Self Managed Ira Account

Simplified employee pension sep.

Self managed ira account. A self directed individual retirement account sdira is a type of ira managed by the account owner that can hold a variety of alternative investments. It typically takes just 15. For this purpose we suggest opening self directed brokerage account with ally invest. With a self directed brokerage account you control the buying and selling of securities.

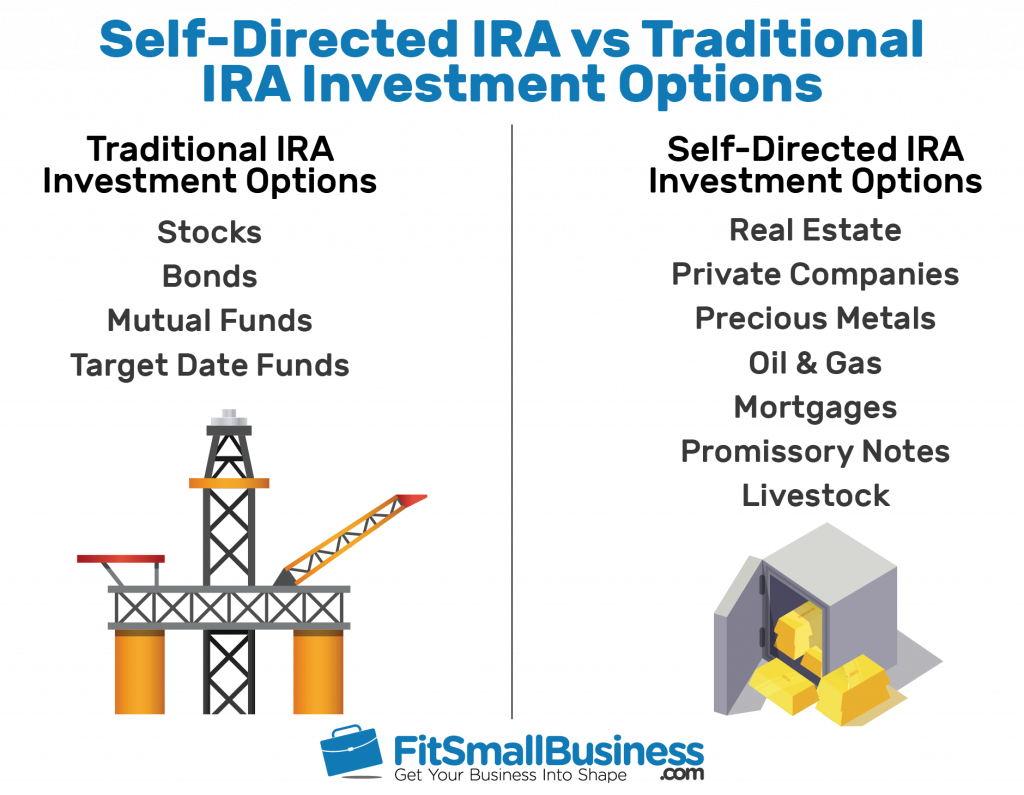

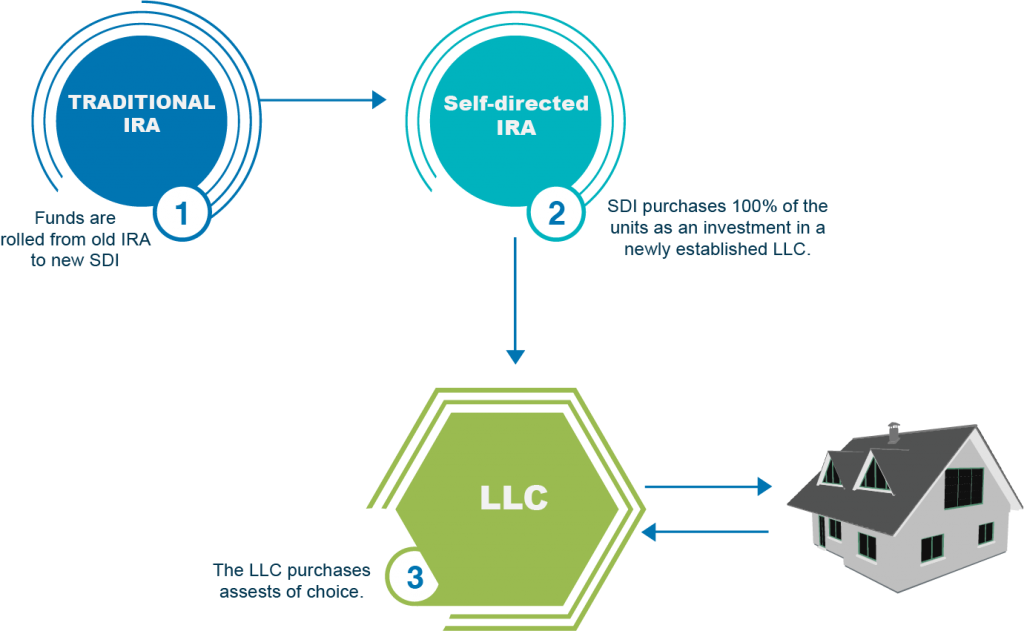

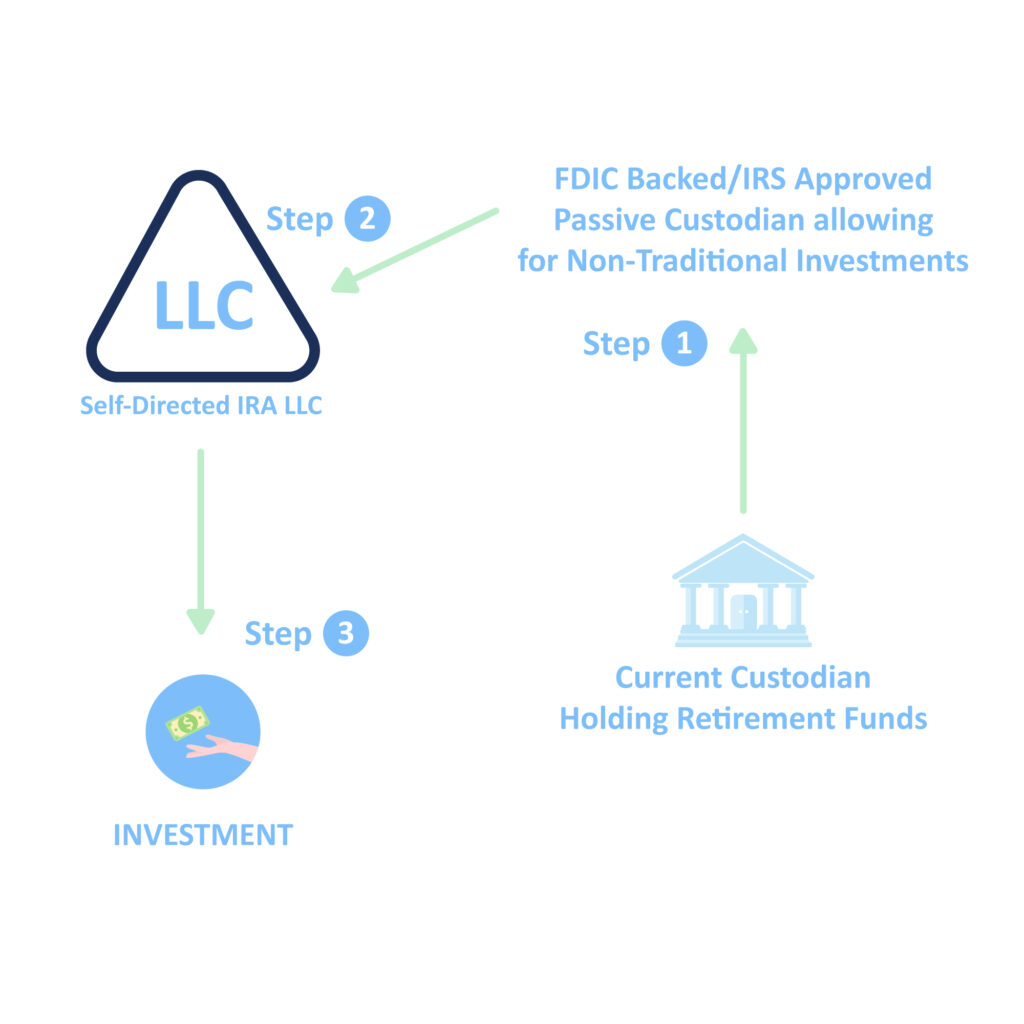

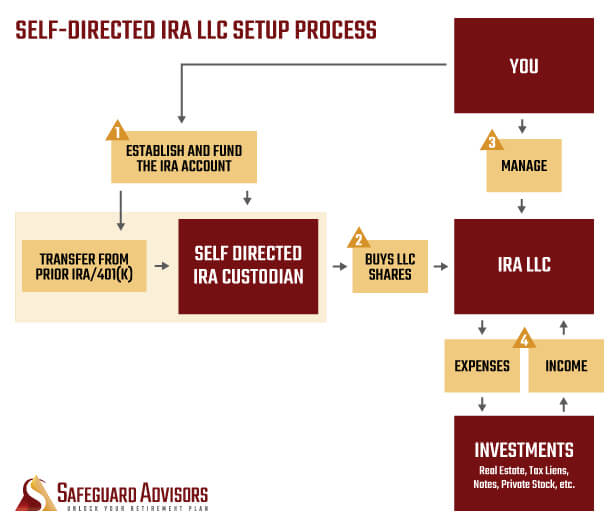

A self directed individual retirement account sdira is a type of ira managed by the account owner that can hold a variety of alternative investments. A self directed ira custodian or facilitator gives you the freedom to direct your own investments in stocks and bonds as well as alternative assets like real estate private equity and precious metals. Some examples of these alternative investments are. Real estate private mortgages private company stock oil and gas limited partnerships precious metals horses and intellectual.

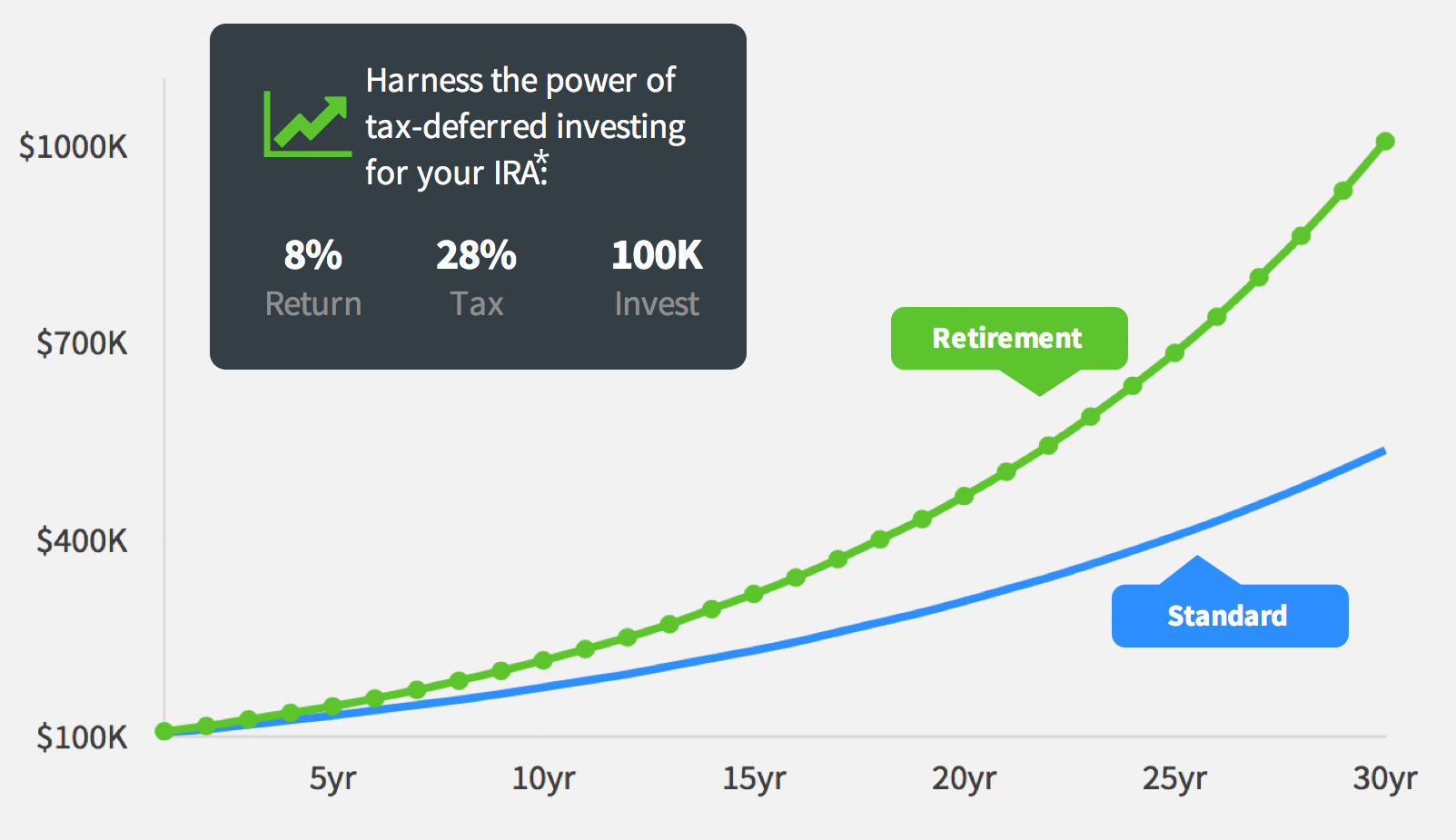

Fund your brokerage account. A self directed ira is a type of traditional or roth ira which means it allows you to save for retirement on a tax advantaged basis and has the same ira contribution limits. An individual retirement account or ira is one of the best places to save for retirement the tax benefits can give your savings a nice lift. It s not uncommon for people to have actively managed ira accounts that is paying a professional to manage their accounts for them.

If you are looking to invest for your retirement then what you need is no ira fees low commissions and large established brokerage firm for self directed account. That makes a lot of sense if you know close to nothing about investing. For a buy and hold investor who does not make a significant number of trades a managed account could be more expensive than a self directed brokerage account where fees are typically charged based on transactions. A self directed ira allows investors to hold unique and varied investment options inside a retirement account.

Unlike traditional iras or roth iras which often consist of stocks and bonds a self. A self directed individual retirement account is an individual retirement account ira provided by some financial institutions in the united states which allows alternative investments for retirement savings. The complete guide to the roth ira.