Which Balance Transfer Offer Is Better

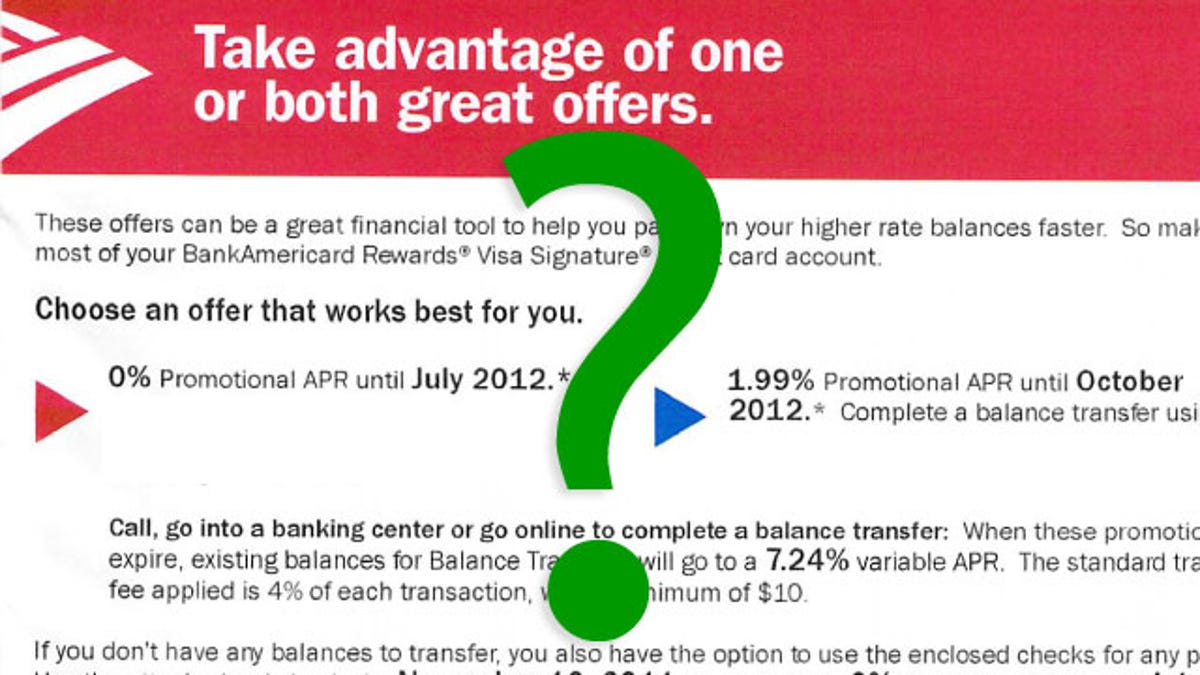

From a bank s perspective balance transfer facilities offer a two pronged advantage.

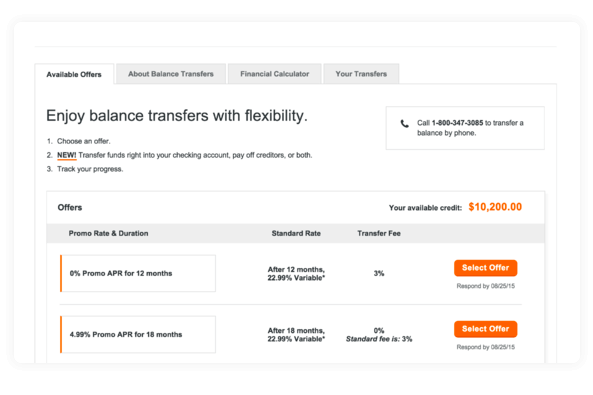

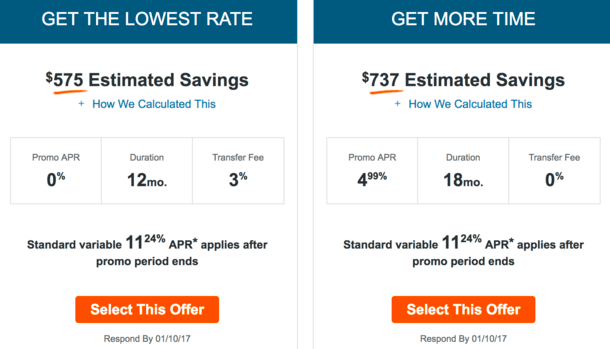

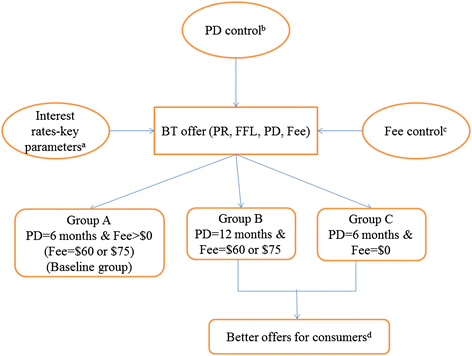

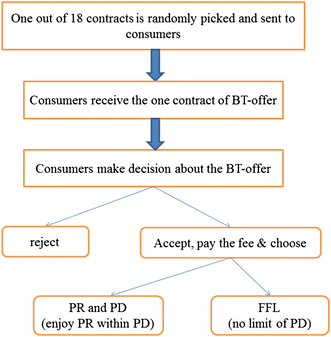

Which balance transfer offer is better. A balance transfer offer of 12 months won t provide you with enough time so you should look for a balance transfer offer with the longest 0 promotional period. But in the meantime balance transfer fees mean that a 0 percent introductory rate is never really 0 percent. Why do banks offer balance transfer. Let s say for example that you receive an offer to do a balance transfer and the credit card company gives you two choices.

Balance transfers can be useful tools that could help you to pay down your credit card debt. After that the apr will be 14 99 to 23 74 variable based on your creditworthiness. Note that the calculator assumes that the balance transfer fee will be added to the balance owed. If the balance transfer offer provides for a 0 percent interest rate for the first 12 months and you have to pay a 5 percent balance transfer fee then you are effectively paying 5 percent on the balance transfer.

0 intro apr on balance transfers for 15 months from the date of the first transfer. So here are some of the best balance transfer offers currently available in canada to help get rid of unwanted credit card debt. This row displays the dollar amount of the balance transfer fee for each entered offer. Just remember with balance transfer offers don t use your credit card to make new purchases once you make your balance transfer.

The calculated result is the balance transfer percentage multiplied by the amount transferred or the balance transfer cap whichever is smaller. On the other hand if you can afford 250 monthly payments then a balance transfer offer of 12 months or more would be ok since you should be able to have it paid off in a year with all of your payments going toward the debt s. You can perform a 24 month transfer to a card with no balance transfer fee but comes with an apr of 4 99. What you should know about balance transfer credit cards.

That s just an extra rm 50 in balance transfer fees and a whopping rm 1 058 less than letting the interest charge compound as per our earlier example.