Workmans Comp And Liability Insurance

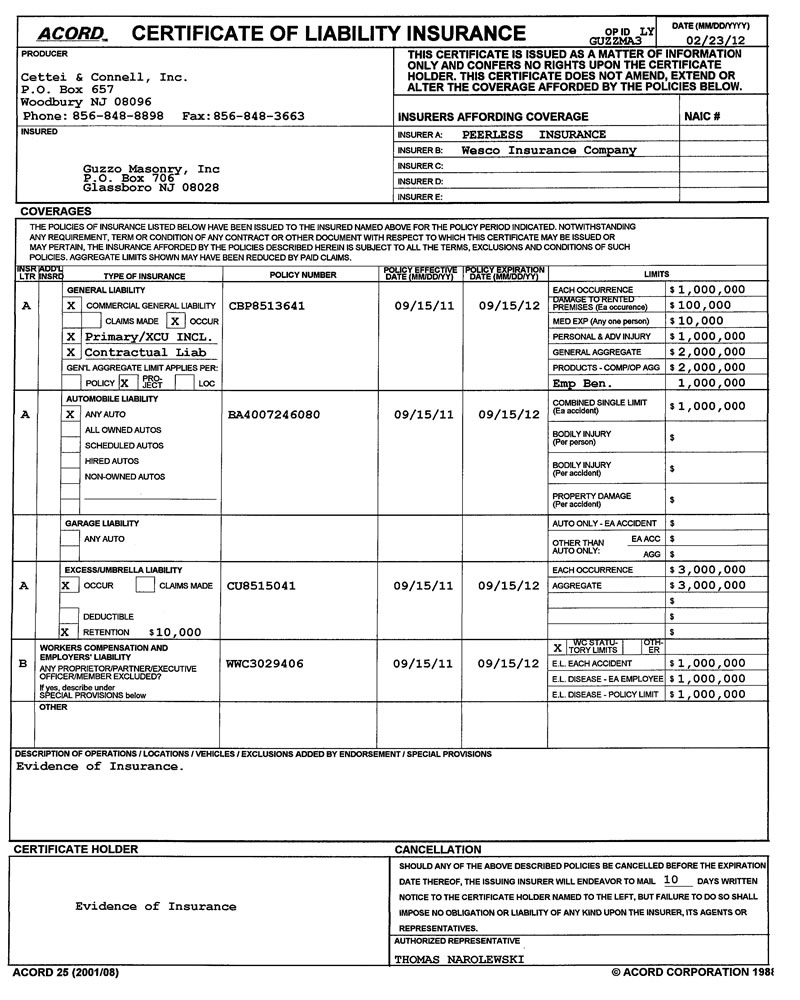

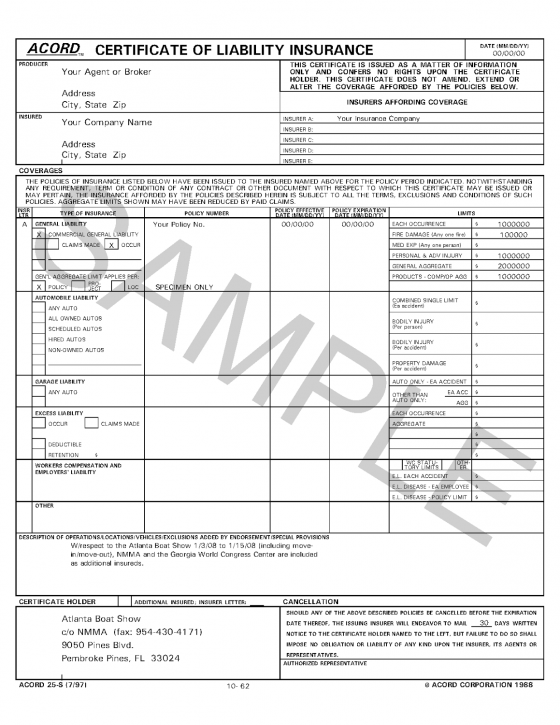

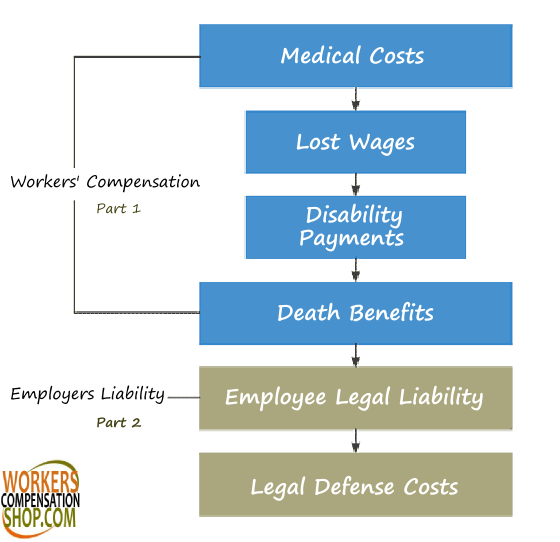

The workers compensation and employers liability insurance policy covers your statutory liability as an employer under state workers compensation laws.

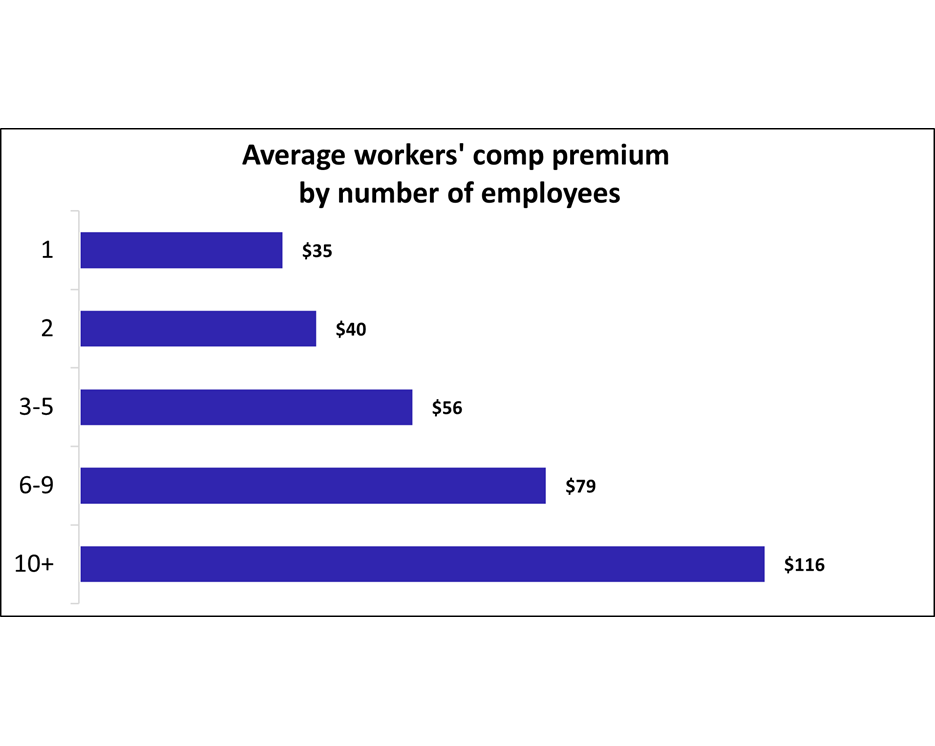

Workmans comp and liability insurance. Workers compensation or workers comp formerly workmen s compensation until the name was changed to make it gender neutral is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee s right to sue his or her employer for the tort of negligence. Learn the difference and ensure your business is protected. It pays for medical treatment because of injuries and indemnity payments for employees disabled by work related accidents. Who needs to be insured.

Check a claim status. General liability protects you when a client breaks an ankle on your property and sues for medical expenses. Workers compensation insurance from allianz workers compensation operates under complex state based legislation that can make understanding your obligations and managing your claims difficult. Icare insures more than 284 000 nsw employers and their 3 4 million employees.

With more than 32 billion in assets we are one of the largest insurance providers in australia. Our expert team understands the complexities of workers compensation and will support your business and injured workers through the claims management process. Both policies may be required for construction professionals. Includes who needs to be insured what to look out for in contracts who should pay and when to notify mom about insurance.

Work injury compensation insurance. This coverage can include rehabilitation services and death benefits too. Workers comp and the different protections each insurance provides. How to check the status of a work injury claim by sms online by phone or in person.

Workers comp steps in when your employee breaks an ankle while working and makes a claim for coverage. All employees doing manual work regardless of salary level. Understand general liability vs. Both policies deal with bodily injuries.

If you are an employer you are required to buy work injury compensation insurance for. We would like to show you a description here but the site won t allow us. Workers compensation insurance is also called workman s compensation or workman s comp. All employees doing non manual work earning a salary of 2 100 or less a month excluding any overtime payment bonus payment annual wage supplement productivity incentive payment and any allowance.