Understanding Homeowners Insurance Coverage

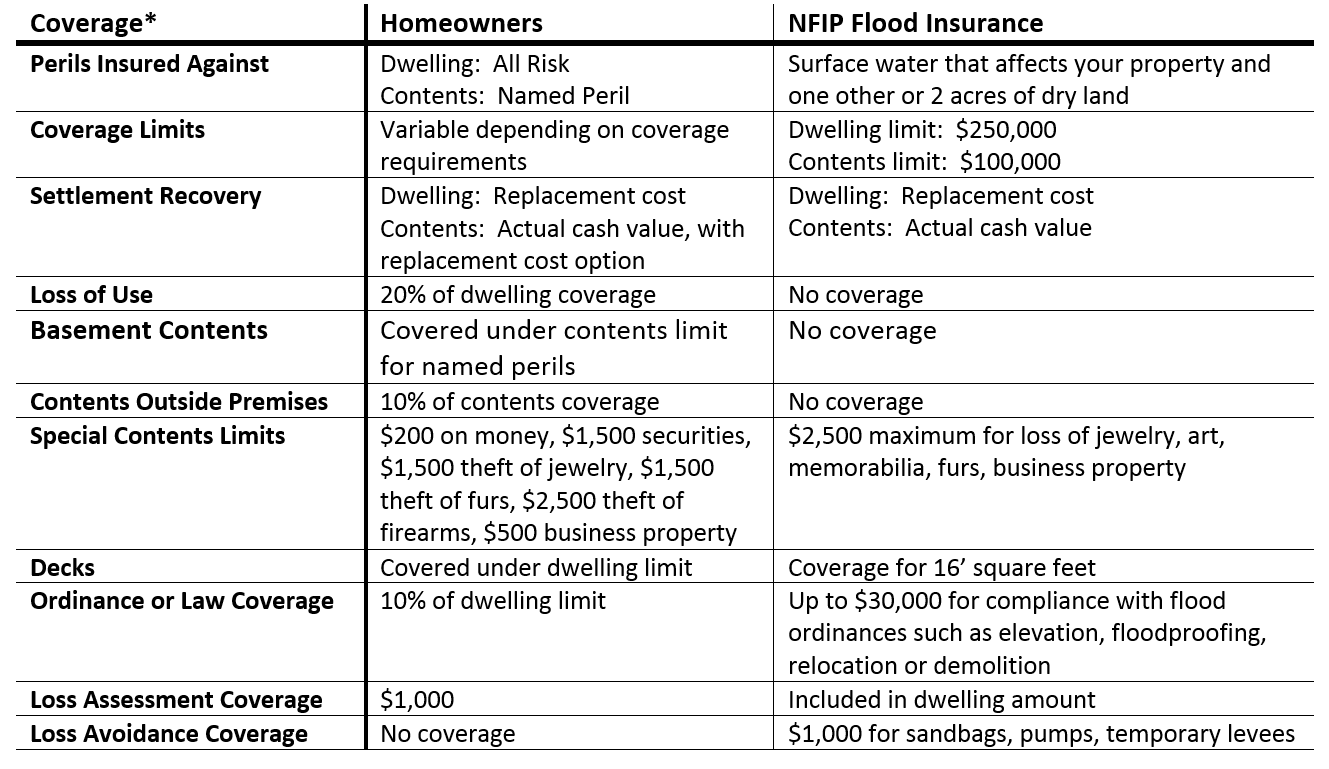

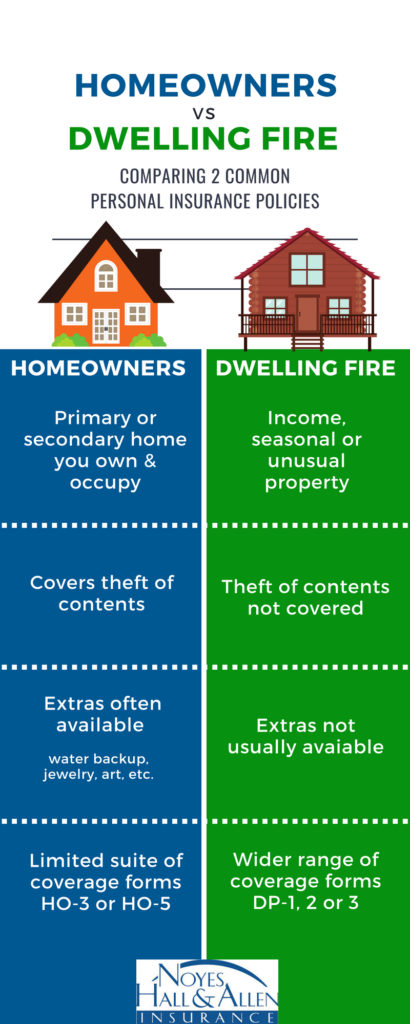

Homeowners insurance comes in several types called policy forms some types provide more expansive coverage than others so it s worthwhile to know the difference.

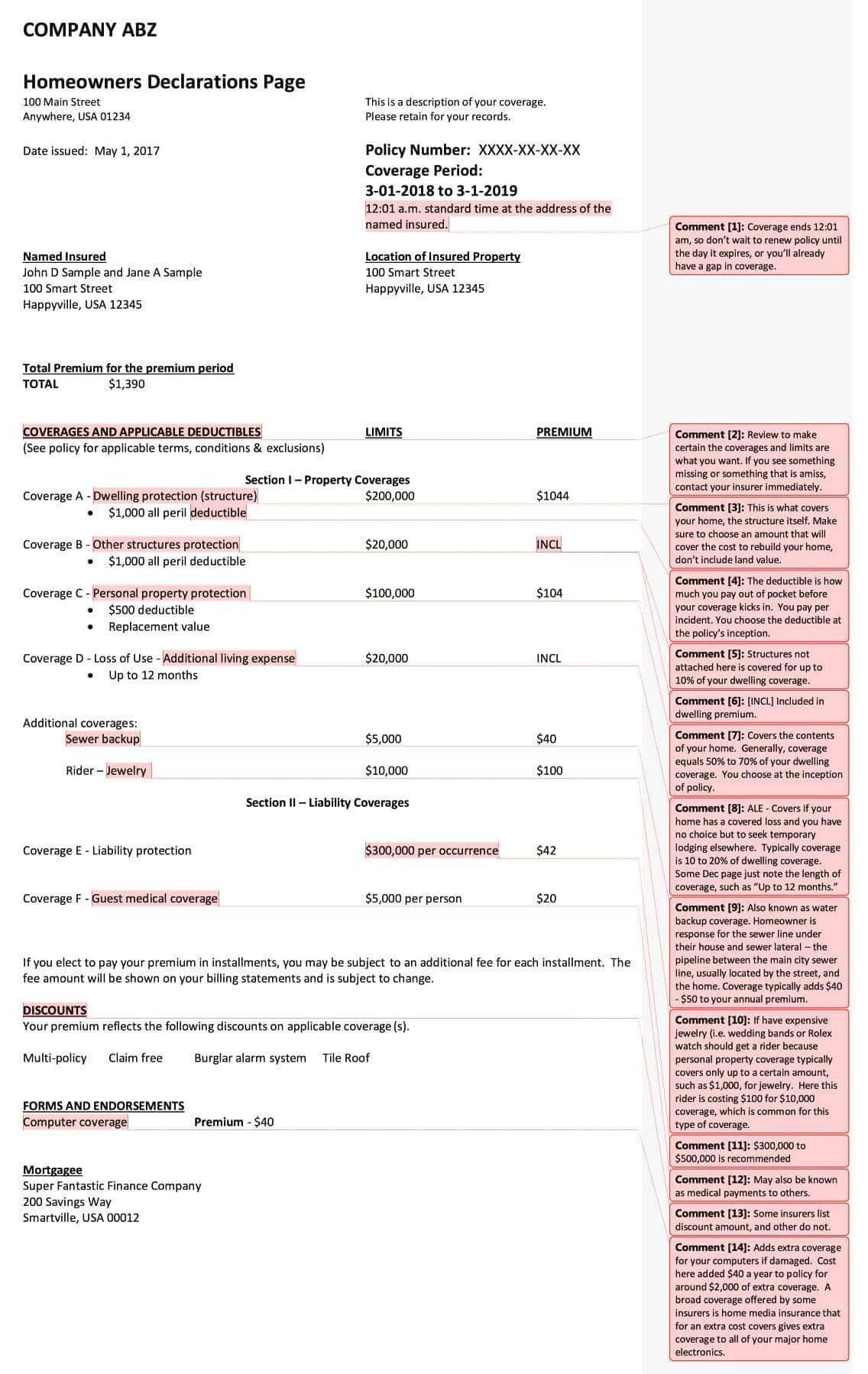

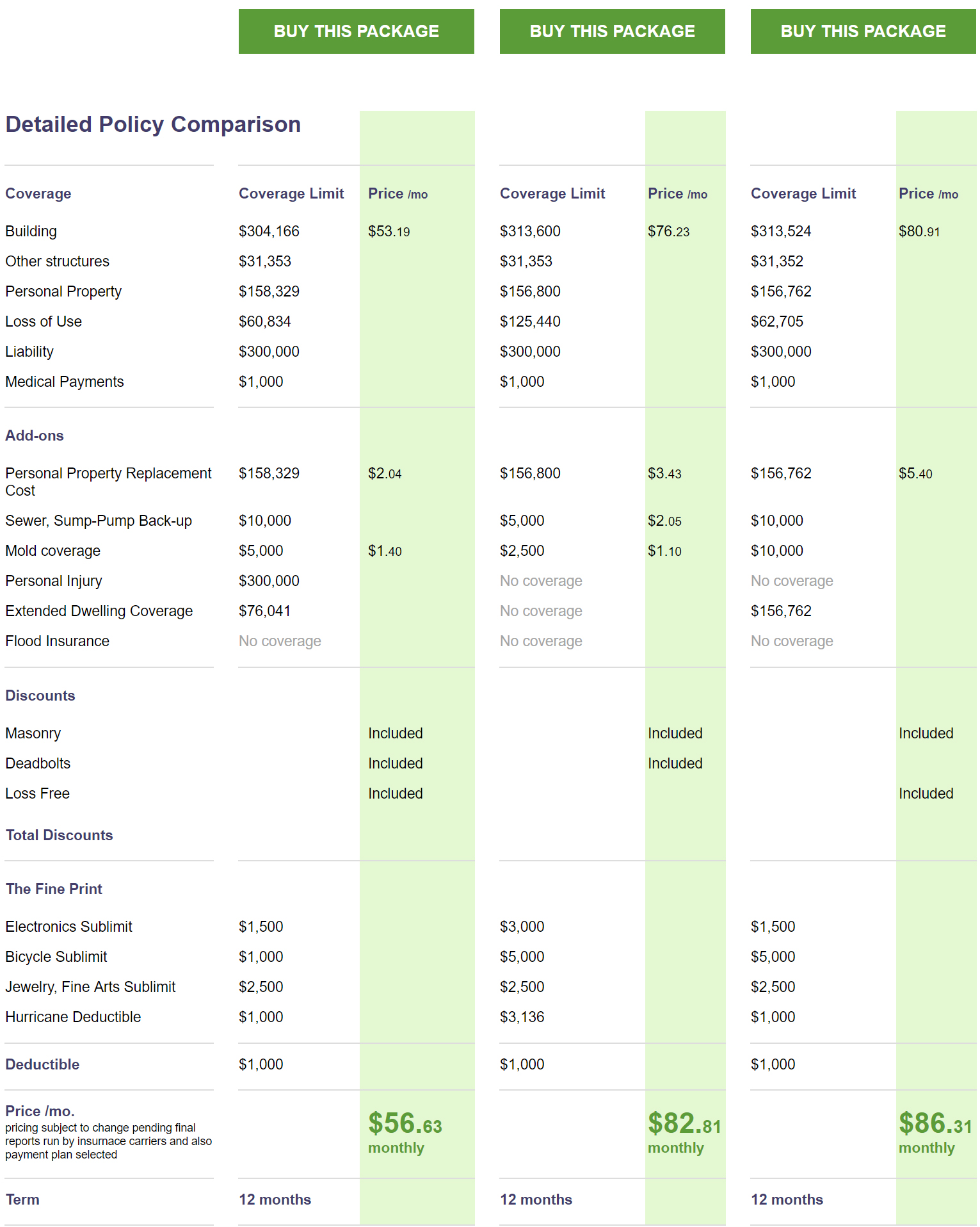

Understanding homeowners insurance coverage. When shopping for insurance it is important to understand what you are getting when you purchase a homeowners insurance policy some people decide to buy insurance online by using popular online insurance quote websites and some stay with a local agent. The general insurance coverage offered to you is often defined by the type of policy form used. Attractive nuisances can lead to expensive injuries and pricey lawsuits. For example there s the homeowners broad form ho 2 homeowners special form ho 3 and the homeowners comprehensive form ho 5.

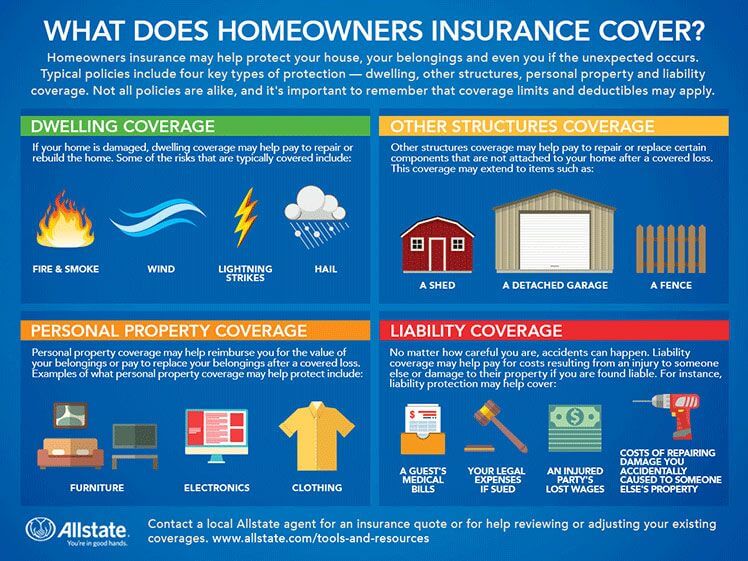

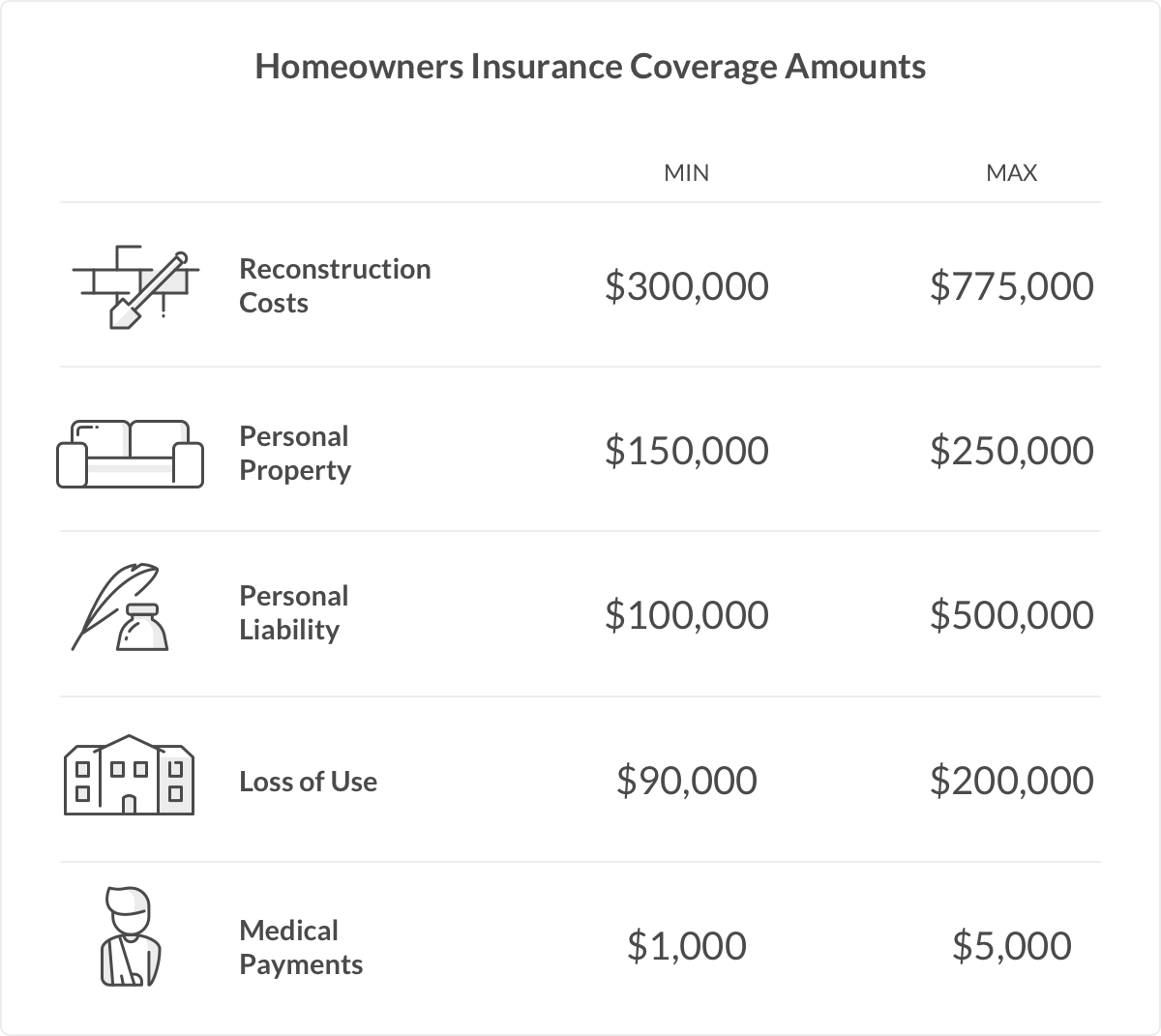

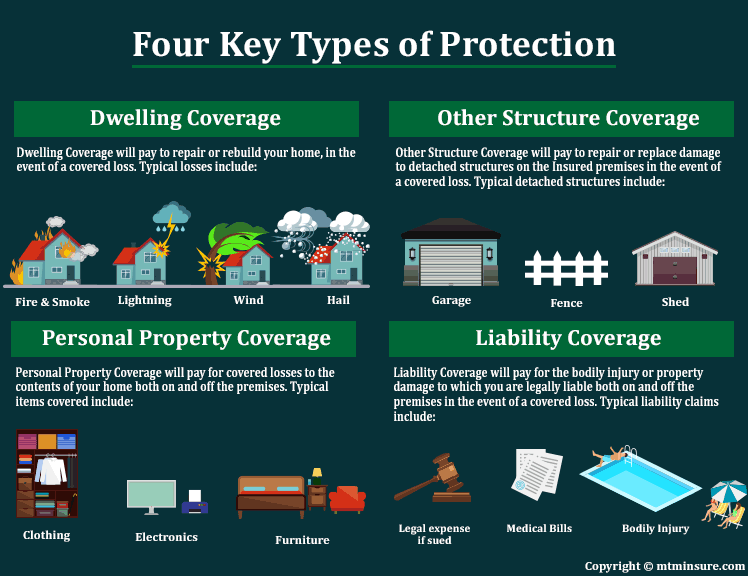

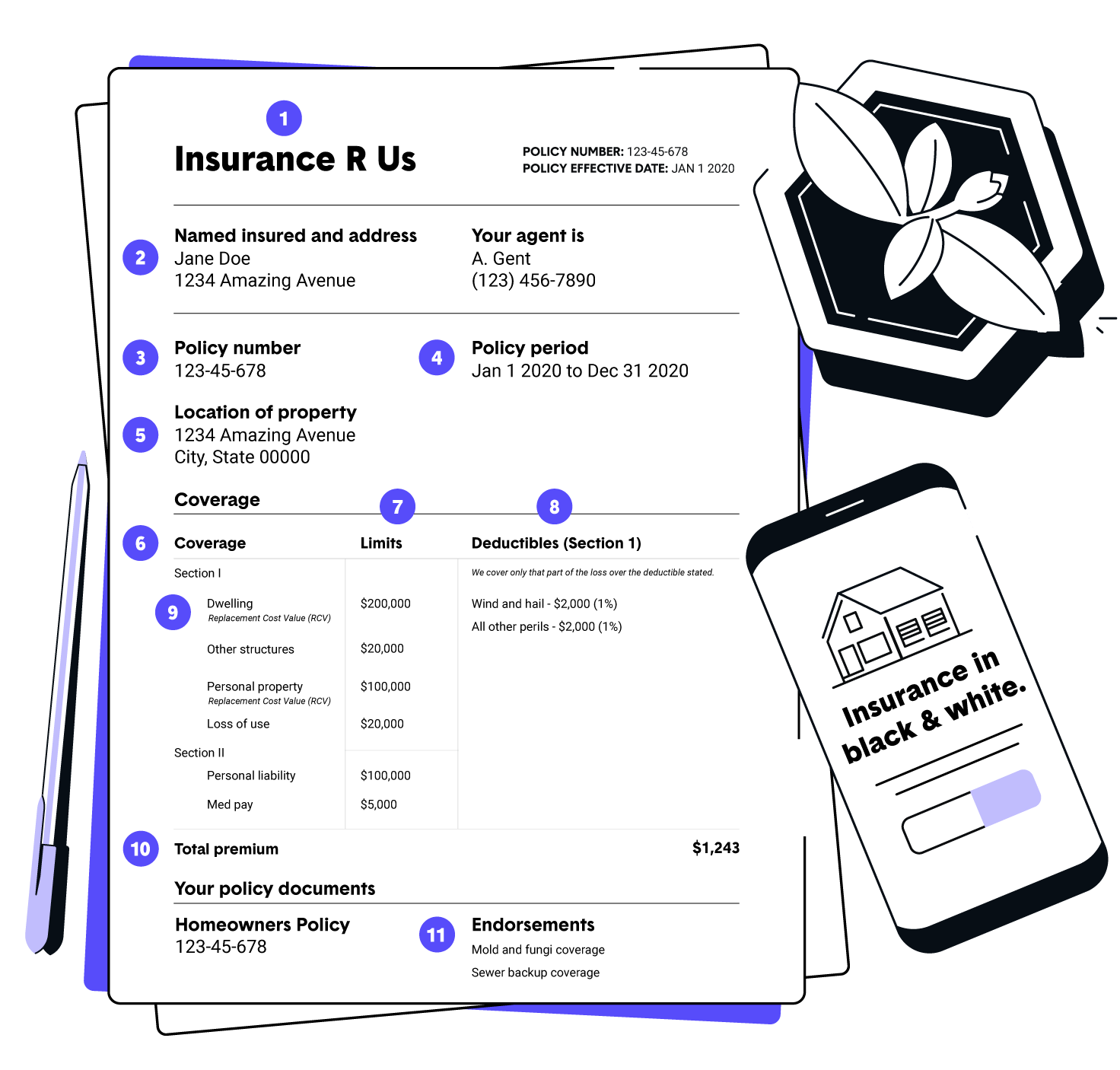

To cover this you need to purchase the following optional auto insurance coverages. Geber86 getty images. According to the insurance information institute iii most basic home insurance policies have some level of coverage for the structure of your home your personal belongings liability and additional living expenses. Overview of your property coverage.

Understanding your personal liability. An item located on a property that is appealing but potentially hazardous especially to children. Advice from insurance experts. Understanding homeowner s insurance options if you re a homeowner your house needs to be insured for a minimum of 80 percent of its value not counting the value of the land.

The basic job of a homeowners policy is to protect your home and possessions from certain perils such as wind hail fire damage and theft. Insurance is something most people don t even want to think about until they need it the most. But understanding what is and isn t covered in your homeowners insurance policy can mean the difference of being able to rebuild your home and replace your personal belongings. Collision this optional coverage reimburses you for damage to your car that occurs as a result of a collision with another vehicle or other object e g a tree or guardrail when you re at fault.

Understand the basics of homeowners insurance. Important definitions for homeowners.