Va Home Morgage

In contrast loan providers who choose to make nonconforming loans are exercising a greater threat tolerance and do so knowing that they deal with more obstacle in marketing the loan.

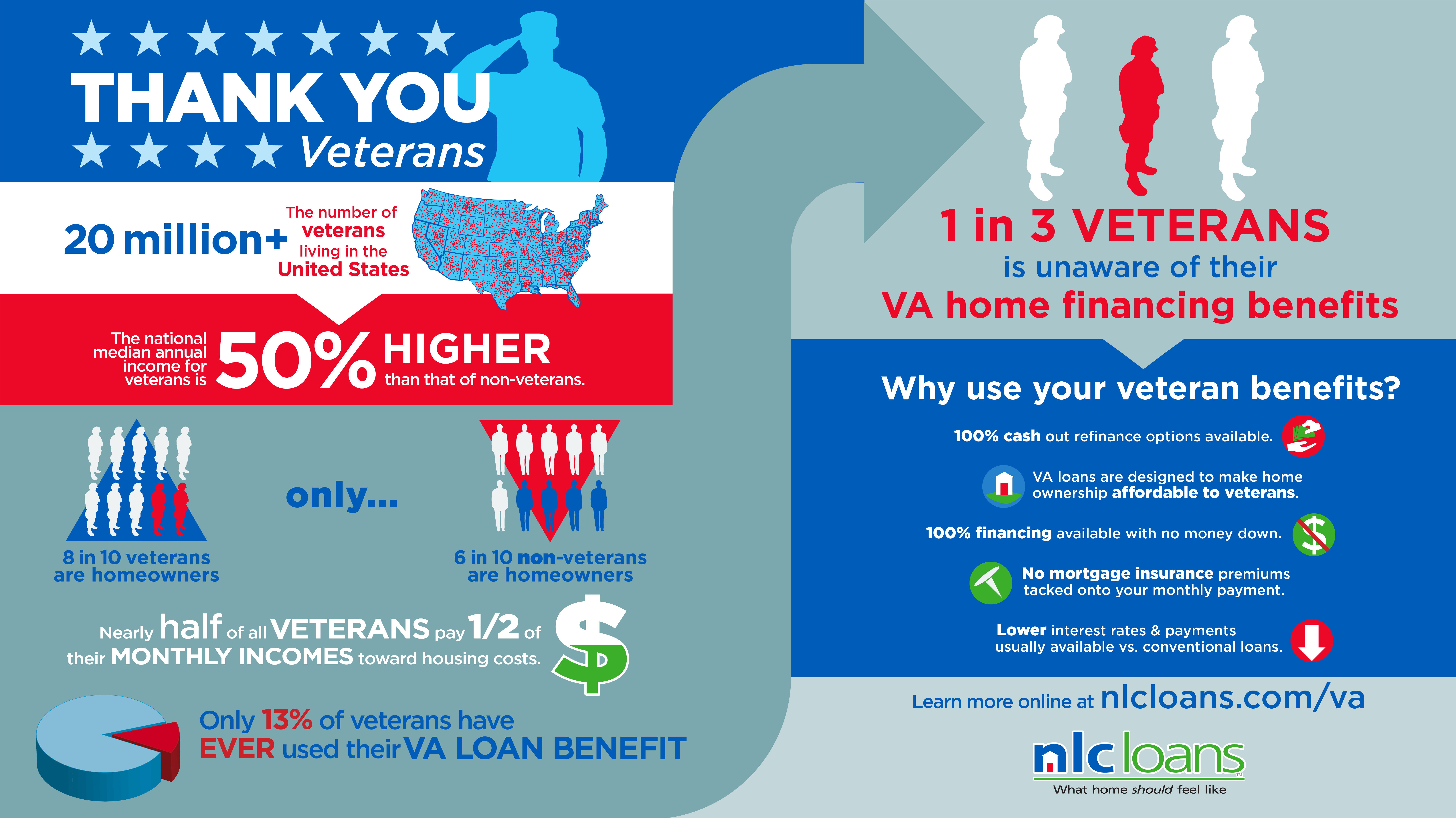

Va home morgage. Use our free va mortgage calculator to quickly estimate what your new home will cost. Va direct and va backed veterans home loans can help veterans service members and their survivors to buy build improve or refinance a home. Included are options for considering property tax insurance fees and extra payments. While the va does not lend money for va loans it backs loans made by private lenders banks savings and loans or mortgage companies to veterans active military personnel and military spouses who qualify.

A va loan is a mortgage loan that s backed by the department of veterans affairs va for those who have served or are presently serving in the u s. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs. Department of veterans affairs or va. Free va mortgage calculator to find the monthly payment total interest funding fee and amortization details of a va loan or to learn more about va loans.

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries. Also explore other calculators covering mortgage finance math fitness health and many more. We offer va home loan programs to help you buy build or improve a home or refinance your current home loan including a va direct loan and va backed loans. When considering whether to refinance be wary of any unsolicited va loan refinancing offers that sound too good to be true.

Learn about our different loan programs and how to apply. The home must be for your own personal occupancy. Va home loans are mortgages that are partially backed by the u s. One of the most common home loan in canada is the five year fixed rate shut home loan as opposed to the u s.

As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy. Includes va loan limits taxes insurance and the latest mortgage rates. Refinance a non va loan into a va backed loan. Va loan refinance rates.

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)