What Does Personal Liability Mean In Renters Insurance

I am a claim adjuster not an agent and i don t believe you can buy a renters policy just for your own personal property.

What does personal liability mean in renters insurance. That s why personal liability coverage is an important component of your homeowners insurance or renters insurance policy. I suspect it is the liability coverage and trust me you need and want that coverage. The coverage for your personal property is a secondary reason for getting renters insurance. Let s say a guest visits your home and while walking through your garage is hit by a falling ladder.

While personal liability coverage can be purchased as a stand alone policy it is included in most residential insurance policies including homeowners renters and condo. What does renters insurance cover. What do these mean to you. Personal liability insurance is perhaps the most integral component of your homeowners or renters insurance policy protecting you from expensive litigation or medical bills in the event you re held liable for bodily injury or damage to someone s personal property.

Now that you know the definition of personal liability insurance here s a real life example. Renters insurance typically includes three types of coverage. Talk to your independent insurance agent to figure out the right policy for you. Filing a claim under your personal liability coverage whether it s a stand alone policy or not is similar to filing any other type of insurance claim.

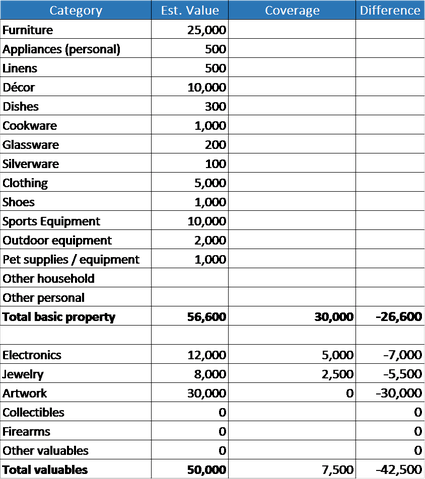

Personal property liability additional living expenses personal property coverage can help pay to replace your belongings if they re stolen or damaged by a covered risk. Personal liability coverage may help protect a renter in these types of situations. Injuries to people or damage to their property must be accidental and unintentional. Luckily you ve come to the right place for a short lesson on what renters insurance covers.

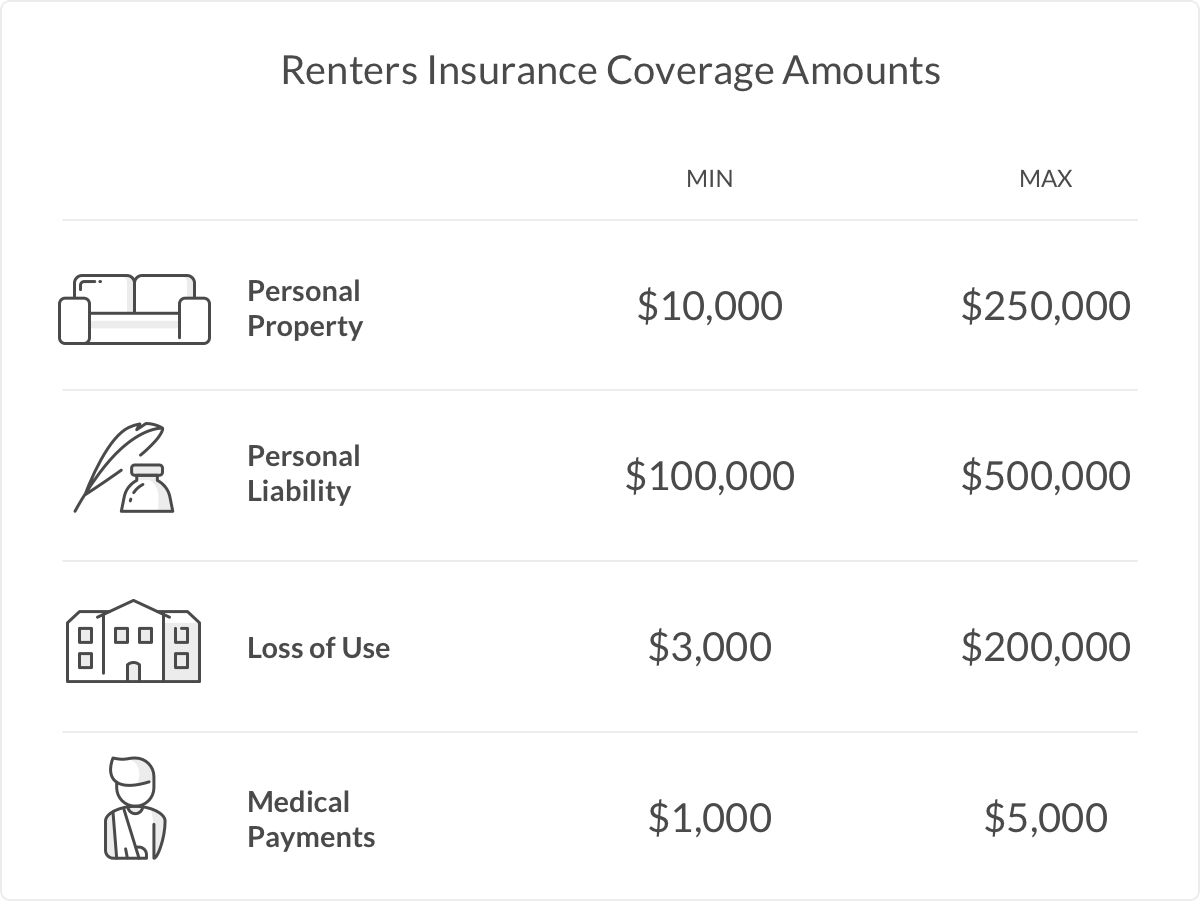

Many people have renters insurance not nearly enough people but 30 of renters. The standard policy covers up to 100 000 in liabilities but you may want more coverage. Renters insurance covers liability personal property loss of use and medical payments to others. Personal property liability and additional living expenses.

Available through your home insurance condo insurance or renters insurance policy it may provide coverage for your defense in the event that an action is brought against you whether you are responsible or not. It helps you avoid paying legal defense fees out of your own pocket. Renters who seek additional liability coverage beyond their renters insurance policy limits may benefit from a personal umbrella policy. A typical renters or tenants insurance policy grants you 100 000 of personal liability coverage to go along with your personal property protection.