Typical Car Insurance Rates

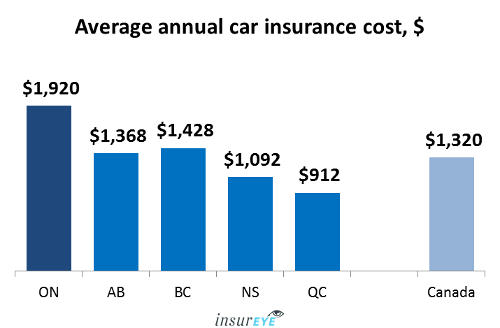

After collecting quotes from top insurers across the country we found the average auto insurance rate to be 2 390 per year or 200 per month.

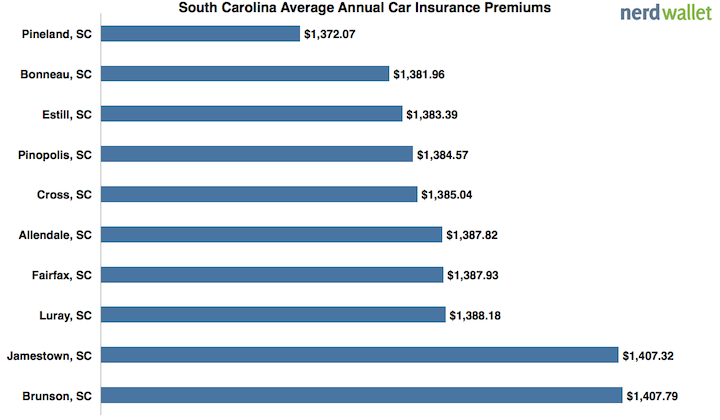

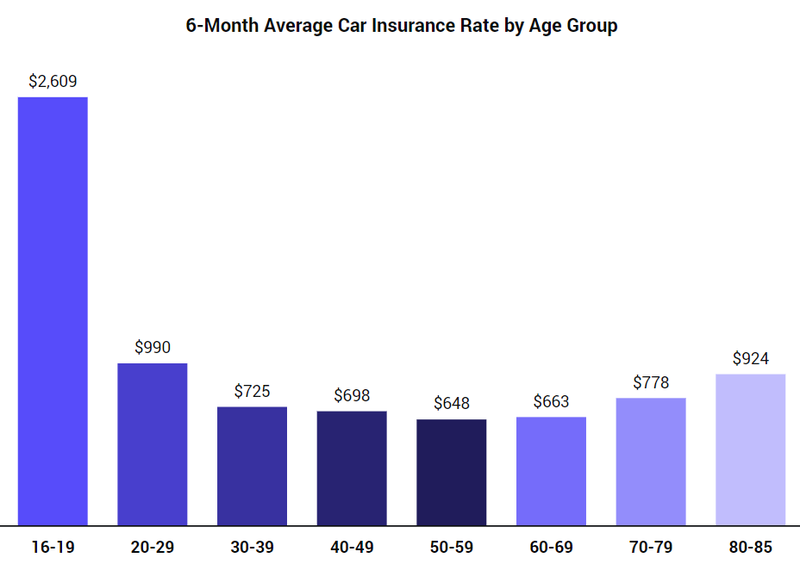

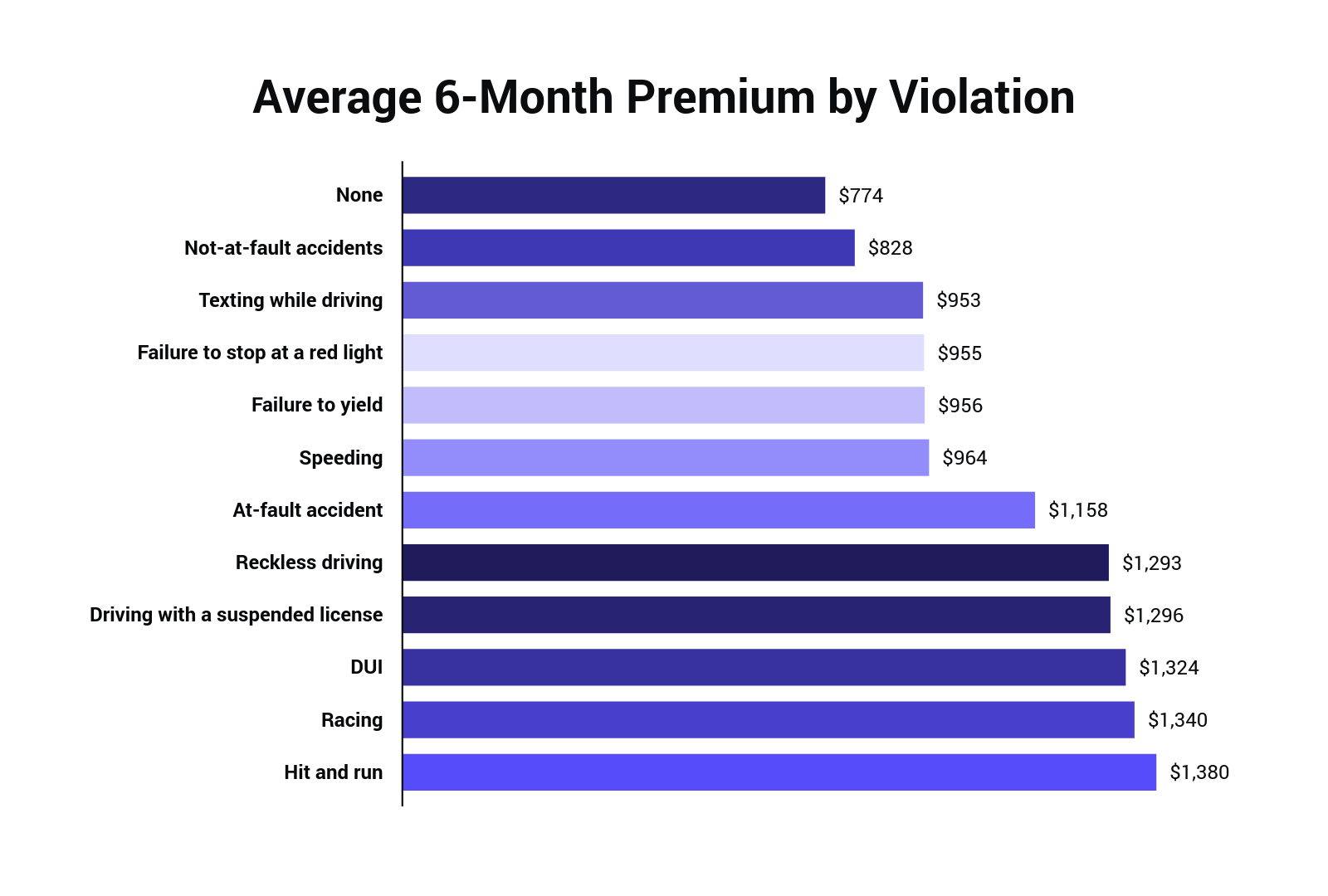

Typical car insurance rates. Because most insurance providers will charge you for three years after an accident this 767 increase equates to more than 2 301 in total fees. On average an at fault property damage accident will raise your premium by an average of 767 per year. We examined the average cost of car insurance by state to help drivers estimate how much they should be paying for coverage. The insurance prices are the lowest for drivers in their fifties.

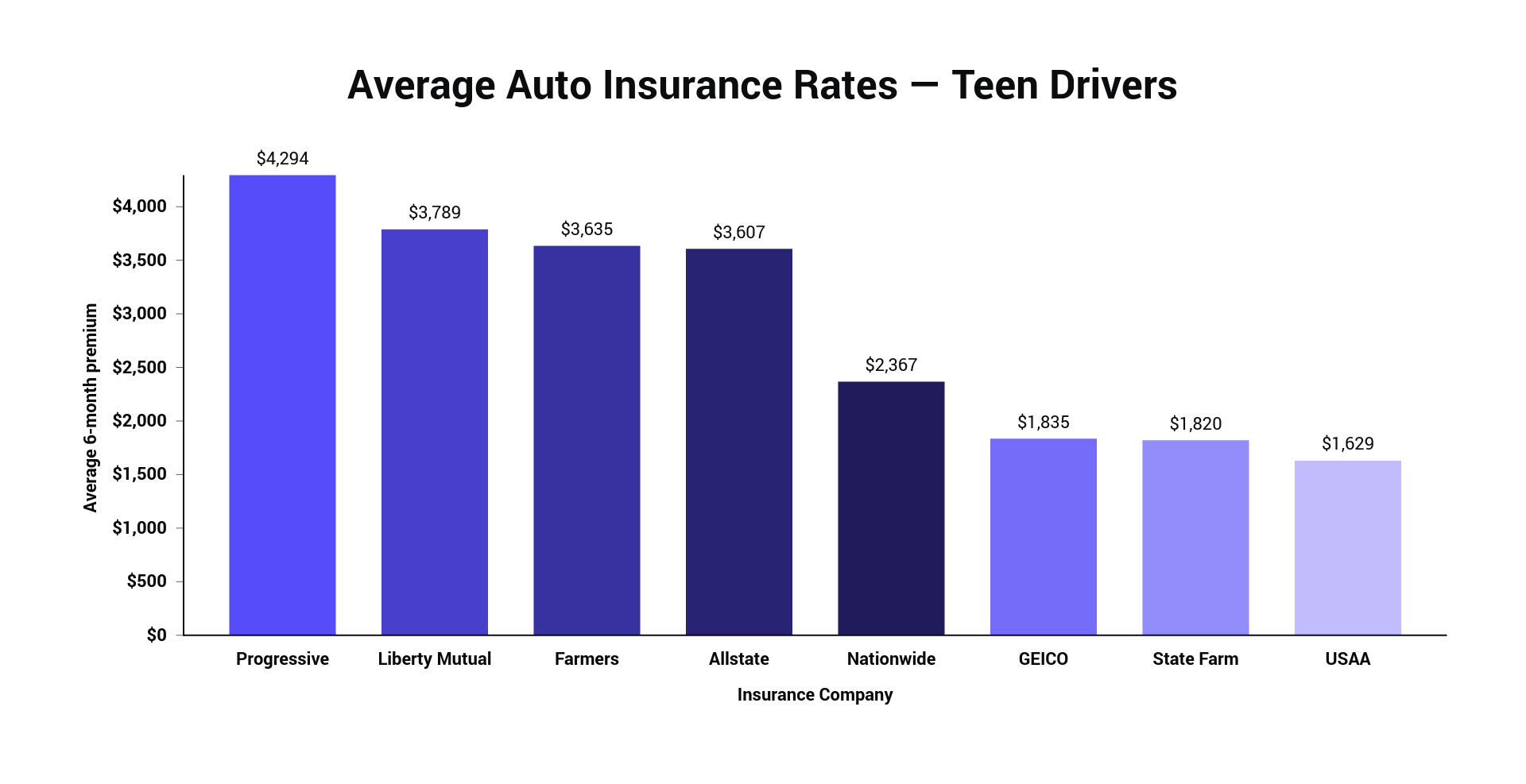

The difference between the highest and lowest rate is what you can save if you shop around for coverage. The rates vary significantly based on a driver s age. State required insurance minimums can also raise or lower insurance costs. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums.

The difference between the highest and lowest rate is what you can save if you shop around for coverage. National average car insurance rates. Our average car insurance rates tool above lets you compare auto insurance rates by zip code. Average car insurance rates by age and gender for the early 20s when you hit your 20s your rates start to drop but you ll still pay more than most drivers until you reach age 26.

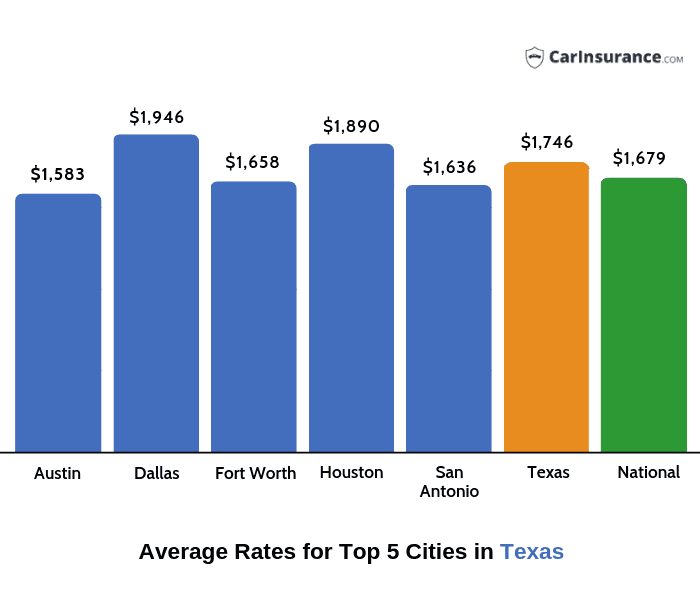

Continue reading for some important considerations to keep in mind when comparing your car insurance. Once a person hits their late seventies the rates will start increasing again. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. Average cost of car insurance is 1 758 per year but every driver will pay a different rate places with a higher population density lower incomes and a large percentage of uninsured drivers will have a higher average car insurance cost because the likelihood of filing a claim is higher.

Our average car insurance rates tool above lets you compare auto insurance rates by zip code. Because car insurance rates are based on individual factors your car insurance rates will differ from the rates shown here. Below you ll find average car insurance cost by age for several common coverage sets for the time when your teen years are in the rear view mirror but much cheaper rates are still a bit further down the road. Based on reported rates from several state governing insurance departments and information from organizations such as the national association of insurance commissioners the national car insurance average rate is just above 900 per year of coverage.

Insurance requirements affect rates even though we ll be looking at average car insurance rates from across the united states it s important to keep in mind that each state has its own laws and requirements to regulate the insurance industry and establish minimum. At fault accidents and car insurance rates. Average car insurance rates explained.