Section 179 Income Limitation

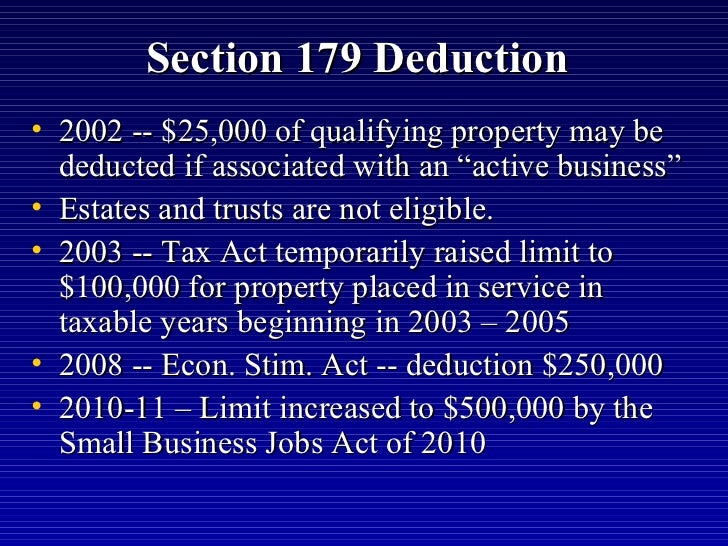

The phase out limit increased from 2 million to 2 5 million.

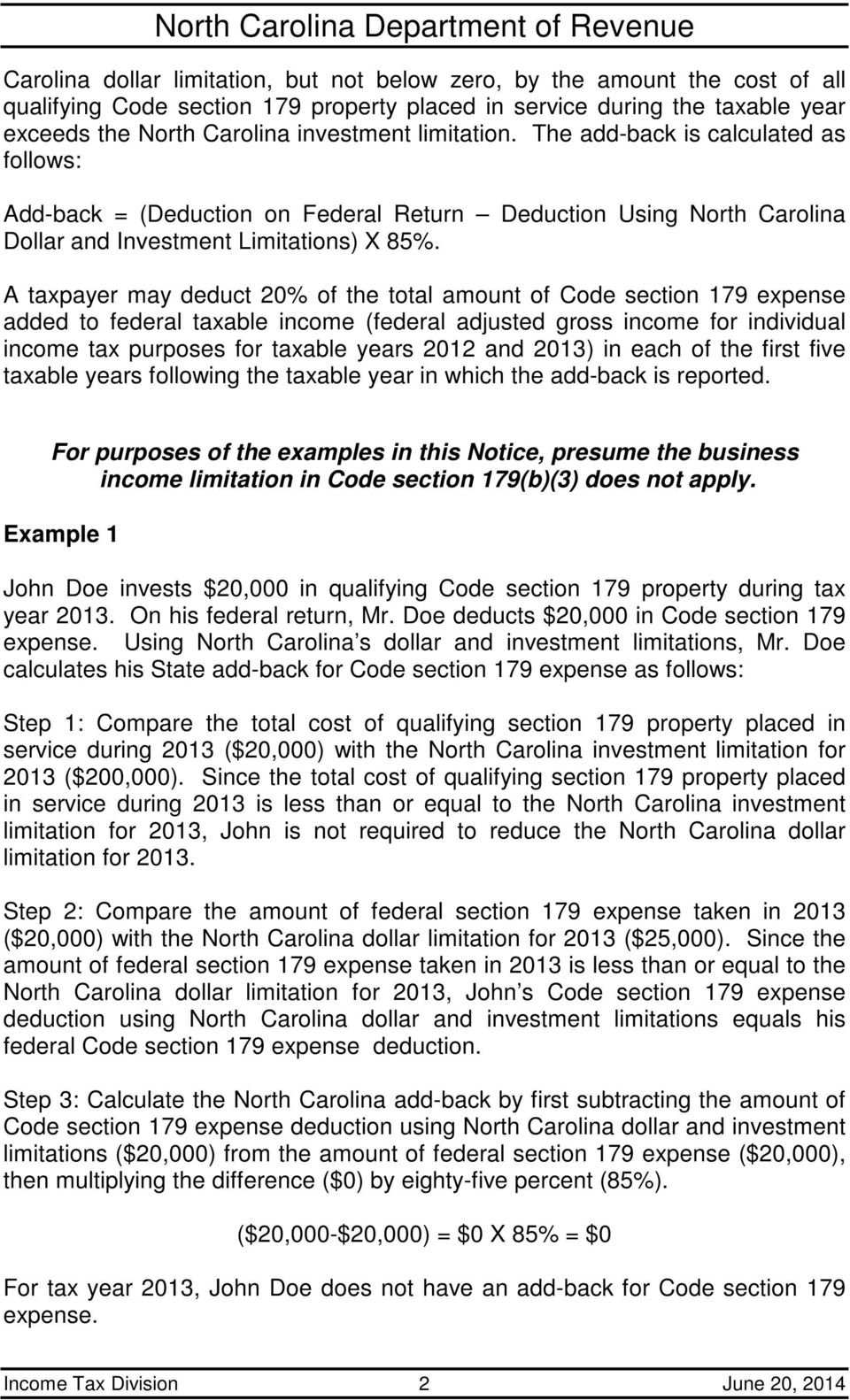

Section 179 income limitation. A few limits apply to the section 179 deduction. The taxable income limitation is also applied separately at the partner level. It also increased the phase out threshold from 2 million to 2 5 million. For 2019 you can expense up to 1 000 000 of eligible property.

The portion of a section 179 deduction disallowed by reason of the taxable income limitation is carried forward by the partnership until it has sufficient taxable income from the active conduct of its business to absorb the suspended deduction. The total amount allowed to be deducted for property that is placed in service in the 2018 tax year generally cannot be more than 1 000 000. For 2019 business tax purposes the annual limits on section 179 deductions are 1 02 million on individual items of equipment and purchased computer software and 25 500 for sport utility vehicles. Taking the section 179 election allows the taxpayer to elect to deduct the total cost of the property purchased in lieu of depreciating the property over the life value.

The deduction starts to slip away after spending 2 500 000. Unlike bonus depreciation any section 179 deduction elected that is not allowed due to income limitation is carried forward to future years. A taxpayer may elect to expense the cost of any section 179 property and deduct it in the year the property is placed in service. Section 179 does come with limits there are caps to the total amount written off 1 040 000 for 2020 and limits to the total amount of the equipment purchased 2 590 000 in 2020.

Also bonus depreciation can push the taxpayer into a net operating loss but section 179 cannot. Passive income such as assets used in rental property is not eligible for the deduction. X s taxable income for purposes of both sections 179 and 170 b 2 but without regard to any deduction allowable under either section 179 or section 170 is 11 000. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service.

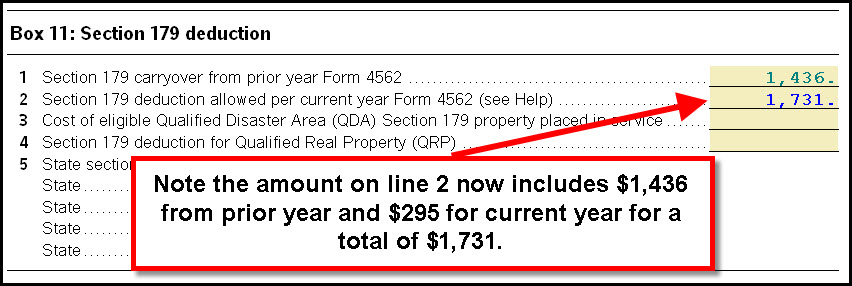

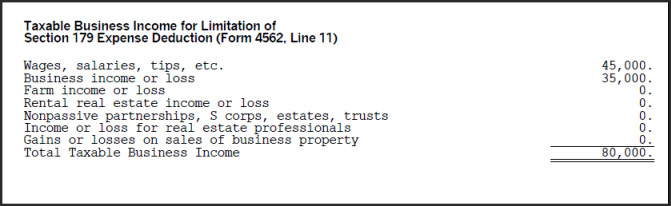

Your business can spend up to a maximum of 2 55 million on section 179 equipment. The program calculates business income for purposes of the section 179 business income limitation as follows. Annual limits on section 179 deductions. If the section 179 business income limitation applies proconnect tax online will generate a section 179 expense limitation worksheet showing the computation.

Wages salaries tips etc. The new law increased the maximum deduction from 500 000 to 1 million.