Where Can I Open A Traditional Ira

The secure act signed into law on december 20 2019 removed the age limit in which an individual can contribute to an ira.

Where can i open a traditional ira. The easiest way to open schwab ira account is online. A traditional ira is an investment account that offers tax advantaged retirement savings. Under the terms of the secure act of 2019 all retirees can now contribute to traditional iras if they earn income. How much can you put into a roth ira.

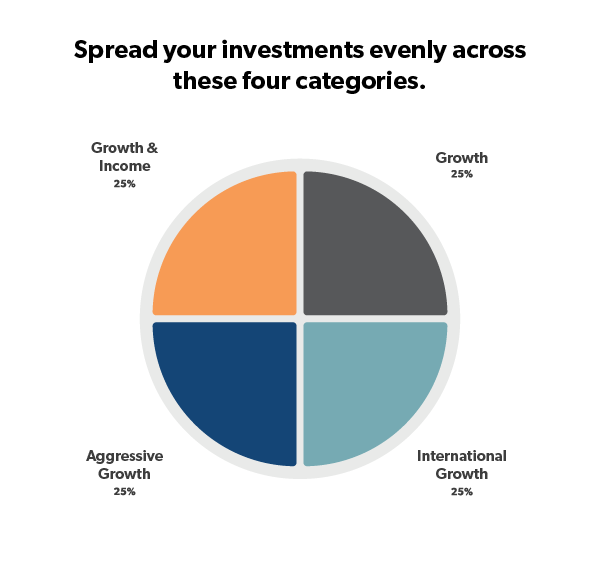

For 2020 the maximum contribution to a roth ira is 6 000 per year but if you re 50 or older that increases to 7 000 per year. Phaseout for traditional ira contribution deduction. Company retirement plans generally have higher contribution limits than either a traditional or a roth ira. Anyone can open a traditional ira but if you or your spouse if you re married contributes to a retirement plan at work then there are income limits that might restrict your ability to deduct.

There is a bit of a. You must be younger than 70 1 2 to open a traditional ira but you can start a roth ira account at any age. Single or head of household. You can also get help opening an account by calling us at 866 855 5636 or visiting one of 300 local branches.

Restrictions on what you can deduct are based on income limits. See this page for income and other limits for both types of iras. The online account application process only takes about 10 minutes. Retirees can continue to contribute earned funds to a roth ira indefinitely.

Depending on your income filing status. Agi limit for full traditional ira contribution deduction. Employee 401 k contributions for 2020 can increase by 500 to 19 500 while the. Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a traditional ira.

/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)

:max_bytes(150000):strip_icc()/IRAproviders-5c42006dc9e77c000173d373.jpg)

/istock512752254.kroach.ira.cropped-5bfc32dac9e77c00519c008c.jpg)

/iras-5bfc31f246e0fb0051bf0553.jpg)