Rollover 401k To Roth Or Traditional Ira

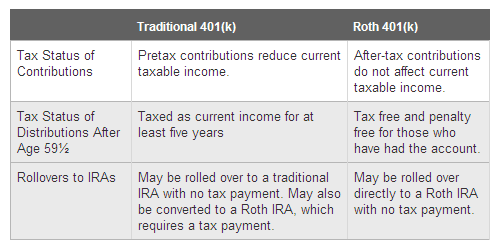

Roll over a roth 401 k into a roth ira tax free.

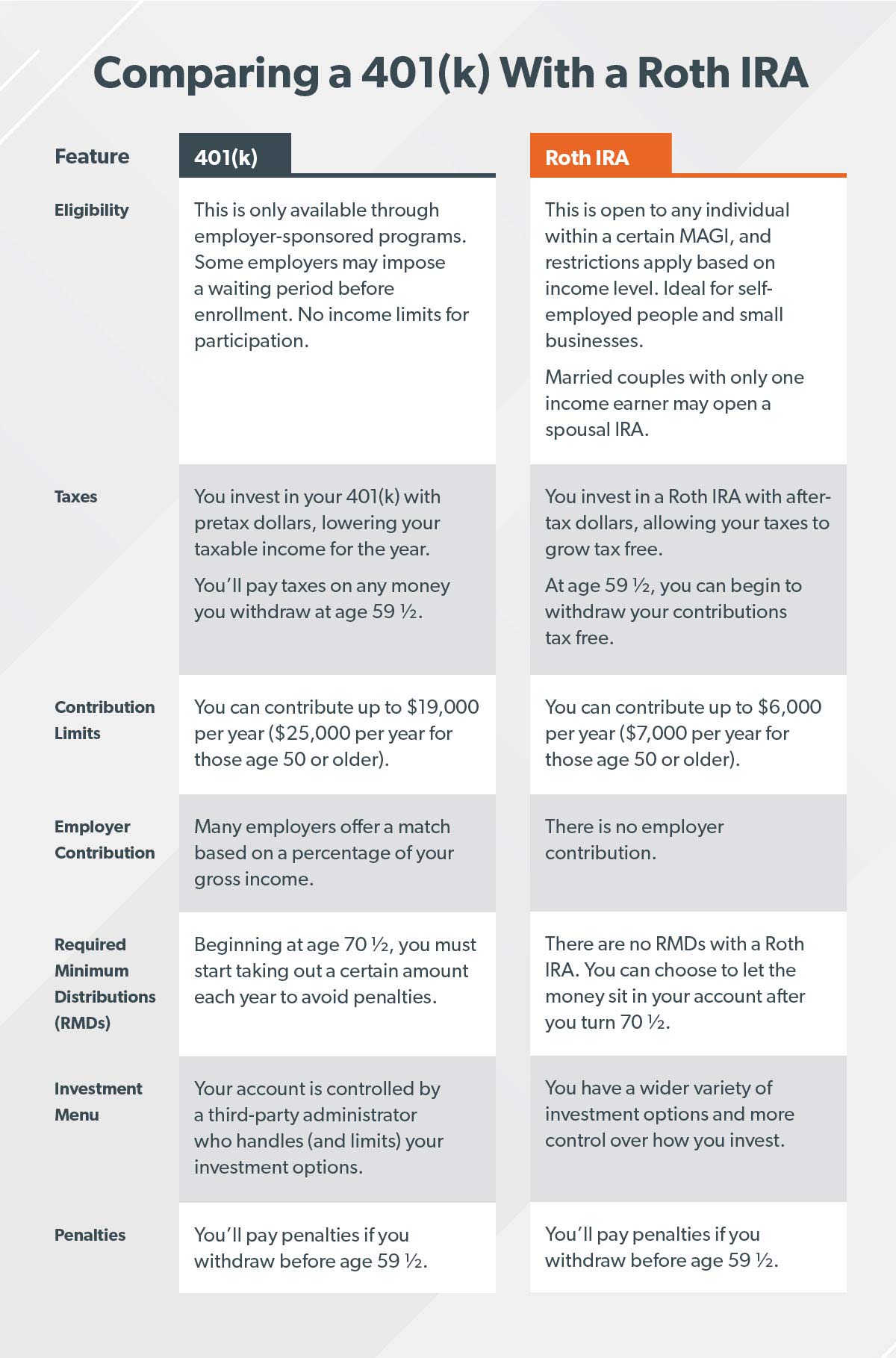

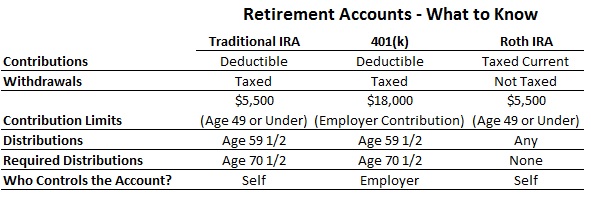

Rollover 401k to roth or traditional ira. A roth 401 k combines the employer sponsored nature of the traditional 401 k with the tax structure of the roth ira. A rollover ira can be a traditional ira with the same withdrawal rules or you can open a rollover ira that s a roth that s what you would do to roll money from a roth 401 k. The conversion amount is considered income for that tax year and depending on how large of a sum you re converting this could be a substantial amount. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

Withdrawing earnings early could incur both taxes and. Beyond the type of ira you want to open you ll need choose a financial institution to invest with. An ira rollover is a transfer of funds from a retirement account into a traditional ira or a roth ira via direct transfer or by check. More sneaking in the backdoor roth ira.

Since your traditional 401 k funds are pre tax dollars and a roth ira is funded by post tax dollars you re going to have to pay income tax when you convert a traditional 401 k to a roth ira. You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover. Same goes for a roth 401 k to roth ira rollover. You can rollover from a traditional 401 k into a traditional ira tax free.

If your employer offers this type of plan you ll contribute after tax money to your account and you won t owe taxes when you start receiving distributions. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. Choosing one for your rollover depends on the type of account you have now and other factors such as when you want to pay taxes. If your employer offers a match though that money is in a.

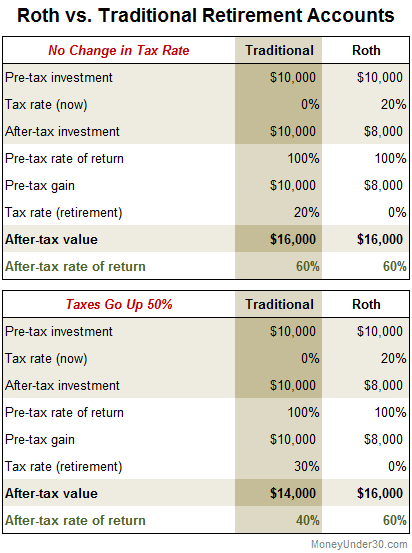

Both roth and traditional iras offer advantages. You can also roll over into a roth ira if you were previously investing in a traditional 401 k or 403 b but this will be considered a roth conversion and you ll have to pay taxes on any pre tax contributions and all earnings that you convert. You can t roll a roth 401 k into a traditional ira. You must roll over into a roth ira tax free if you were previously investing in a roth 401 k or roth 403 b where you worked.

Can i roll over my ira into my retirement plan at work. If you rolled a traditional 401 k into a roth ira via the traditional ira the clock starts ticking from the date those funds hit the roth.