Sell My Annuity Payments Lump Sum

It is important to know what we can and cannot purchase.

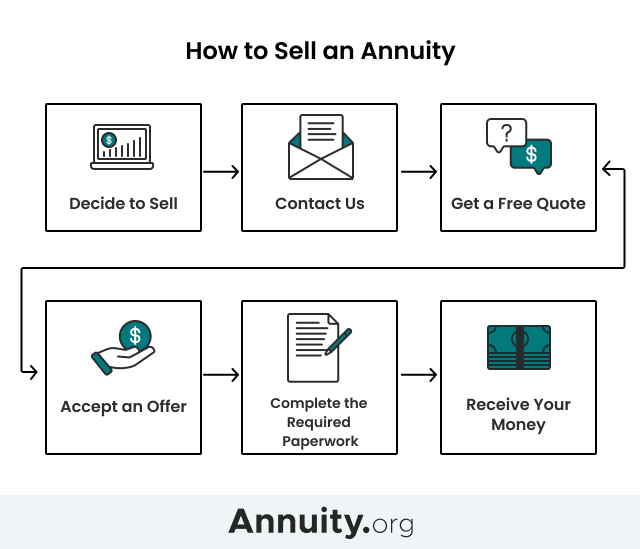

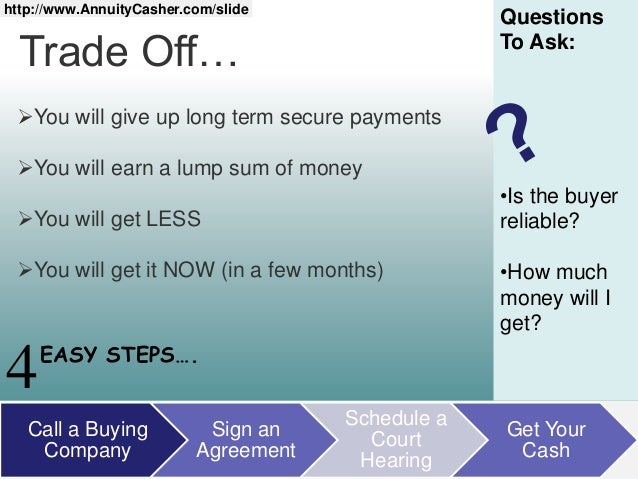

Sell my annuity payments lump sum. However instead of selling your annuity payments for a set period of time you re selling a lump sum of the annuity payout you re entitled to receive. The larger the portion of annuity they sell the larger the lump sum they receive. Before you decide to sell a single payment consider the costs associated with selling your annuity payments the options for selling and how they stack up against the financial consequences of withdrawing funds. You have full control over spending and investing your money.

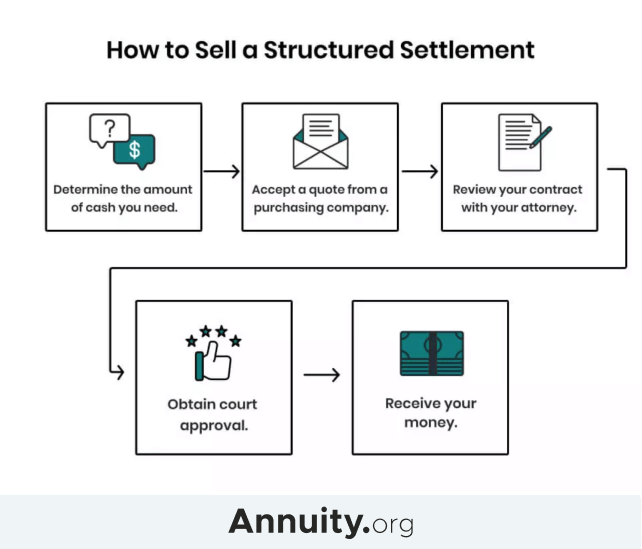

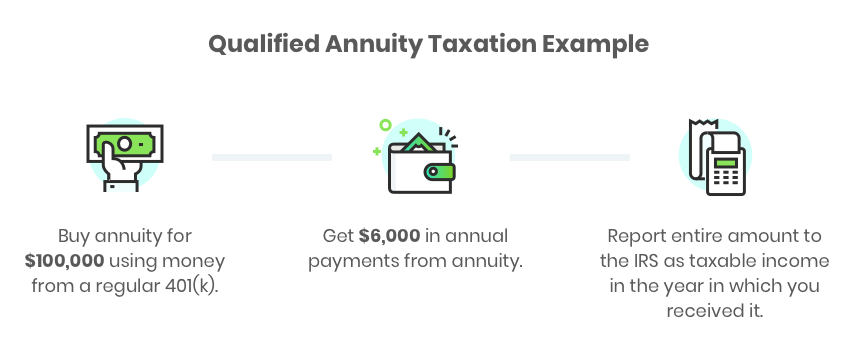

Withdrawing annuity savings early can increase the amount of interest needed to pay for a lump sum of your earnings. You can sell your current or future annuity payments to a third party buyer in exchange for a lump sum payment. This means they receive a specific dollar amount which will be deducted from future annuity or structured settlement payments. So if you need 50 000 to start a business for example you could perform a lump sum sale of that amount of benefits.

If you have these kinds of expenses then selling an annuity for a lump sum of cash may be a good option for you. Typically an annuity is purchased with a lump sum in exchange for these future payments. Withdrawing funds from your annuity can come with expensive fees and other penalties. Similar to a partial sale a lump sum sale allows the annuity owner to sell a portion of their annuity payments in exchange for a lump sum.

We cannot purchase retirement annuities that were issued by a previous employer. Sell my annuity llc will not only help determine if you should sell your structured settlement or annuity we. You can take care of bills and get your life back to normal. You don t have to sell your entire annuity to get a lump sum.

In instances where you must access you lump sum from the insurance company directly there can be a significant surrender charge which reduces the amount of money you can expect to receive. These are the kind of circumstances that may require you to sell structured settlement payments or sell annuity payments to a buyer of these assets. You get a big fat lump sum check. Let me point out some pros and cons of selling your pension to your employer the way i see it at least.

In addition the amount of annuity payments owners wish to sell will determine the amount of cash they get up front. Many people will sell their annuity because their financial circumstances change and they need cash immediately rather than waiting for their scheduled payments. An annuity can be sold as a whole or in part based on your needs. Sell my pension advanteges.

Is selling your pension in your own best interest.