Va Mortgage Loan Closing Costs

All closing fees on an irrrl may be rolled into your new loan.

Va mortgage loan closing costs. Va home loan closing costs for disabled veterans may be lower if they re eligible for a funding fee exemption for service related disabilities. To talk to us about a va loan and their closing costs please call 800 220 5533 or get started online. A down payment is not required on va loans. Va loan closing costs average anywhere from 3 to 5 percent of the loan amount but can vary significantly depending on where you re buying the lender you re working with seller concessions and more.

Learn about the va funding fee and other loan closing costs you may need to pay on your loan. Common va loan closing costs. In total closing costs commonly represent 2 5 of the value of a mortgage depending upon the size of the loan and its terms and conditions. Interest rate reduction refinancing loans irrrls are another exception.

Va loan closing costs average around 1 3 of the loan amount on bigger home purchase prices and 3 5 of the loan amount for less expensive homes. Use this calculator to help estimate closing costs on a va home loan. However the veteran is responsible for closing costs. Va loan closing cost calculator estimate your total va loan closing costs with funding fee.

Information about your eligibility for the waiver can be found by checking your certificate of eligibility online or reviewing the status of a pending disability claim. These charges include fees for appraisals usually between 300 and 500 title insurance which can cost as much as 2 500 and credit reports which may cost around 50 or 60. In some cases the costs are rolled in to the mortgage and paid over time but it is more common for them to be paid out of pocket at a formal settlement meeting. The veteran can pay them out of pocket or receive seller and or lender credits to cover them.

Ask freedom mortgage about va loan closing costs. If you re buying a house with a va loan you can expect to pay various closing costs. We are dedicated to helping veterans and service members buy and refinance homes. This is an estimate of how much you will need on the day your home purchase is made.

Please consult with your real estate professional handling the transaction to review these expenses. If you have any questions concerning fees and charges on a va loan contact the va regional loan center. Closing costs must be paid at closing and may not be financed into your loan. Enter your closing date the sale price your military status quickly see the estimated closing cost.

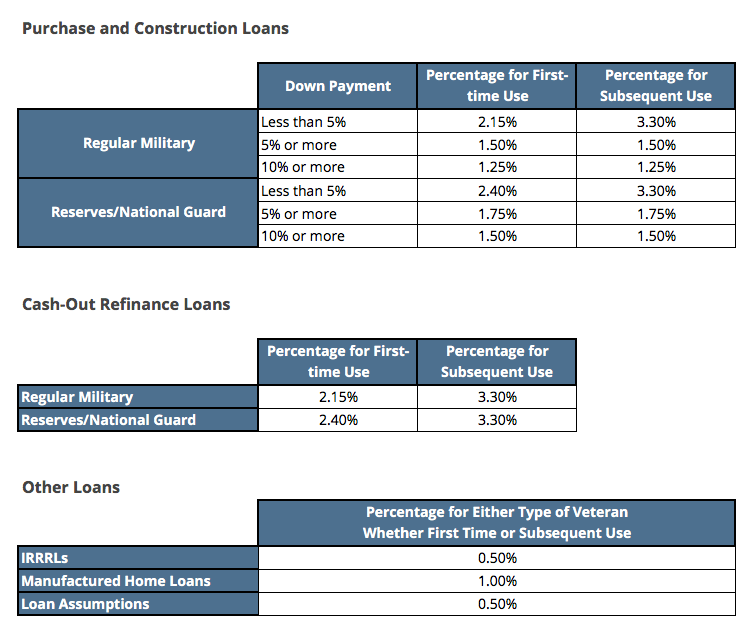

The va funding fee is a one time payment that the veteran service member or survivor pays on a va backed or va direct home loan.

/home-sellers-paying-closing-cost-credits-4134262_FINAL-b881d78ab2234285b358324624cc0e16.png)