Syndicated Loan

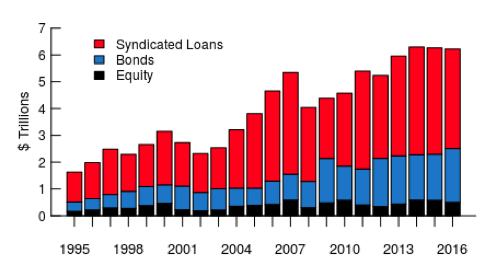

Bloomberg sglobal syndicated loans database consists of more than 54 000 active loan tranches and approximately 160 000 replaced or retired loans covering nearly 40 000 unique borrowers across more than 200 countries and 100 different currencies.

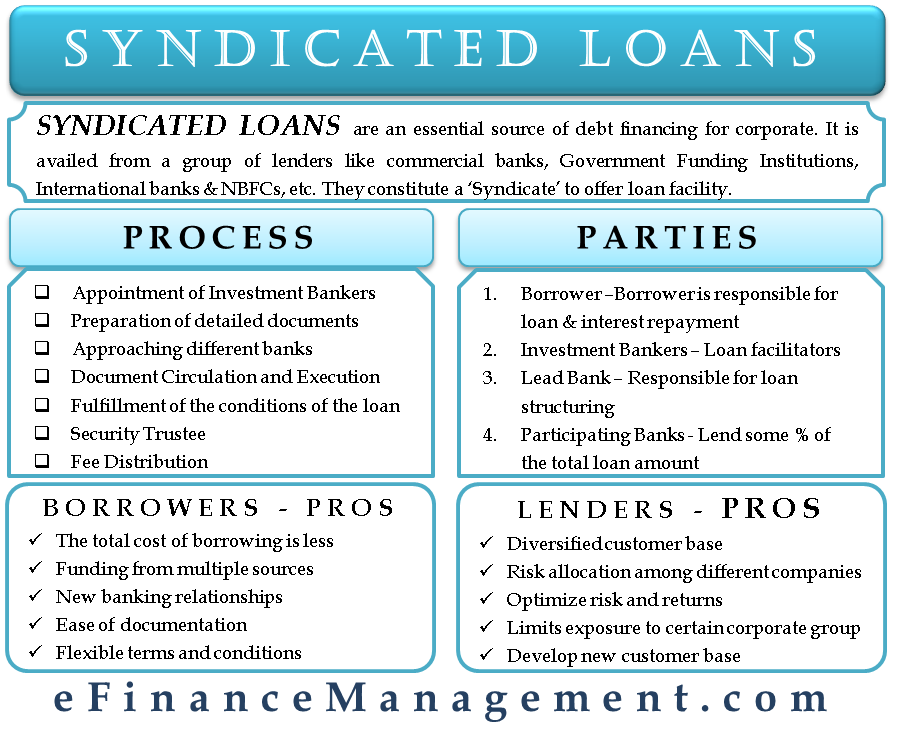

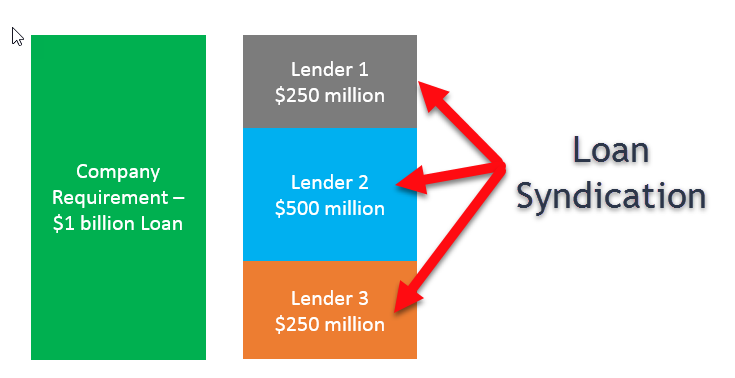

Syndicated loan. A syndicated loan also known as a syndicated bank facility is a loan offered by a group of lenders referred to as a syndicate that work together to provide funds for a. The amount of one syndicated loan is so big such that one lender cannot fund or take on the debt alone. A syndicated loan is offered by a group of lenders who work together to provide credit to a large borrower. They use the funds to help them bankroll takeovers acquisitions or expansion projects.

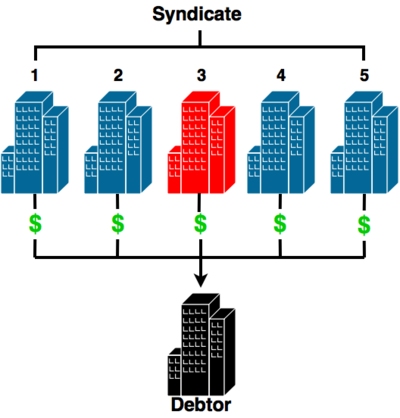

Syndicated loans are debts issued by a consortium of lenders to a sole borrower. And europe to receive loans from banks and other institutional financial capital providers. Syndication of loan meaning. Corporations are usually the borrowers for this type of loan.

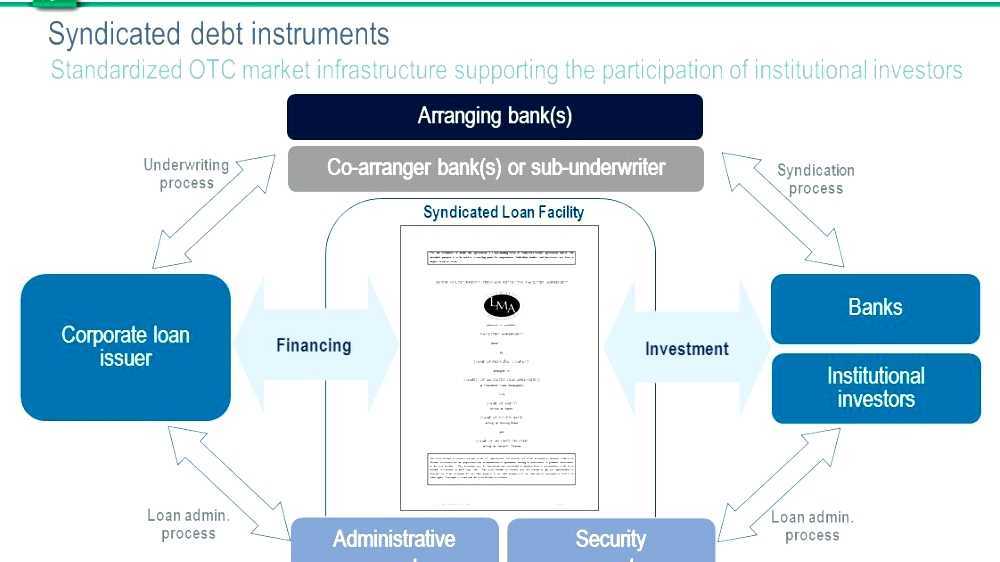

A syndicated loan also known as a syndicated bank facility is a loan where several financial institutions form a group syndicate and lend money to one borrower there is just one loan agreement with terms and conditions that apply to all the lenders in the syndicate. The word syndicate means a group of people or organizations combined to promote a common interest. Usually one bank is appointed as the agency bank to manage the loan business on behalf of the syndicate members. Where a group of lenders collaborate together usually through an intermediary being a lead financial institution or syndicate agent which organizes and administers the transaction including repayments fees etc to provide financial requirements to a single larger borrower usually out of the capacity of single lender where division of risk and returns takes.

Syndicated loan is a form of loan business in which two or more lenders jointly provide loans for one or more borrowers on the same loan terms and with different duties and sign the same loan agreement. Corporations are allowed to enter into contracts sue and be sued own assets remit. A syndicated loan is a loan offered by a group of lenders called a syndicate who work together to provide funds for a single borrower. There is an interest rate fixed or floating and a.

Syndicated loan a loan made by many lenders to a single borrower. In many ways a syndicated loan operates like an ordinary loan. Competitive bid option definition. Syndicated loans are made in large amounts that would be too big for one lender to handle.

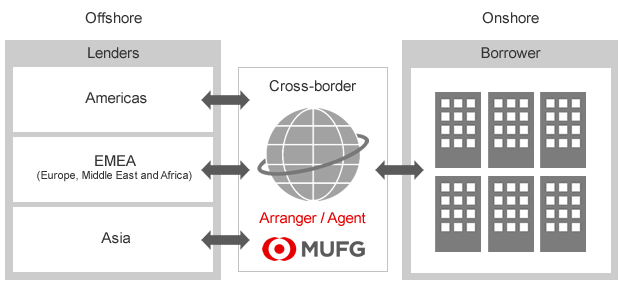

A syndicated loan is one that is provided by a group of lenders and is structured arranged and administered by one or several commercial banks or investment banks known as lead arrangers. The borrower can be a corporation corporation a corporation is a legal entity created by individuals stockholders or shareholders with the purpose of operating for profit. Syndicated loan a large eurocurrency loan from a group of international banks.