Sell My Structured Settlement Payment

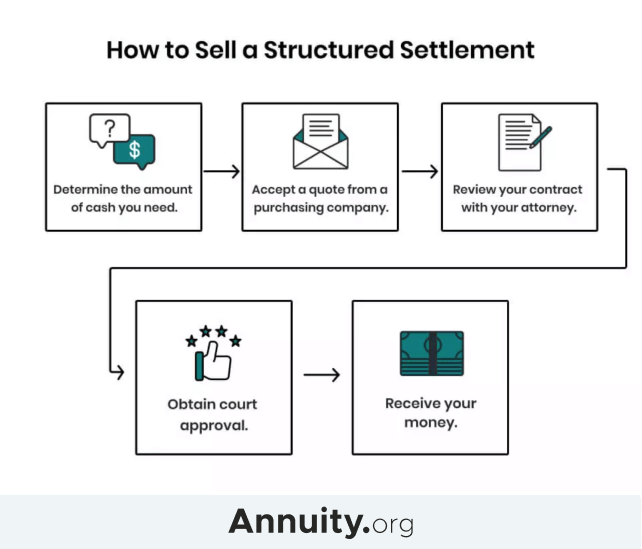

Once approved the legal process takes place.

Sell my structured settlement payment. A judge has to sign off on selling your payments from your structured settlement. Structured settlement annuities are a financial instrument that is normally used to provide regular tax free payments to personal injury victims over a long period of time. Whatever your reason this guide will help you sell your settlement for cash. Once the judge approves the transaction the insurance company who has been paying you releases the money to the factoring company and then you are paid.

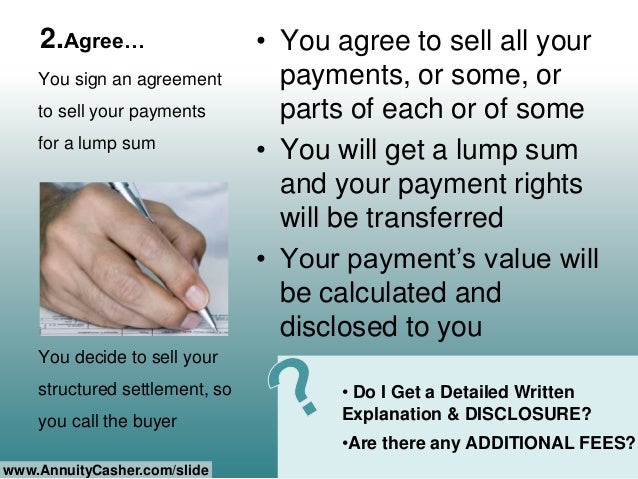

Or you could decide to sell six months worth of payments. Instead of facing unexpected stress and management issues that come with receiving a lump sum of money the recipient is protected from bad judgment that could result in spending a large. The terms of your settlement and the laws in your state will determine whether you can sell your payments. Your protection is also the reason you must have your sale approved by a judge.

Cashing in your structured settlement may be the right choice for you. State laws that fall under the structured settlement protection acts are intended to protect settlement recipients from unethical structured settlement buyers. Annuities can be sold in portions or in entirety. Sell your structured settlement.

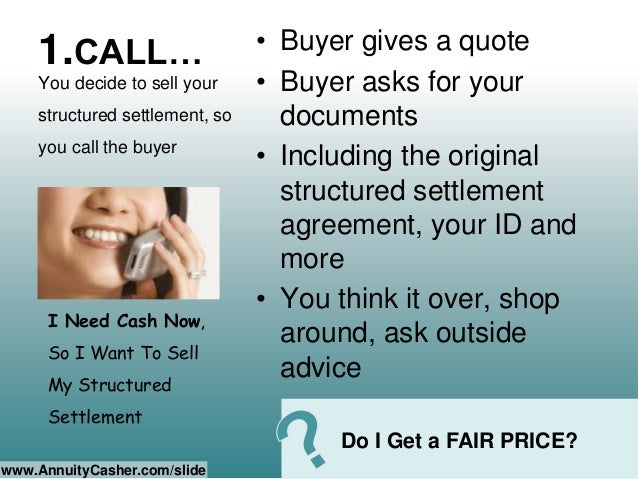

The vast majority of people who sell structured settlement payments sell only a portion of those payments. If your financial needs have changed recently selling the rights to these payments in exchange for a lump sum payout from a company that specializes in buying annuities can give you some financial flexibility. The stress of financial issues can be enormous. You can sell your annuity or structured settlement payments for cash now.