Va Loan Prequalify

Although the preapproval letter lets you know how much you can borrow it is not a commitment to lend.

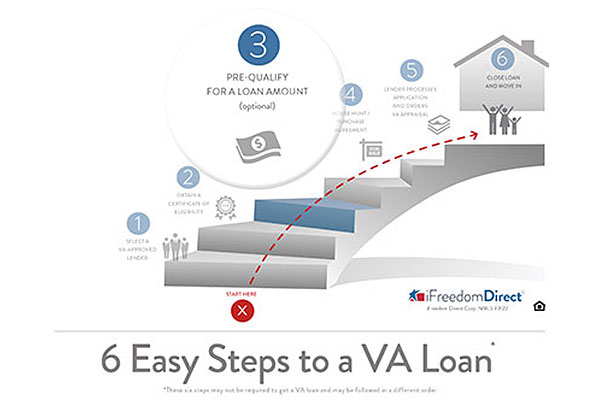

Va loan prequalify. Prequalification on a va home loan enables military borrowers to correct red flags that could halt the loan process. 5 3 searching for homes. Wants in a home. Prequalification indicates whether you meet the minimum requirements for a loan and.

The figures above are based upon va s debt to income ratio which is a ratio of total monthly debt payments housing expense installment debts and so on to gross monthly income. This letter is good for at least 30 days and as long as 90 days if you stay in touch with your home loan advisor. Veterans can take a moment to fill out the short va application form below and one of our specialists will get back with you. Learn about va home loan eligibility requirements for a va direct or va backed loan.

5 6 house hunting property guidelines. 5 starting the house hunt open section. Since va loan prequalification is not the same as approval what is the value of this optional step. Va home loan prequalifying requires some documentation.

4 7 finding a va lender. 5 2 defining needs vs. In short the va wants to make sure that you have sufficient income leftover after accounting for your monthly debt expenses including your mortgage payment property tax homeowners insurance as well as other debt expenses including credit cards personal auto and student loans. 4 5 va loan prequalification.

First prequalifying can give you a ballpark price range for house hunting. 4 6 va loan preapproval. 4 4 va loan limits. During prequalification a borrower might learn he or she needs to improve credit history and provide proof of self employment income.

Further along in the mortgage process we ll ask you for documentation to verify this information. The va program uses a residual income analysis to determine your ability to qualify for a mortgage. The first thing borrowers need to do in order to obtain a va home loan is to apply for it. Mortgage prequalification is an informal evaluation of your creditworthiness and how much home you can afford.

Find out how to apply for a certificate of eligibility coe to show your lender that you qualify based on your service history and duty status. 5 1 finding a real estate agent.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)