Tax Basis Balance Sheet Example

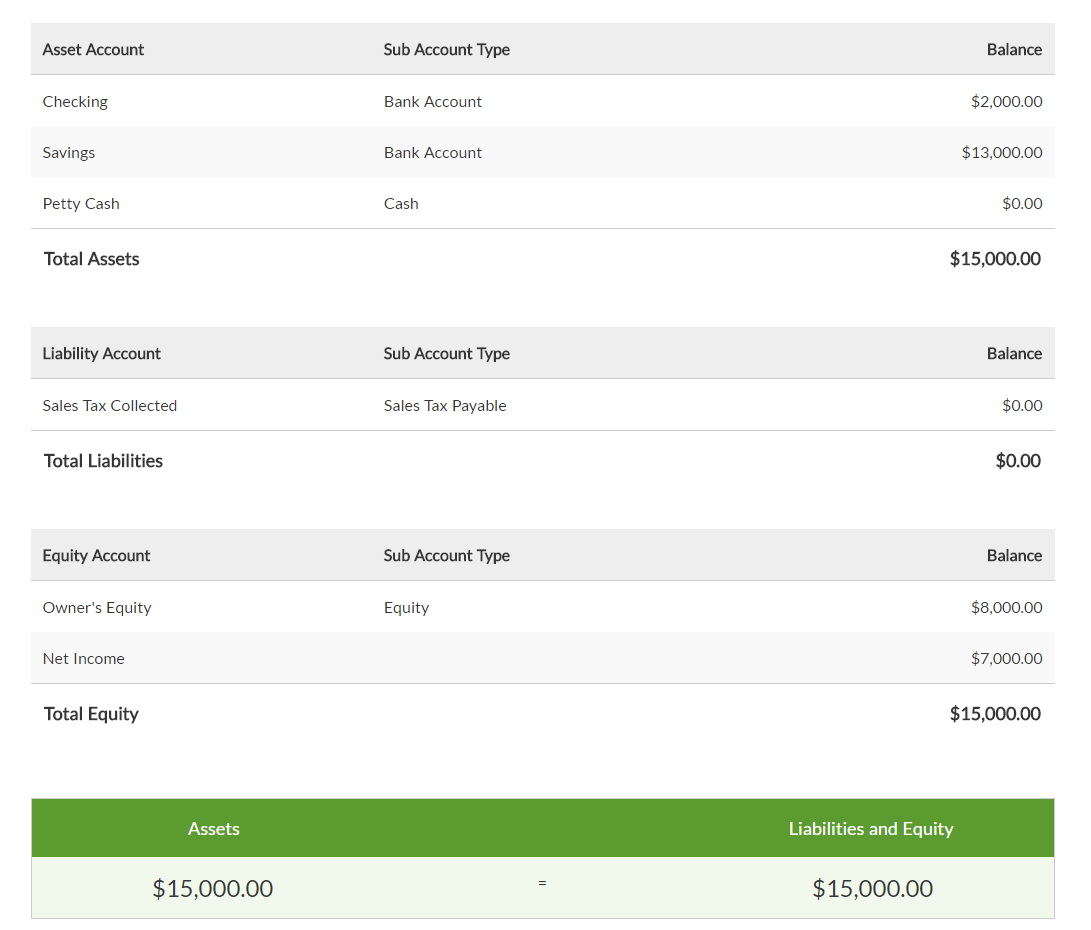

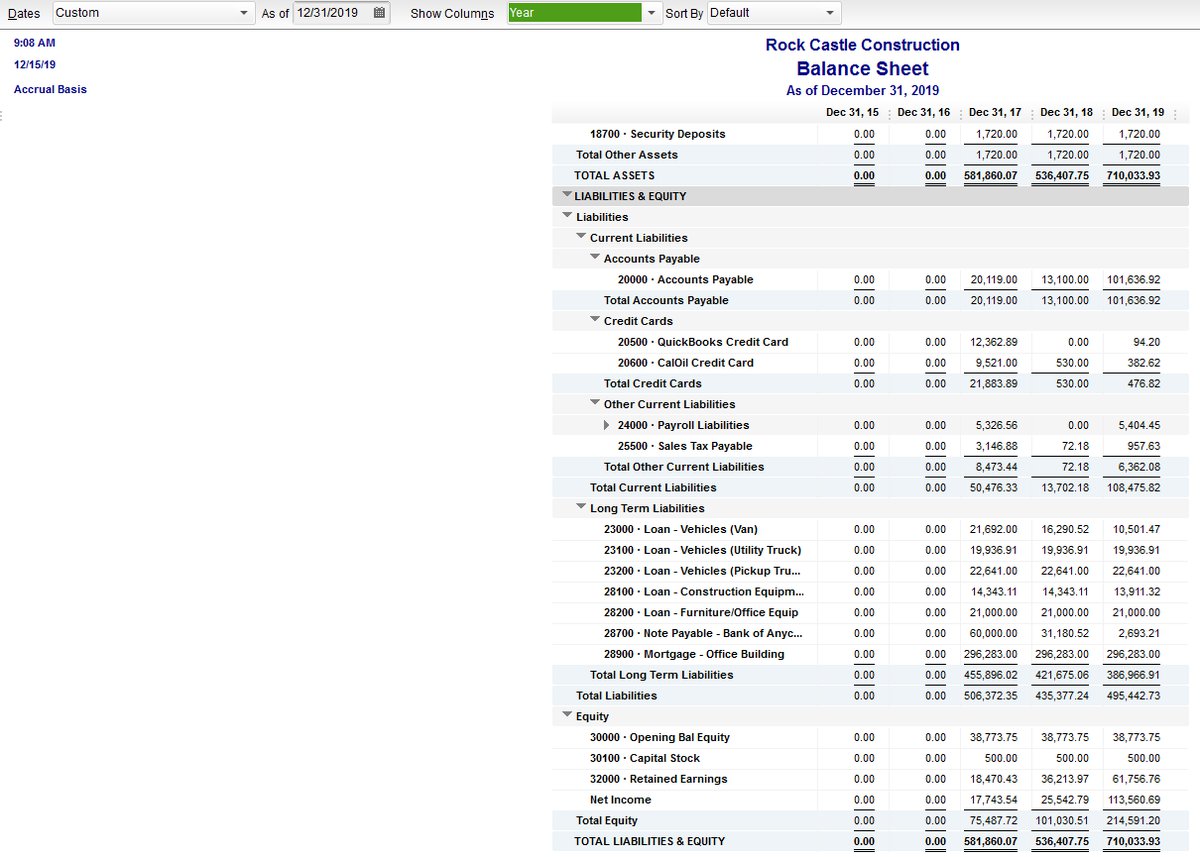

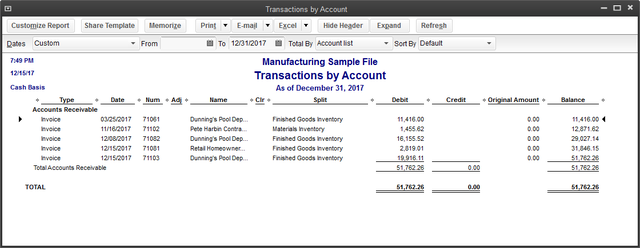

Cash basis accounting balance sheet example.

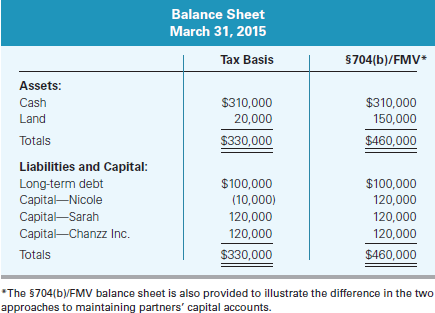

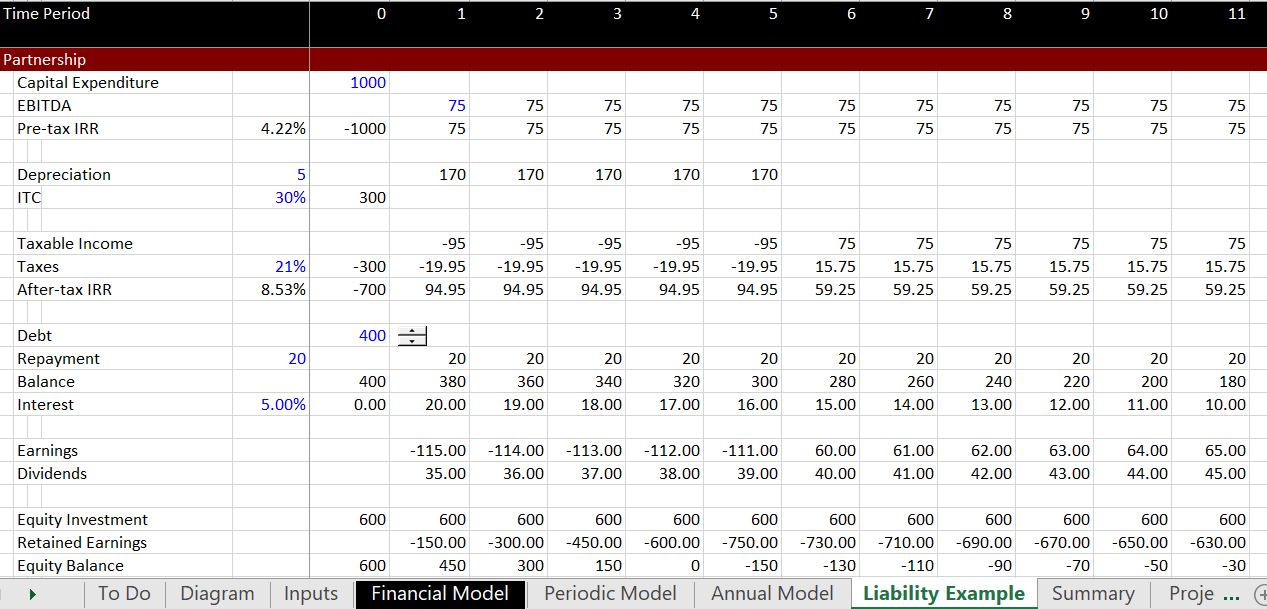

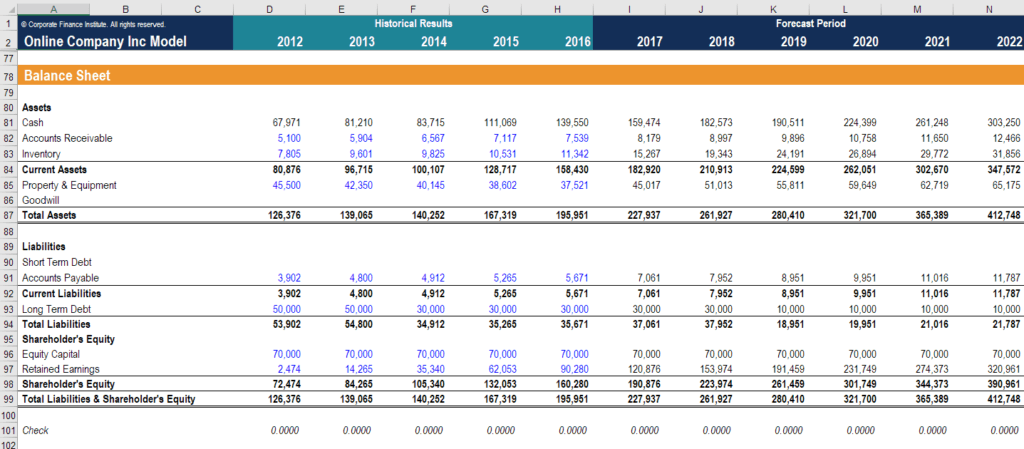

Tax basis balance sheet example. Tax basis balance sheets follow the same format as regular balance sheets but are designed as if they were prepared for tax purposes. After the asset value increases to 240 000 partner a sells his interest to partner t for 120 000 fmv. Tax basis balance sheets provide managers with the current deferred tax liability of a company assuming all assets were sold at their current value value and all liabilities could be paid off at the value reported in the balance sheet. For example under the income tax basis of accounting.

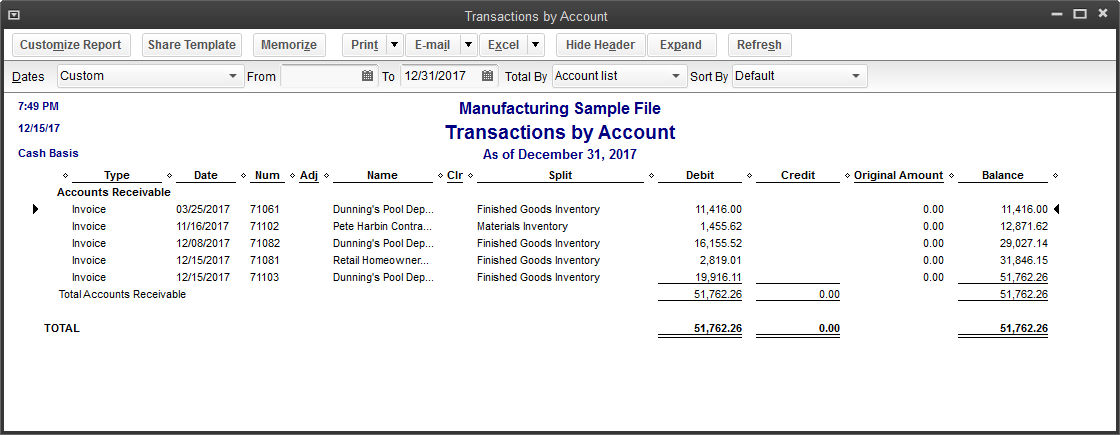

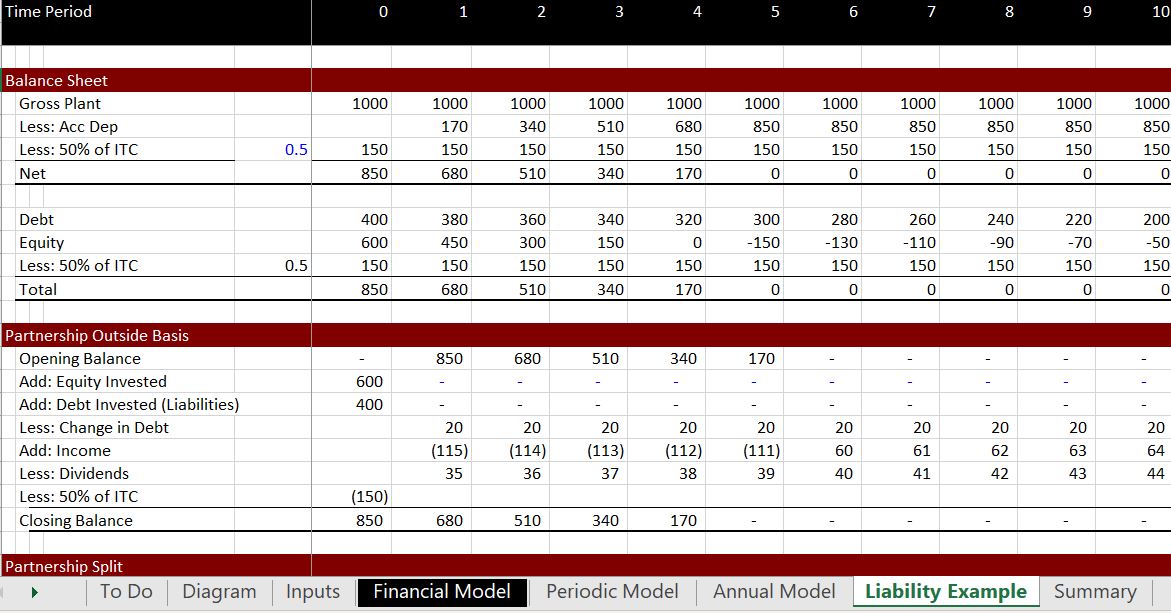

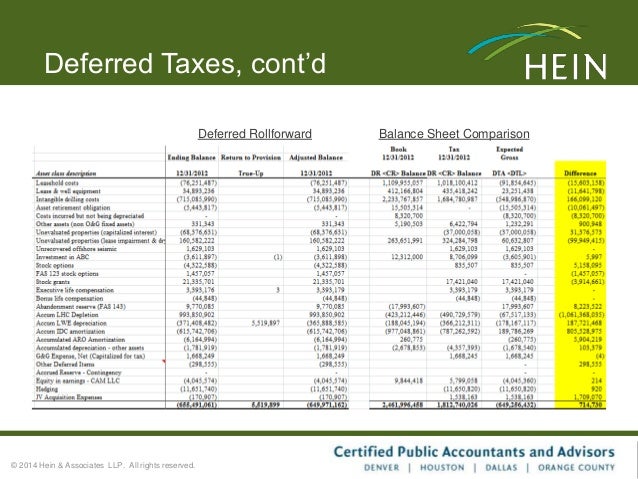

See balance sheet. It details the tax basis balance sheet detail columns 1 5 based on the accounting records including the closing temporary difference per the tax accounting records. Reg 1 755 1 b 2 ii example 1 partner a contributes 50 000 cash and asset 1 below with fmv of 50 000 and tax basis of 25 000 giving him tax basis of 75 000. The balance sheet is a record of your business s progress giving you a snapshot of your financial condition.

One important statement is the balance sheet. For instance the tax compliance group would use it to update the tax basis balance sheet after tax returns are filed. Board of director of company xyz address. Partner b contributes 100 000 cash.

This entry can be computed by subtracting the previous year s book basis balance sheet from the previous year s. Adjust the trial balance to reflect the previous year s book to tax adjustment. In accounting you use financial statements to compile and review financial information. Compared to gaap the income tax basis approach typically involves treatments that could make the reporting less complex.

The same as the cash basis except that long term assets and long term liabilities are included in the balance sheet. The balance sheet contents under the various accounting methodologies are. To complete the analysis during the year you must perform all the necessary steps to determine the actual tax basis balance sheet as if the return was filed. Records revenues and expenses as they are earned or incurred irrespective of changes in cash.

Rent received in advance will show in the liability side of a balance sheet as on 31 12 2018 example 5 interest received on fd xyz ltd has invested 500 in fd 5 for 5 years on 01 01 2019 full amount will receive after maturity i e after five years on 31 12 2023 but accrued interest will recognize every year. Increased efficiency in tax departments multiple groups within tax departments will use a tax basis balance sheet for various purposes.

:max_bytes(150000):strip_icc()/InvestoApple2jpeg-da0c6b0acbc7478d9df0caf561ad0afc.jpg)