Secured Business Line Of Credit

There are two wells fargo secured business lines of credit.

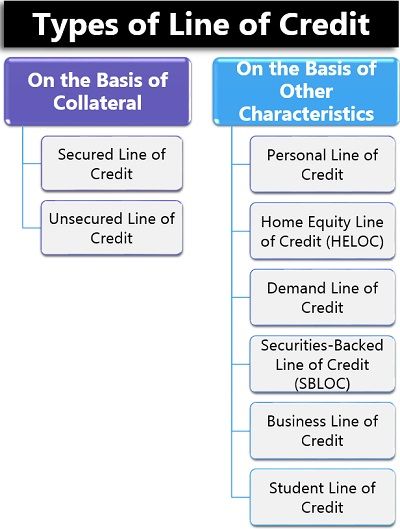

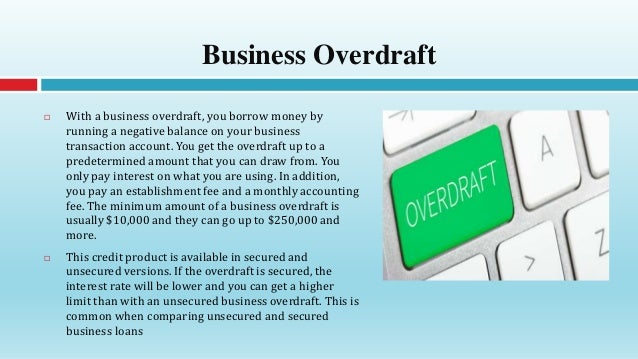

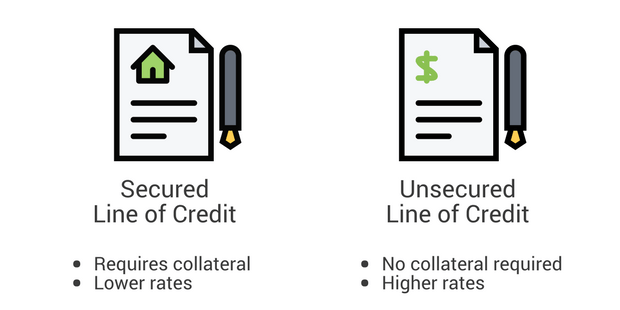

Secured business line of credit. Non real estate business assets are provided by the borrower as collateral for the secured line of credit. Since the secured businessline account is collateralized the interest rate will be lower than a comparable unsecured line of credit. Business line of credit and term loan interest rate discounts are available to business applicants and co applicants who are enrolled in the program at the time of line of credit or term loan application for a new credit facility excludes specialty lending products that receive customized pricing. Unsecured lines of credit.

The business line or prime line. The amount of collateral pledged will determine the credit amount. The advantages of secured lines of credit are higher credit limits and lower interest rates but your asset could be repossessed. In general an unsecured line of credit is going to carry higher borrowing costs but it may be your best option compared with high interest credit cards or small business loans.

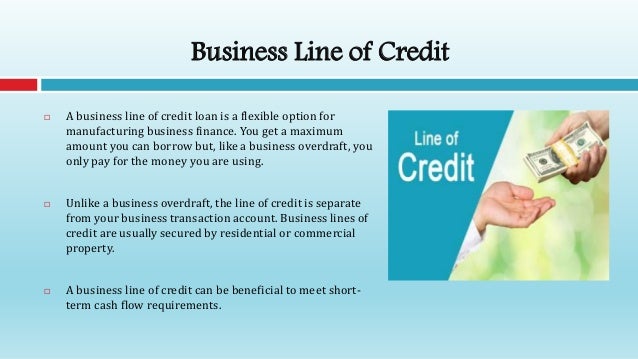

A business line of credit can be secured or unsecured depending on whether collateral is required when applying. Business lines of credit can be secured or unsecured depending on whether any collateral is backing the credit line. Secured lines of credit are a great option if you need short term working capital to cover business needs such as gaps in accounts receivable collections or inventory purchases. It is a revolving loan similar to a credit card.

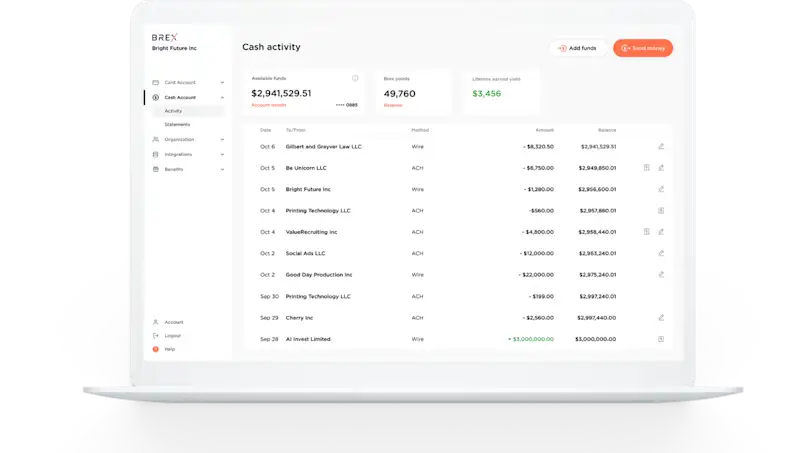

While the business line may be suited for relatively new businesses or those rebuilding business credit with amounts between 5 000 and 100 000 the prime line is designed for established businesses with 2 million to 5 million in annual revenue. A line of credit loc is an open ended loan that can be used for any purpose.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-FINAL-b923e17560394229b556ae9adec6f507.png)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)