Tax Credit For College Students

Tax information for students including education credits paying for college and the free application for federal student aid fafsa.

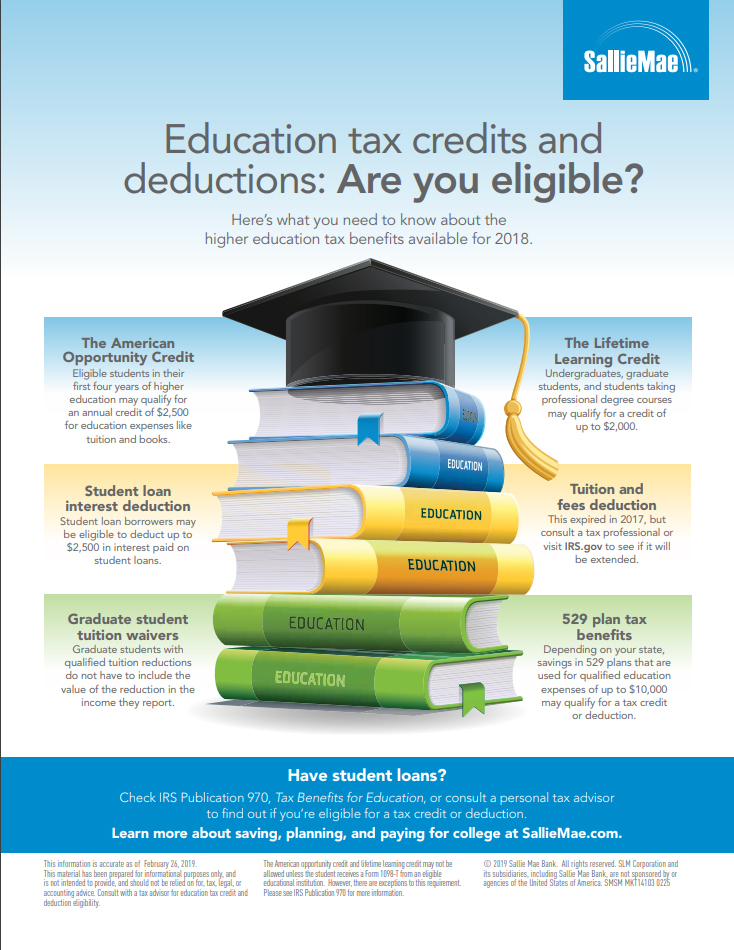

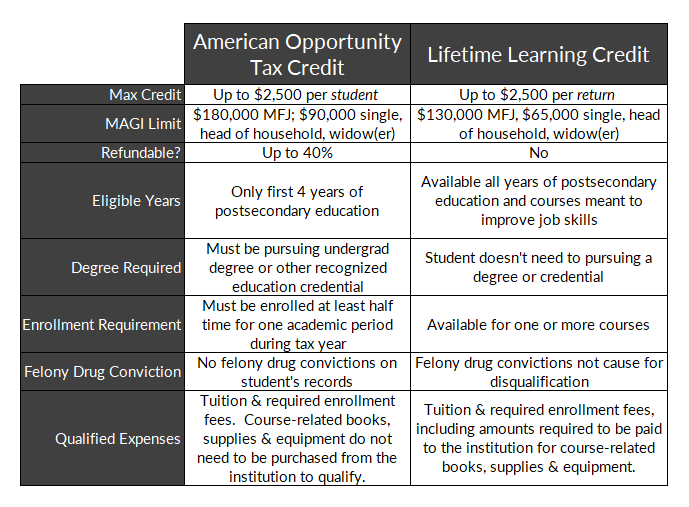

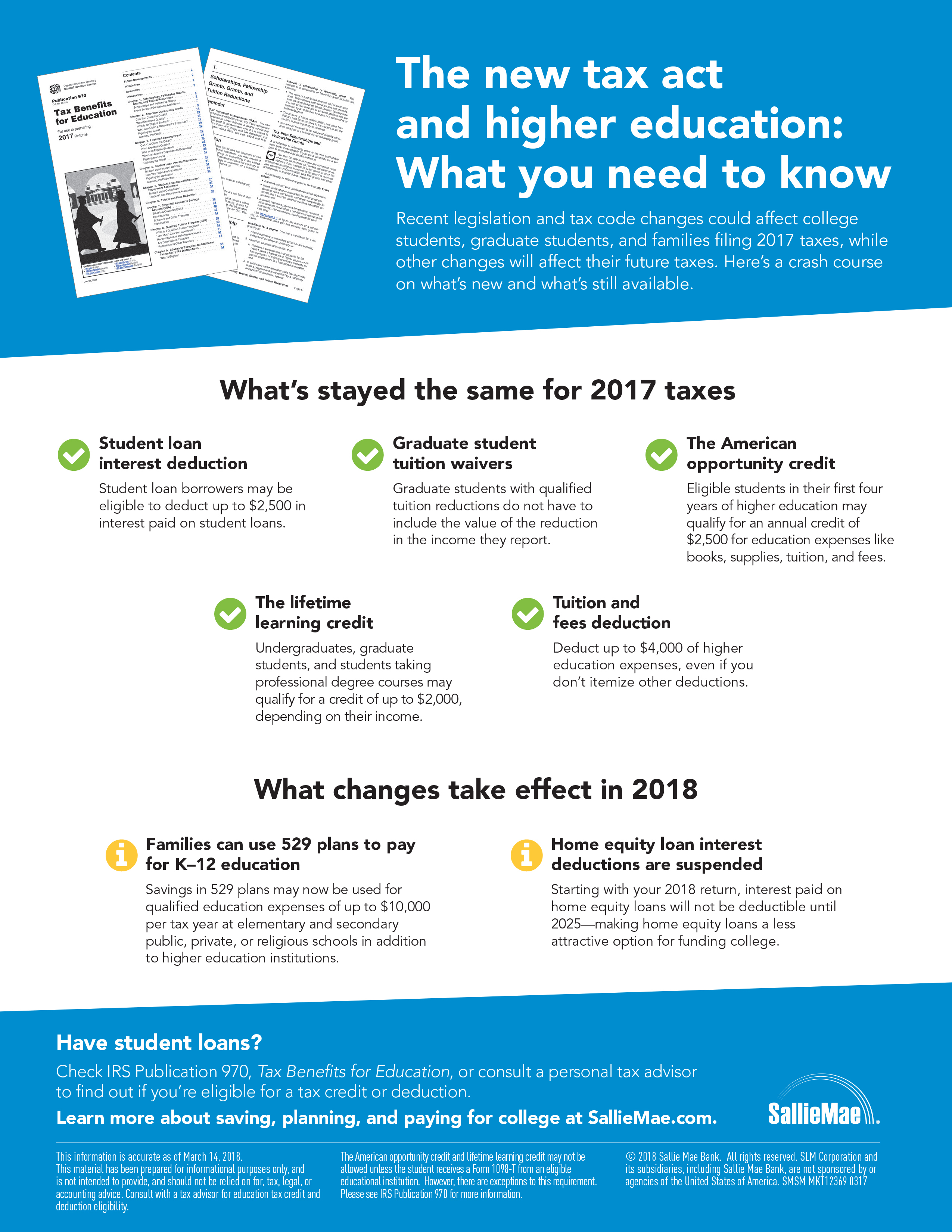

Tax credit for college students. The american opportunity tax credit is. Any available tax benefits might help to reduce the amount students and parents need to borrow. 40 of the tax credit is refundable. Here are some education related tax breaks every college student and their parents should know.

However the american opportunity credit can only be claimed during the student s first four years of higher education. When filing a tax return you may need to include scholarships and grants as taxable income. Only for the first four years at an eligible college or vocational school. College degrees don t come cheap.

This tax credit is worth up to 2 500 annually for eligible students. This means that you could get up to 1 000 of the credit back as a refund if you are eligible to receive it. Worth a maximum benefit up to 2 500 per eligible student.