When To Cash Out Refinance

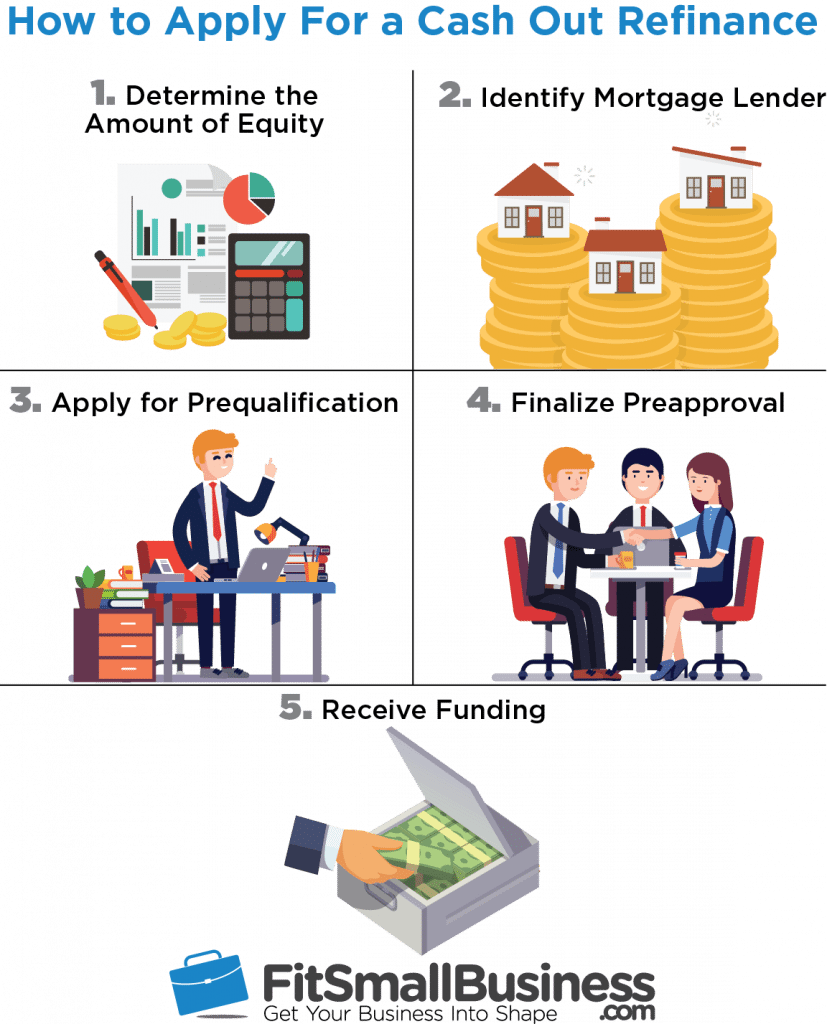

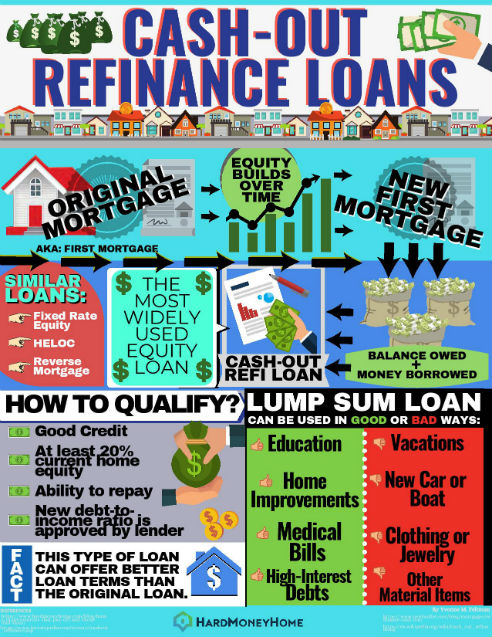

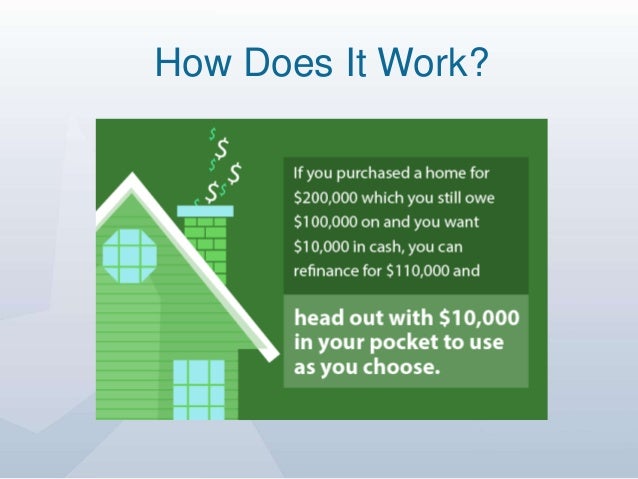

A cash out refinance often referred to as a cash out refi is different from a traditional refinance in that it replaces the old loan with a new one that is for an amount larger than the.

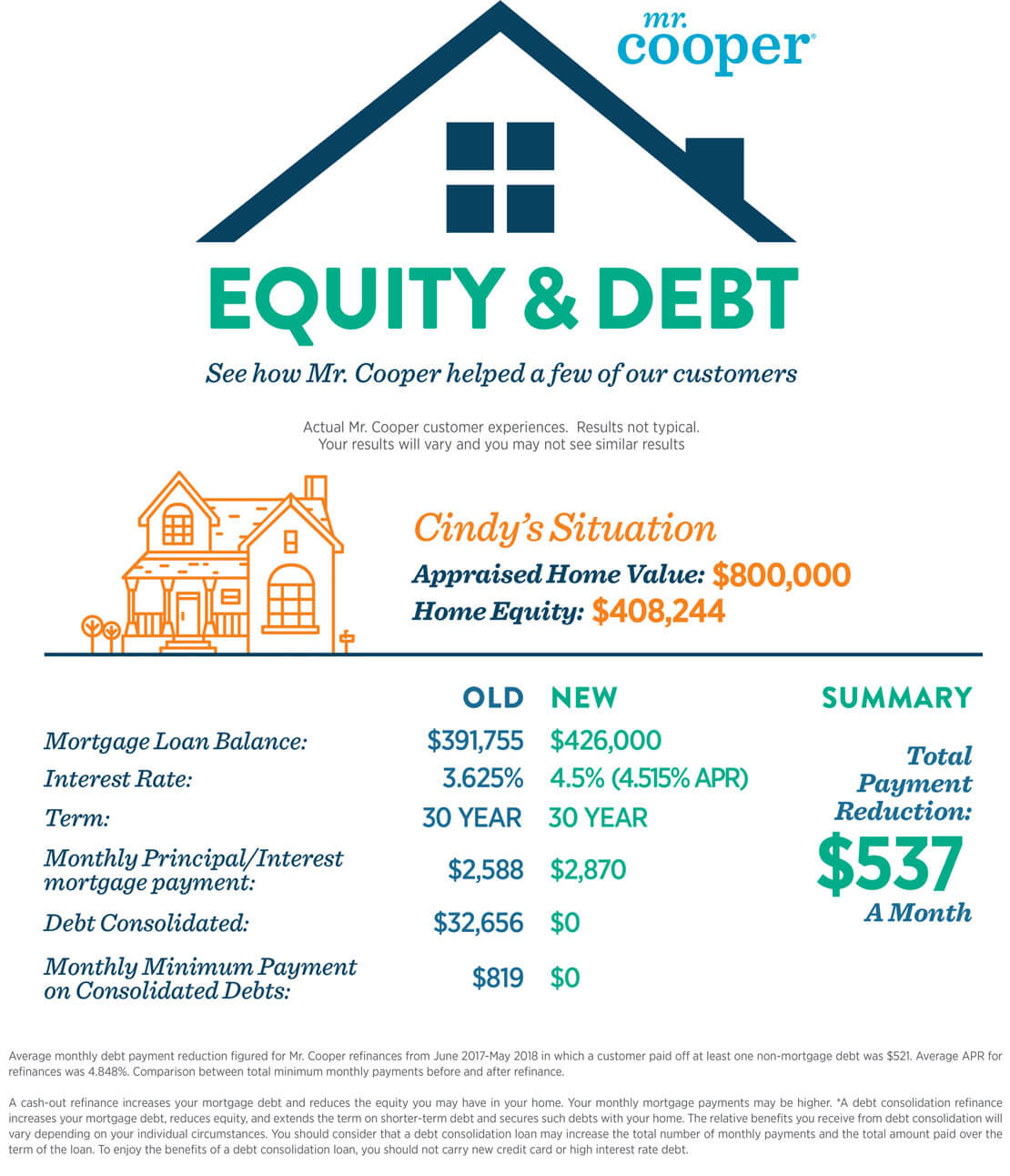

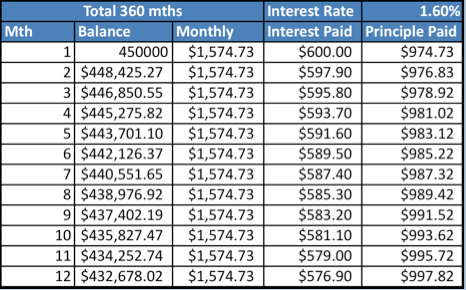

When to cash out refinance. A cash out refi often has a low rate but make sure the rate is lower than your current mortgage rate. You ll be borrowing what you owe on your existing loan plus the cash you take out from your home s equity. You may be able to access about 150 550 if you cashed out today unfortunately you may not have enough home equity to get cash from your home. A cash out refinance allows you to tap your equity by refinancing your mortgage.

A cash out refinance can come in handy for home improvements paying off debt or other needs. Reasons to use a cash out refinance. Discover offers cash out refinance loans at low fixed rates for loan amounts ranging from 35 000 to 200 000. Any remaining funds are yours to use as you wish.

A cash out refinance is a new loan replacing your current mortgage. Lower interest rates if you put an unexpected bill on a variable credit card you might pay a high amount of interest the prime rate that s tied to the federal funds rate set by the federal reserve plus a certain number of percentage. Cash out refinance gives you a lump sum when you close your refinance loan. A cash out refinance is a mortgage refinancing option where the new mortgage is for a larger amount than the existing loan to convert home equity into cash.

The loan proceeds are first used to pay off your existing mortgage s including closing costs and any prepaid items for example real estate taxes or homeowners insurance. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)