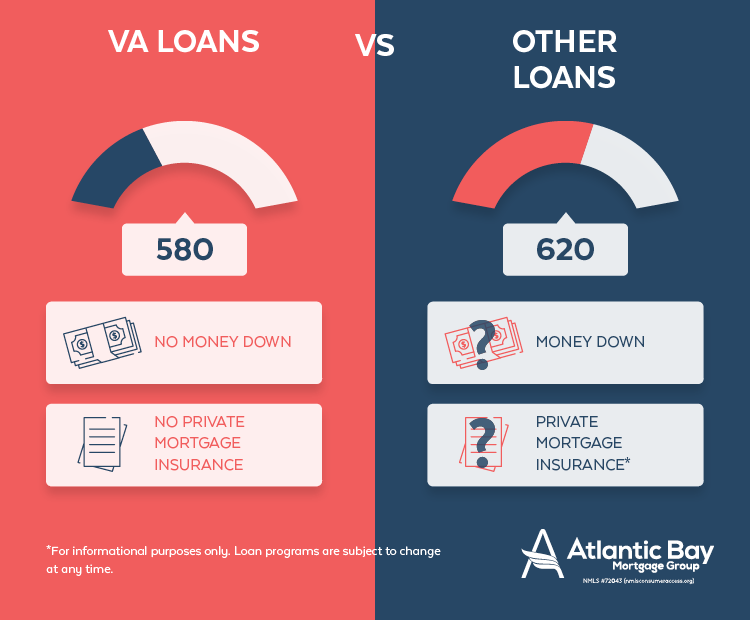

In 1944 the va home loan guaranty program began to provide returning war veterans with a way to buy homes with little or no cash up front. Banks mortgage companies and other lenders are the ones who put up funds for service members to. A va backed purchase loan often offers. No down payment as long as the sales price isn t higher than the home s appraised value the value set for the home after an expert reviews the property.

The fee dips again if borrowers pay down 10 percent or more. If you have remaining entitlement for your va backed home loan find out the current loan limits and how they may affect the amount of money you can borrow without a down payment. Let s put those suspicions to rest with a thorough discussion of the va loan program and an explanation of some why some va borrowers can get a va loan with a 0 down payment. You ll save money over the.

If you re regular military this is your first va loan and you put down nothing the va funding fee will be 4 300. A va loan down payment isn t required but borrowers can still make one. Here are the pros and cons of making a down payment. As of 2020 if you have full entitlement you don t have a va loan limit.

The ability to borrow up to the fannie mae freddie mac conforming. Va loans are made by private lenders. Down payments will vary but generally if you re a veteran with full va loan entitlement buying above your county loan limit requires a down payment. Va loan don t require a down payment but it may be a smart move.

All about the va loan guaranty. Here s how it breaks down for all scenarios. Reasons to make a down payment on a va loan. The benefits above can make it seem like zero money down va loans are the way to go but this issue isn t cut and dry.

Any va loan that stays within a county s maximum can likely be a zero money down loan it will depend in part on your previous va loan utilization and history. For a first time va loan borrower the funding fee is typically 2 30 percent with no money down.

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/AK4UFSTORVALFFLDDJYZS23W4A.jpg)