Types Of Banking Accounts

Cheque current accounts.

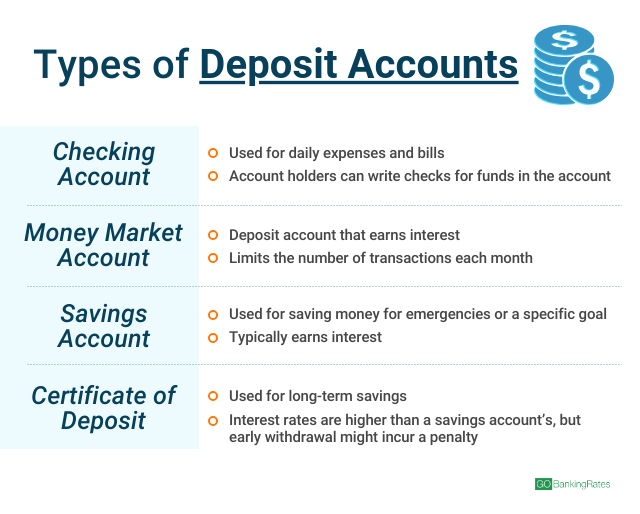

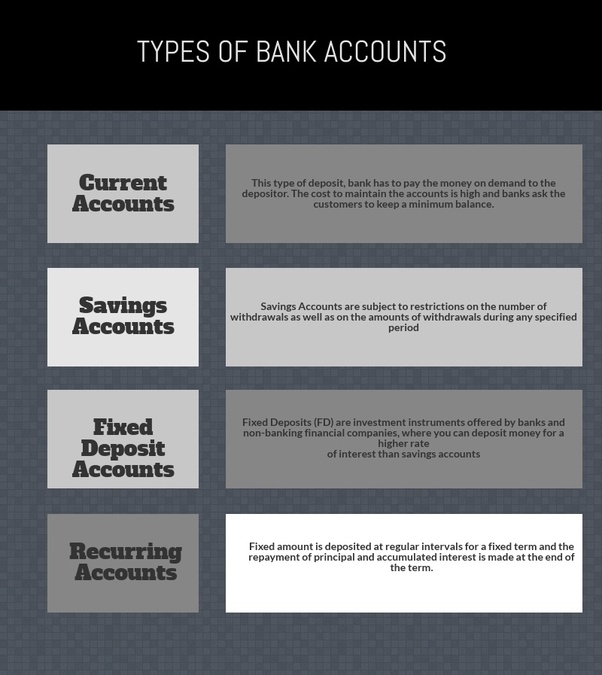

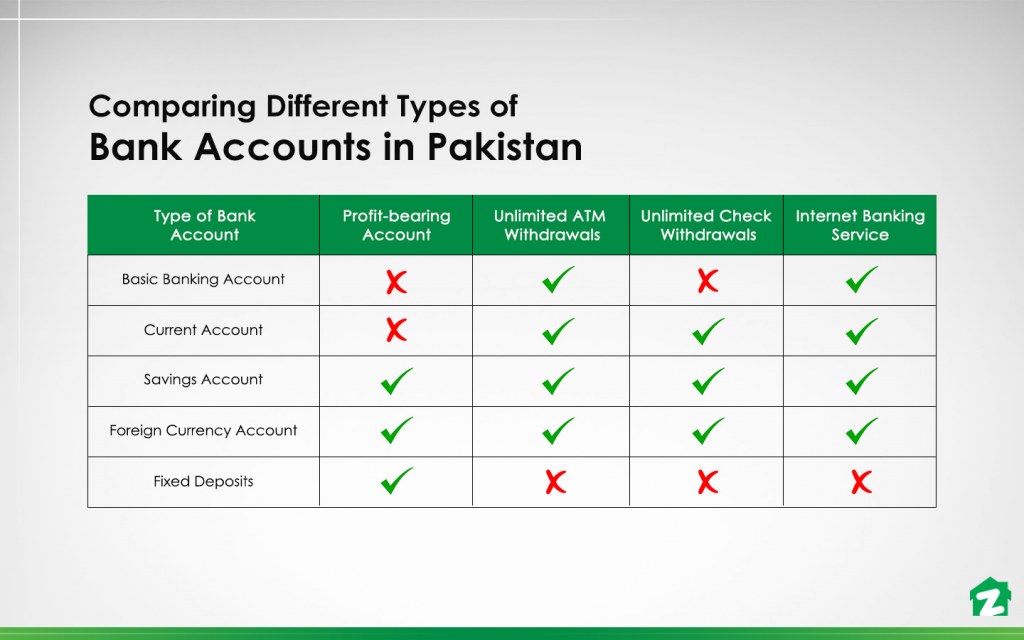

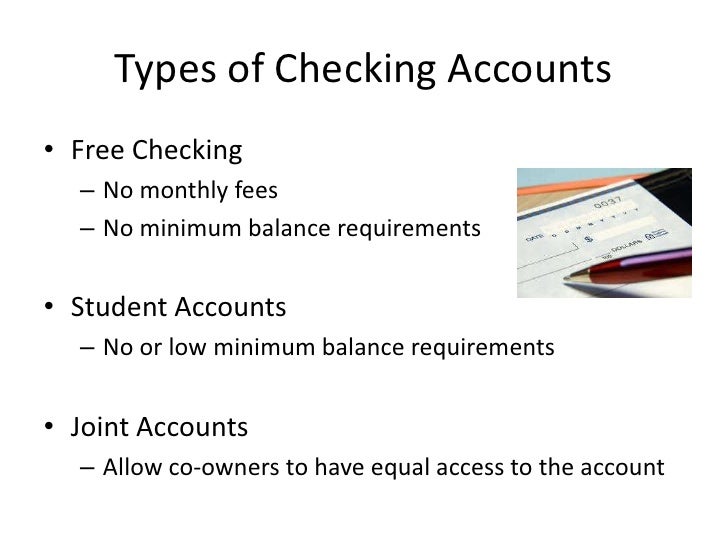

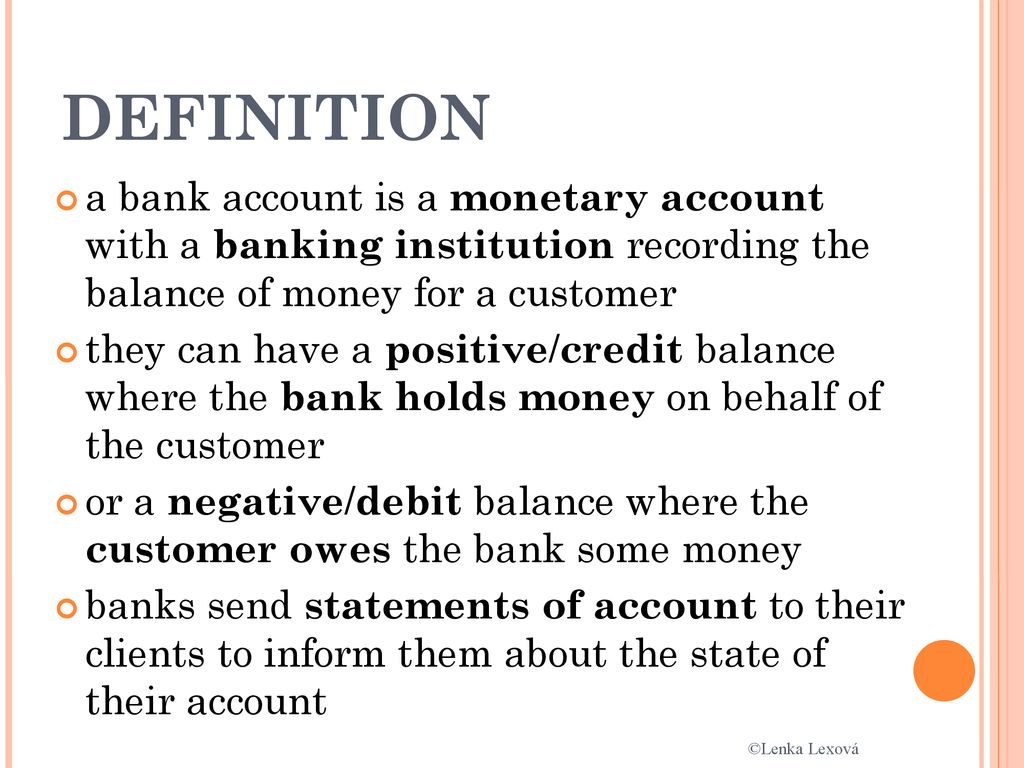

Types of banking accounts. This topic is important for bank exams as generally many questions are asked in bank exams and interview on bank accounts like what are different types of accounts in the bank what is the difference between a current account and saving the account so understanding this topic is very important. Save for free with credit karma savings start saving bank accounts at a glance. Both accounts have contribution limits and other requirements you may need to discuss with your tax advisor before choosing your account once you understand the types of accounts most banks offer you can begin to determine which option might be right for you. Here are six common types of bank accounts and how to use them.

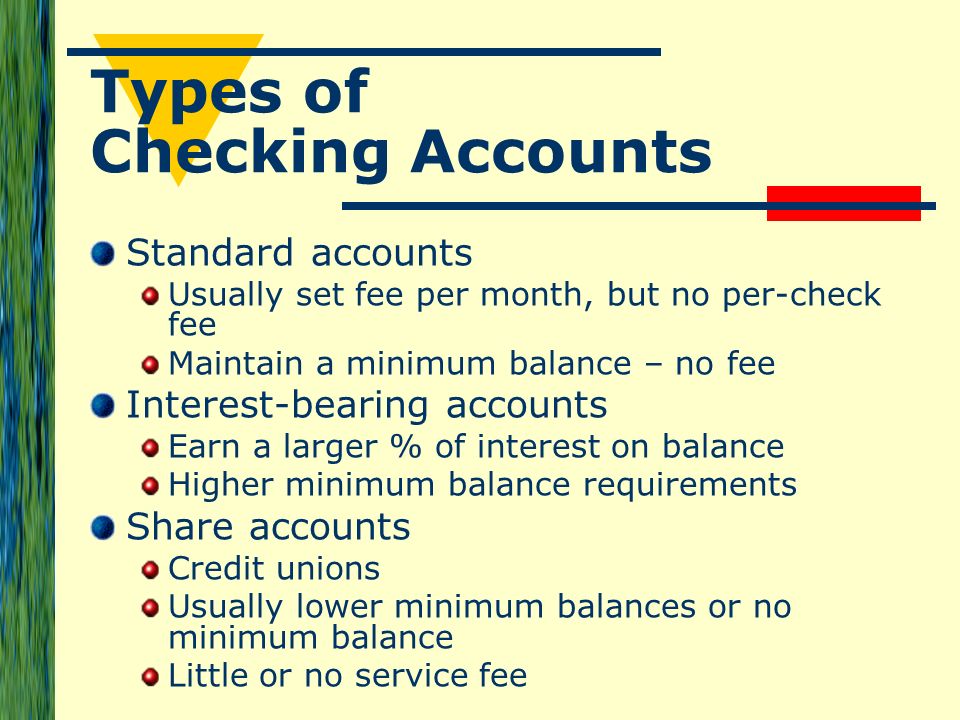

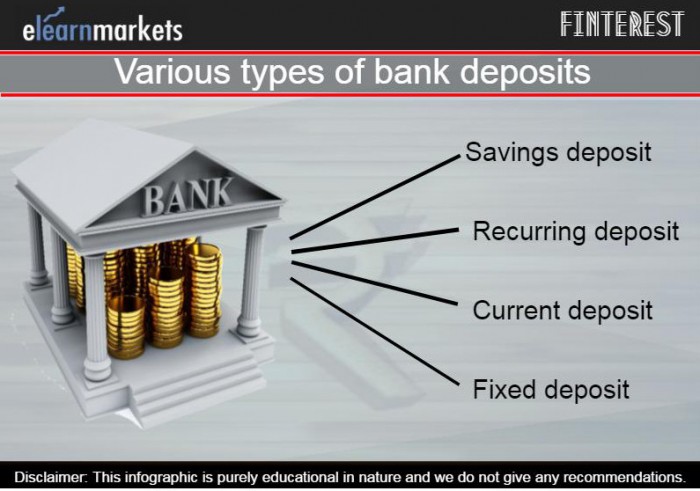

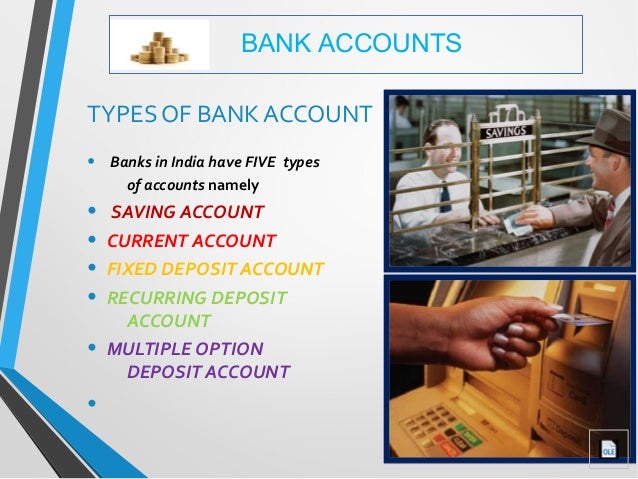

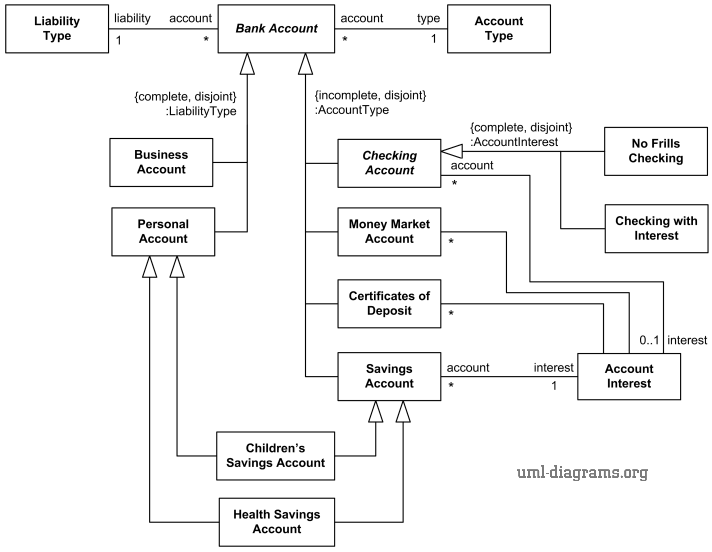

But it s a good idea to know what they are because some offer particular advantages in one area you may need as such they may be more suitable than regular accounts. Types of bank accounts before opening a bank account it s important to understand the different types of accounts available so you can choose one with benefits and services that match your daily needs. Each financial institution sets the terms and conditions for each type of account it offers which are classified in commonly understood types such as deposit accounts credit card accounts current accounts loan accounts. While there is no interest paid on amount held in the account banks charges certain service charges on such.

Current account is mainly for business persons firms companies public enterprises etc and are never used for the purpose of investment or savings these deposits are the most liquid deposits and there are no limits for number of transactions or the amount of transactions in a day. These accounts are not so much bank account types but just specialized versions of the accounts already mentioned or they are simply just another category name for the core accounts listed above. Therefore a checking account is a great place to keep the cash you. Custodial accounts are accounts in which assets are held for a third party.

For example businesses that accept custody of funds for clients prior to their conversion return or transfer may have a custodial account at a bank for these purposes. Get easy access to your money for day to day expenses. There are different types of accounts. Keep in mind that accounts can come with all sorts of fees so be sure to read the fine print and do your homework before opening a new account.

/types-of-banks-315214-final1-5b4fa03f46e0fb0037b29fb0.png)