Rop Term Life Insurance Quotes

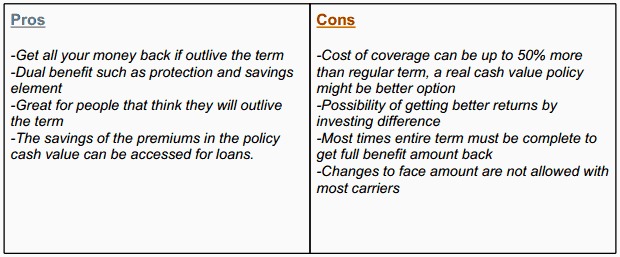

There is an increase in premiums by 20 40 when term coverage comes with this rider.

Rop term life insurance quotes. Simply fill out the required form fields and select the desired rop coverage length and you will receive rates from lowest to highest priced based on your input. As with all insurance plans with a return of premium policy a death benefit is paid out should you pass away. Return of premium term life insurance policies are not the best choice for everyone but for those who want their money back at the end of their policy s term for use in retirement or to offset their debt it can be a great option. Return of premium rop term life insurance.

Many consumers think so. These policies tend to be 4 5 times more expensive than a standard term life insurance policy. At first glance the rop rider looks pretty simple. People who have this issue should purchase rop term life insurance.

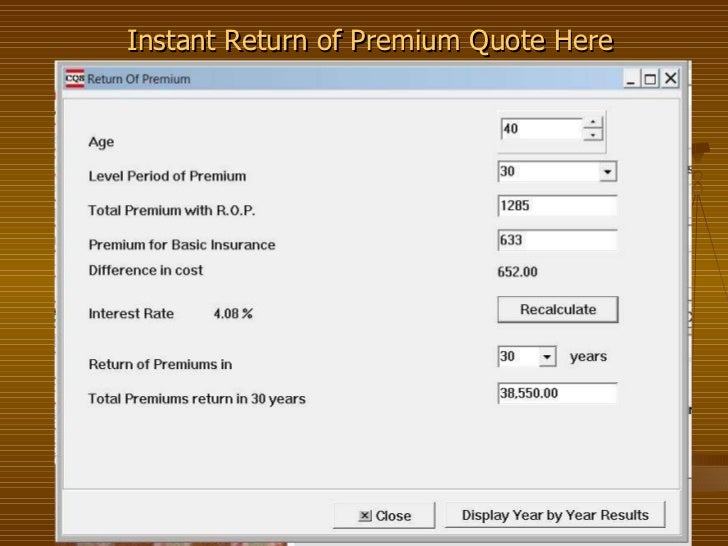

To illustrate the cost difference between purchasing regular term insurance vs. Rop life insurance costs more than a traditional term life policy. In that case return of premium term life insurance from state farm life insurance company not licensed in ma ny or wi or state farm life and accident assurance company licensed in ny and wi might be just what you need. These policies start out at a higher price than regular term and unlike regular term the longer terms usually have lower premiums.

Start comparing term life insurance quotes now. The quote form located on this page will allow you to instantly compare the best rop term life insurance rates. Rop life insurance works by providing life coverage for a certain number of years then returning the premiums paid in if death has not occurred by the time the term ends. A lot of individuals prefer return of premium policies with this type of term life insurance policy you get all of your premiums back at the end of the term period premium is slightly higher than other types of term life insurance.

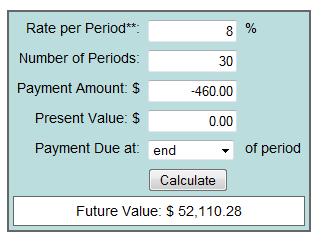

Cost of an rop rider. There is one main difference between return of premium life insurance and other types of life policies. There are no investment accounts cash values or policy loan features on term life. We are going to get a quote on a 30 year term life policy with a 1 000 000 face value.

In our scenario i am using a 30 year old male assuming he is in excellent health. Is the possibility of a full refund at the end of the term worth the extra expense. But just like any other feature this rider comes at a price. Term life insurance protects for a specified period or the term of the term life insurance quotes received.

It offers a level premium payment term of 20 or 30 years whichever you choose. The extra cost is invested by the insurance provider to be paid back to the owner of the policy when it expires. One with the rop ride here are some life insurance quotes that i ran.