Va Loan Assumption Rules

The va lender s handbook va pamphlet 26 7 discusses who is eligible to apply for a va mortgage refinance loan construction loan etc.

Va loan assumption rules. The va loan rulebook makes it clear that the va loan benefit is specifically tied to the veteran. A 12 digit va loan identification number lin is assigned to each loan by va at the time the appraisal is requested. In a typical purchase transaction the buyer is getting a mortgage loan to purchase the home and the seller is using the proceeds of the sale to repay their loan in full shifting the financial obligation for the property solely to the new owner. 7 processing loan assumptions 5 22.

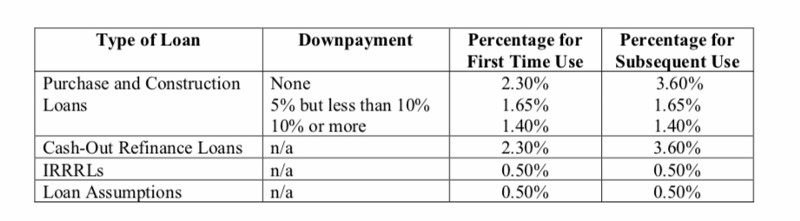

Most times the spouse becomes the buyer. Va loan assumption rules for mortgages approved before or after march 1 1988 for va loans approved before march 1 1988 they can be assumed by buyers without prior approval from the lender or va. Loan assumptions or transfers allow the loan to be assumed by a purchaser if the veteran wants to sell the property. If they agree your mortgage lender will need to make sure your income and credit qualifies based on va standards.

The lender and or the va needs to approve a loan assumption. At one time all homes purchased with a va loan were considered assumable but since then the rules have changed. How to process va loans and submit them to va 5 2 1. The loan assumption however does not automatically release the owner in this case you from any liability from the mortgage.

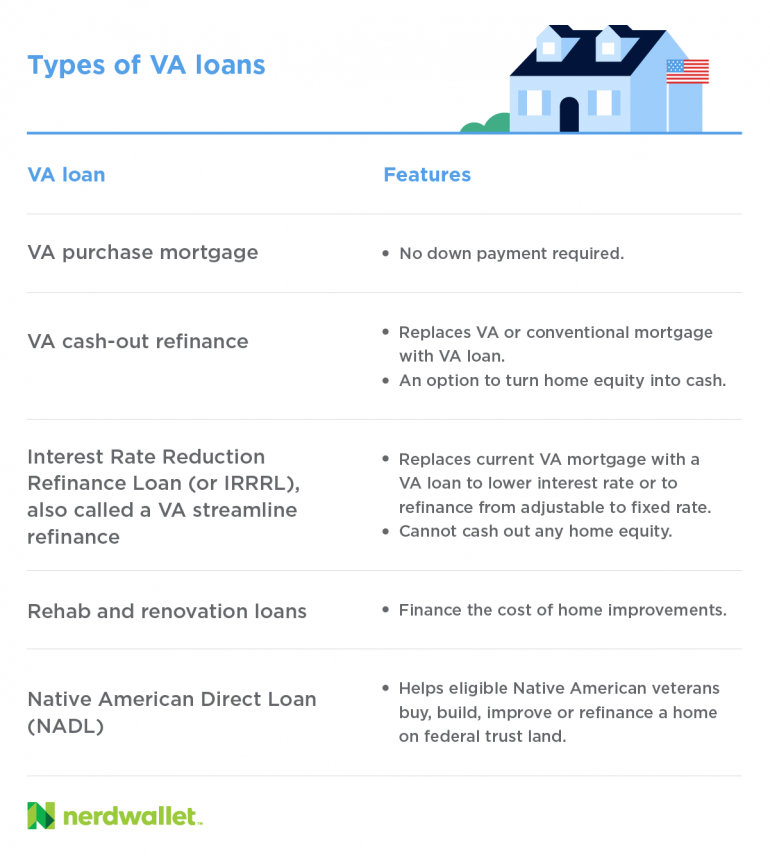

In some cases a va loan may be assumable that is the buyer can take over the va loan regardless of whether they are civilian or military. It is true that va loans are assumable but the borrower is required to work with the lender and or get va approval for the transaction as instructed in va pamphlet 26 7. Transfers of ownership on properties securing loans for which commitments were made on or after march 1 1988 must have the prior approval of the loan holder or its authorized servicing agent if either of them have. Lenders and or the va need to approve a loan assumption.

Va loan rules permit an otherwise eligible va borrower to apply for a new va mortgage loan in the wake of a prior va loan assumption under certain conditions. Va home loan rules for va loan eligibility. If a loan is transferred to another qualified va loan beneficiary their entitlement takes over provided a substitution of entitlement soe is obtained. Unfortunately one of the va rules is that you have to live in the home.

Potential va loan assumption challenges. The veteran does not need approval of either the lender or the va to do this.

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)