Transfer To Credit Card

Make sure you aren t using accents when you enter your name.

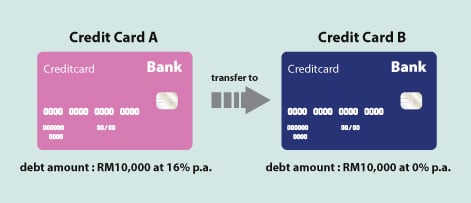

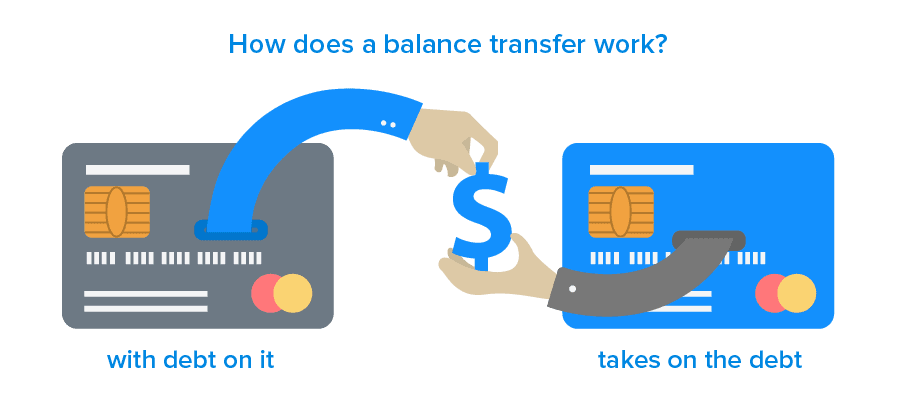

Transfer to credit card. A balance transfer credit card is a credit card that can be used to pay off part or all of the balance owed on another credit card or loan account thus shifting that debt to the balance transfer card which should have a lower apr than the original lender charged. When you take out a balance transfer card you ll be able to transfer a balance from another card or cards. Once you ve transferred the debt you ll make payments to the new card. Log in with the website log in username password click on benefits option in the main menu and select balance transfer.

A balance transfer card can save money by allowing you to transfer your debt to a new credit card ideally with a lower rate. Most credit card providers charge a balance transfer fee of around 3 when you move your debt from one card to another. Log in to your sbi card online account click on the benefits link on left hand navigation and select balance transfer enter details confirm to book bt instantly. Follow the tabs or links to make a payment on the account.

Visit the website of the credit card you wish to transfer the money to. A balance transfer credit card lets you move your existing balance from one or more credit cards onto a new card often with a low or 0 interest rate for a set period. Select the option to make a payment with a credit card and enter the credit card information for the account you wish to transfer the money from. This varies between cards and providers.

Most cards limit how much you can transfer. There is a balance transfer fee of. If your balance is less than 1 you can transfer your total balance as an exception to the minimum. Ensure your debt doesn t exceed the balance transfer limit.

How do balance transfers work. Most balance transfer credit cards offer no interest for upwards of six months which can help you save a lot of money on your debt. If you transfer a balance interest will be charged on your purchases unless you pay your entire balance including balance transfers by the due date each month. Enter the payment amount and submit the payment information.

Discover and citi allow transfers up to your available credit while others may allow transfers at up to 80 of your credit limit.