Timeshare Securitization

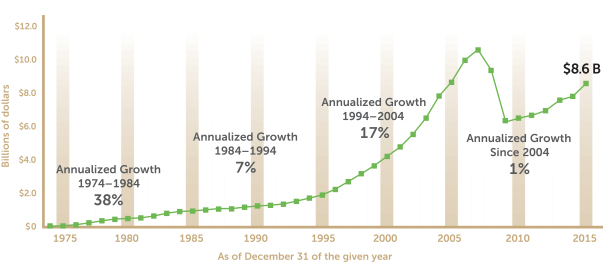

Bonds backed by vacation ownership interval loans performed consistently through the financial crisis helped by strong credit enhancement and today s investors have the benefit of more granular data available on.

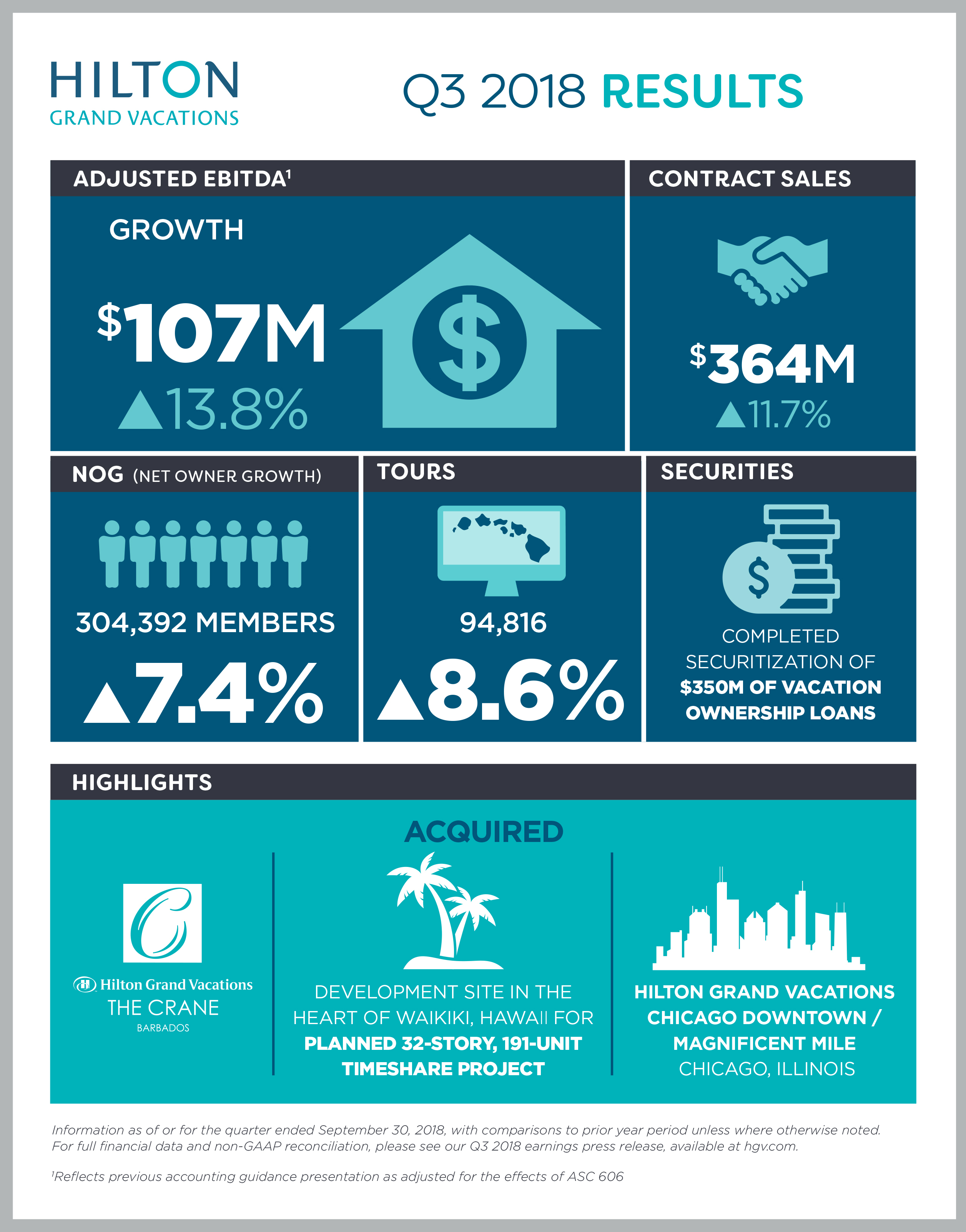

Timeshare securitization. Westgate resorts announced today that it has completed a securitization through westgate resorts 2020 llc the issuer for the issuance of 275 000 000 of timeshare loans to 22 different investors. The transaction collateralized by 13 810 loans with a total balance of 349 5 million is the first for hilton since august 2019 and the second timeshare abs for 2020. Orlando fla july 15 2020 prnewswire westgate resorts announced today that it has completed a securitization through westgate resorts 2020 llc the issuer for the issuance of. Orlando fla may 1 2018 prnewswire on april 23 2018 westgate resorts completed a securitization through westgate resorts 2018 1 llc the issuer in connection with the securitization.

Access our most recent ratings actions. Wyndham destinations sponsored a 325 million securitization that closed may 1. Latest structured finance research see all research insights. The deal was increased by 175m.

With consumer spending on the rise and investors warming to more esoteric assets timeshare operators are increasingly turning to the securitization market to finance loans. Sierra timeshare 2019 2 receivables funding llc issued approximately 188 million of class a notes approximately 116 million of class b notes approximately 101 million of class c notes and approximately 45 million of. How the european clo market has developed over 180 days of covid 19. Wyndham destinations inc.

This transaction was our largest term securitization since 2007 sierra timeshare 2020 2 receivables funding llc is an indirect subsidiary of wyndham destinations. The transaction was completed in reliance upon rule 144a and regulation s as a placement of securities not registered under the securities act of 1933 as amended or any state securities law. Equiant a chandler arizona based loan servicer and financial technology provider has been selected to provide back up servicing and document custody services for the july securitization of 275 million in timeshare loans by westgate resorts an orlando based timeshare resort developer and operator with 29 resorts in 10 states.