Refinance Student Loans Lowest Interest Rate

Also check for hidden fees including application fees and late fees.

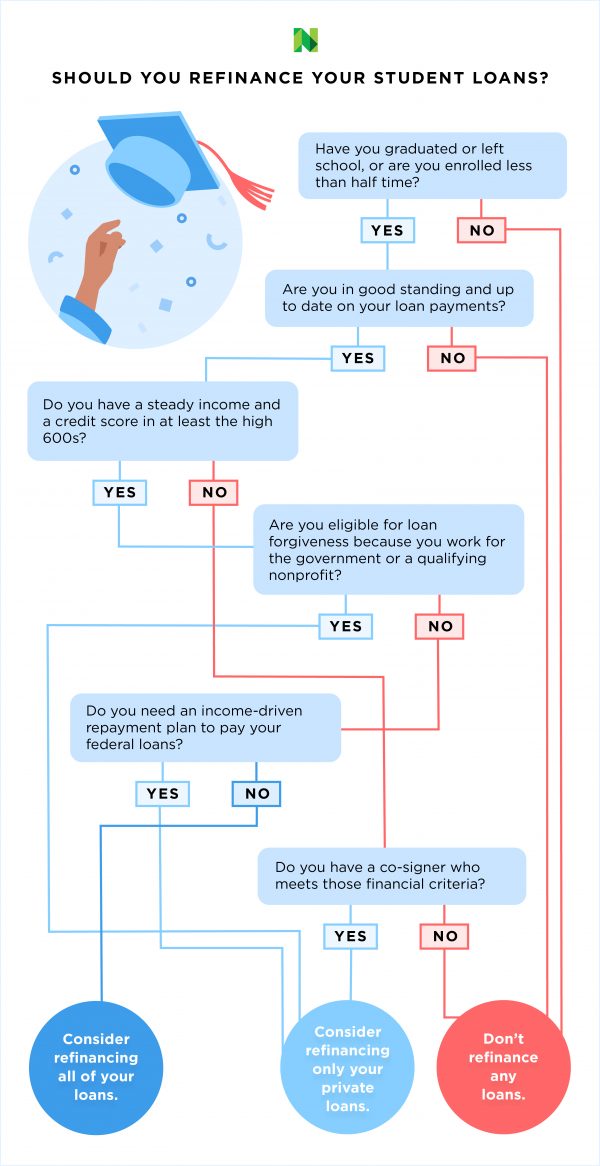

Refinance student loans lowest interest rate. If you refinance your student loans and get a 3 interest rate and 10 year repayment term you can lower your monthly payment by 198 per month and save 23 776 total over the life of your student. Federal interest rates for graduate or professional students direct unsubsidized loans is 4 30 while for parents direct plus loans the rate is 5 30. Refinance your student loans with today s low interest rates. Private student loan interest rates have.

Many people who refinance their student debt repay their student loans faster or use the money they save for other big purchases. For variable rate student loans the rate will never exceed 9 00 for 5 year and 8 year loans and 10 00 for 12 and 15 years loans the maximum allowable for this loan. On 30 000 of student loan debt for instance a 5 interest rate would save you 30 a month and more than 3 600 over 10 years compared with a 7 interest rate. For example let s assume you have 70 000 of student loans at an 8 0 interest rate.

After the federal reserve cut interest rates three times in 2019 and then again unexpectedly last week rates for student loan refinancing are among the most competitive they ve been in years. For variable rate loans although the interest rate will vary after you are approved the interest rate will never exceed 8 95 for loan terms 10 years or less. For loan terms of 10 years to 15 years the interest rate will never exceed 9 95. This student loan refinance calculator shows you how much money you can save when you refinance student loans.

Make sure to compare student loan refinancing companies in terms of their interest rates and repayment terms. For variable rate loans although the interest rate will vary after you are approved the interest rate will never exceed 8 95 for loan terms 10 years or less. For loan terms of 10 years to 15 years the interest rate will never exceed 9 95.

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)