What Is Form K1

An application for and amendments to an application for registration as a national securities exchange or exemption from registration pursuant to section 5 of the securities exchange.

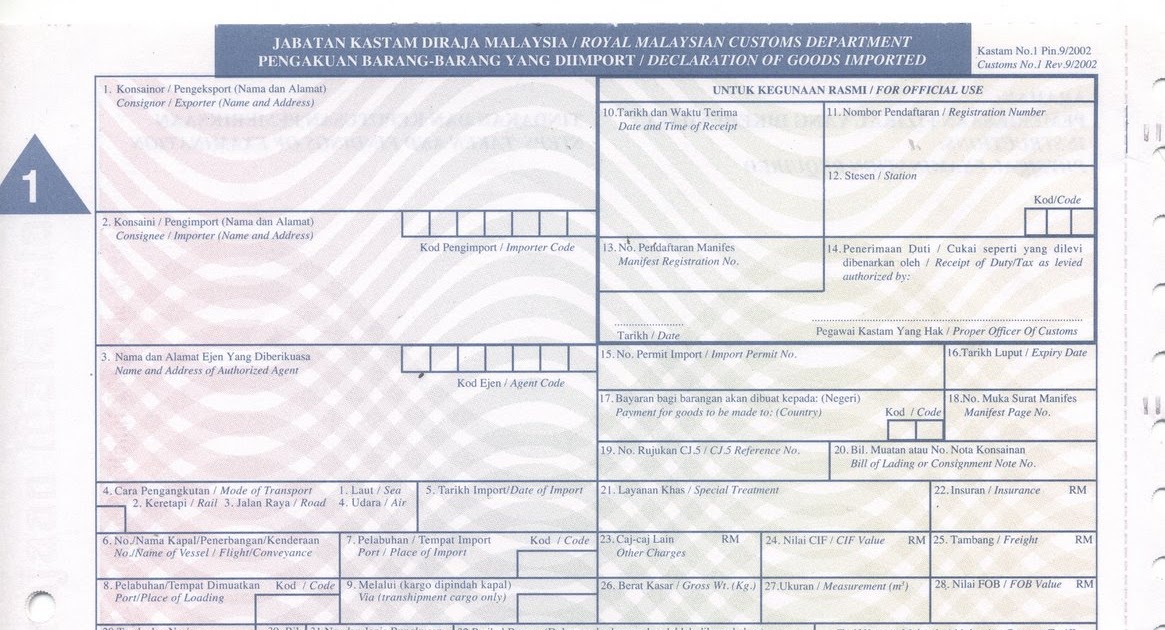

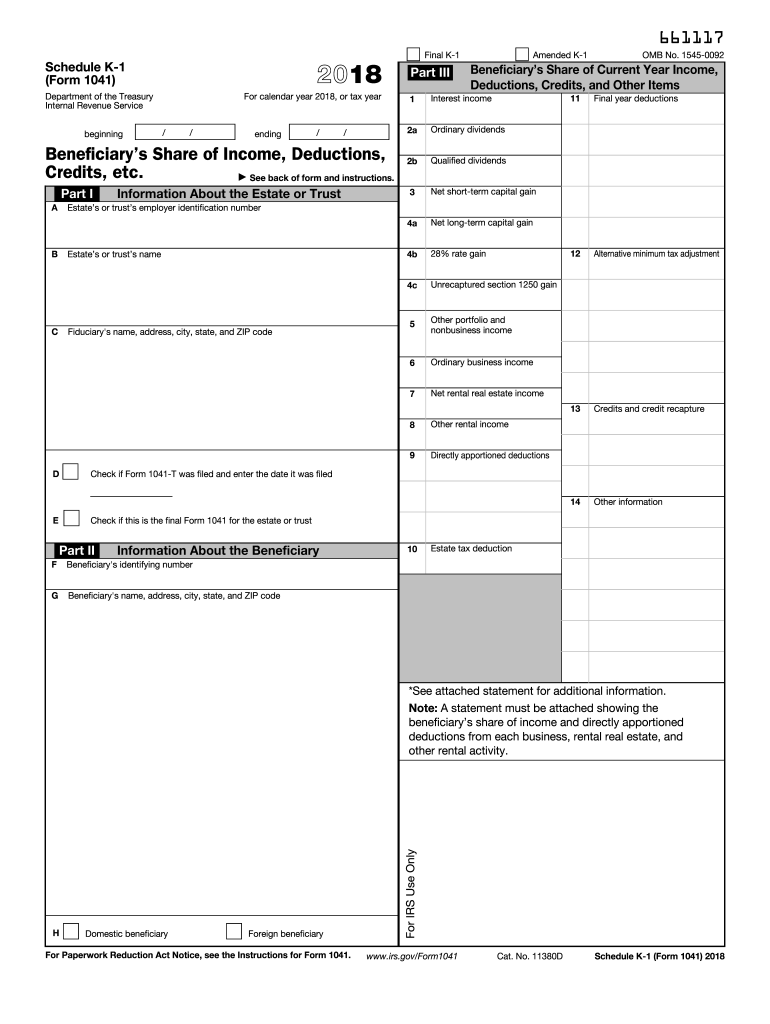

What is form k1. An s corporation reports activity on form 1120s while a partnership. Use schedule k 1 to report a beneficiary s share of estate trust income credits deductions etc on your form 1040. K1a applicable upon importation of goods value rm 10 000 00 k2 use for export of goods from the country k3 transportation of goods between peninsular malaysia sabah sarawak and transportation within the same territory customs no. K1 use for the importation of goods into the country.

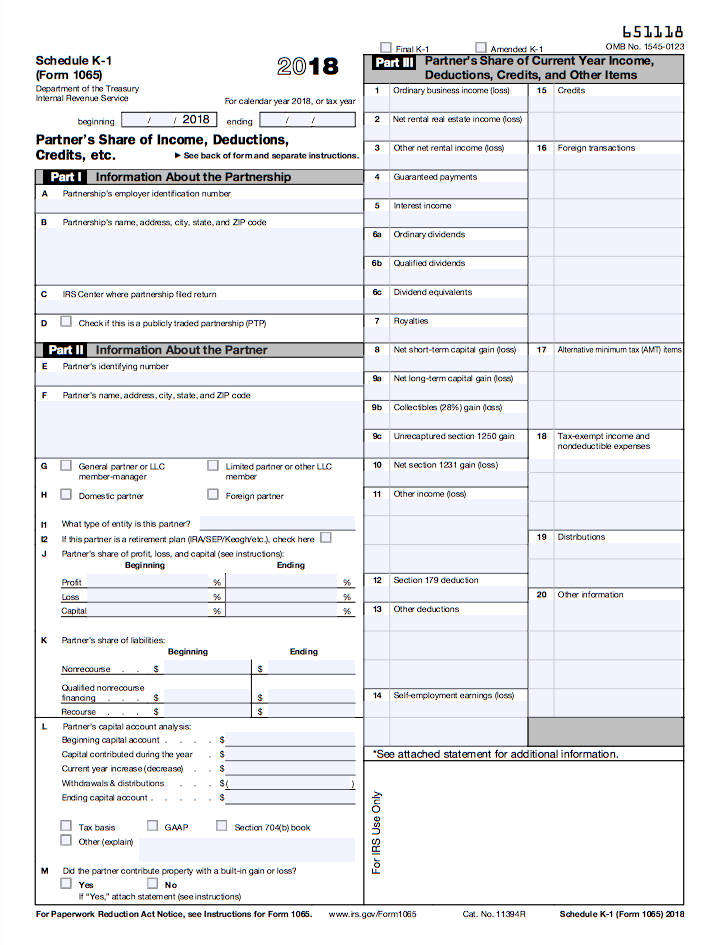

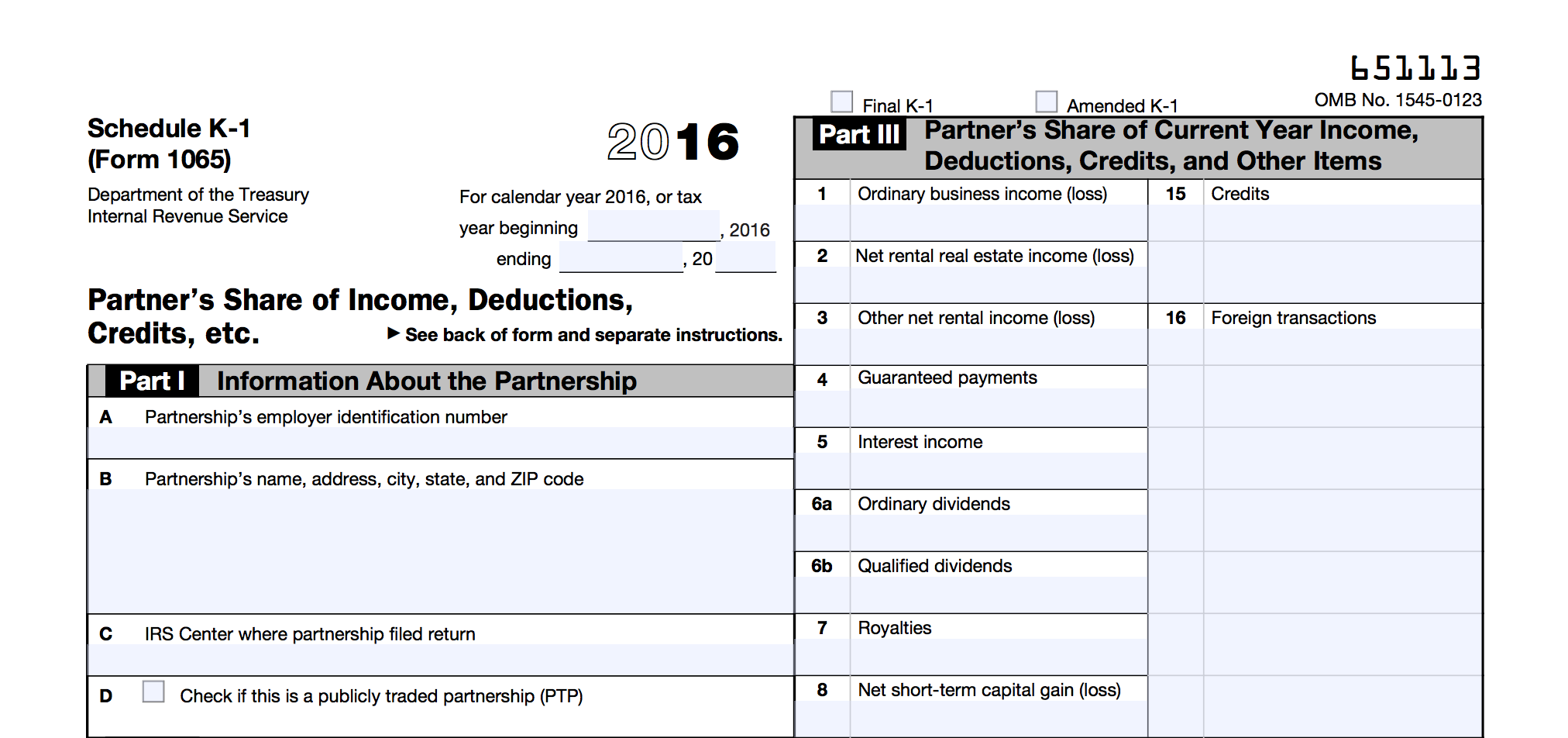

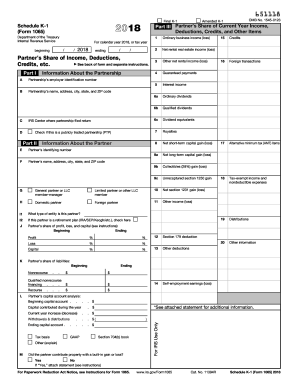

Information about schedule k 1 form 1065 partner s share of income deductions credits etc including recent updates related forms and instructions on how to file. The shareholders use the information on the k 1 to report the same thing on their separate tax returns. Application form k1 for registration of a land charge. 3 form is required for the following circumstances.

The schedule k 1 form may report information other than your share of income or loss. Similar to a partnership s corporations must file an annual tax return on form 1120s. Information about schedule k 1 form 1041 beneficiary s share of income deductions credits etc including recent updates related forms and instructions on how to file. Form k 1 will show each owner s share of the business s income and losses and any credits or distributions that the owner has received from the business.

The march 15 deadline gives business owners enough time to report and file this information with their personal income tax return usually due in mid april. Just like any other form of income you must report income from form k 1 on your individual tax return. Schedule k 1 form 1065 is used for reporting the distributive share of a partnership income credits etc. Box 9 for example shows the amount of depletion depreciation and amortization deductions allocated to you.

The s corporation provides schedule k 1s that reports each shareholder s share of income losses deductions and credits. The form has been amended to include more details of the fee paid to be included. Filed with form 1065. If you have an interest in a partnership or an s corporation you should receive a form k 1 every year.

Schedule k 1 may also show tax credits in box 13 or the information you will need to calculate the domestic production activities income deduction you can take as an income adjustment on your 1040.

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)